KKR Real Estate Finance Trust Investor Presentation Deck

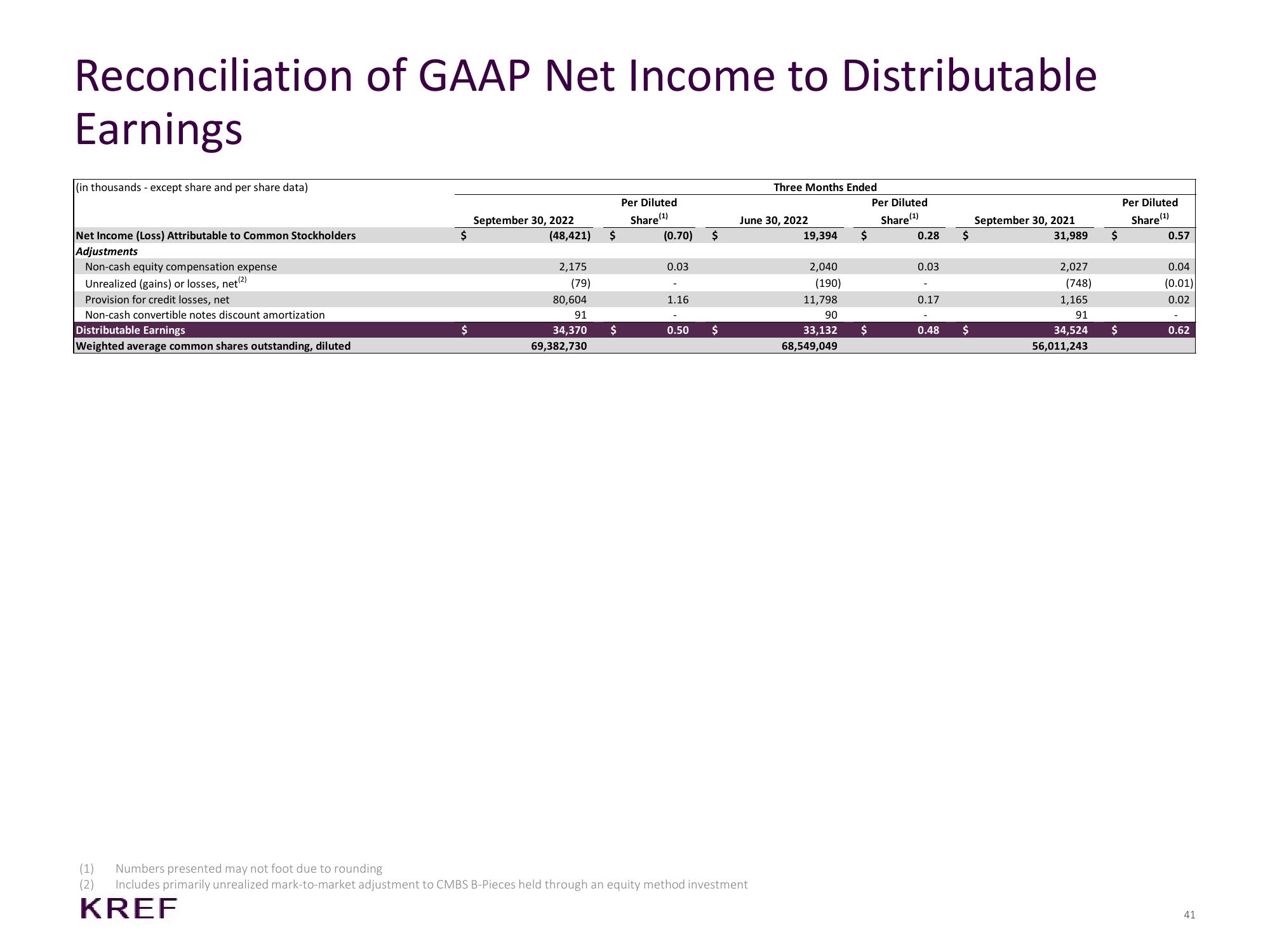

Reconciliation of GAAP Net Income to Distributable

Earnings

(in thousands - except share and per share data)

Net Income (Loss) Attributable to Common Stockholders

Adjustments

Non-cash equity compensation expense

Unrealized (gains) or losses, net(²)

Provision for credit losses, net

Non-cash convertible notes discount amortization

Distributable Earnings

Weighted average common shares outstanding, diluted

$

$

September 30, 2022

(48,421) $

2,175

(79)

80,604

91

34,370

69,382,730

$

Per Diluted

Share (¹)

(0.70)

0.03

1.16

0.50

$

$

Three Months Ended

June 30, 2022

(1) Numbers presented may not foot due to rounding

(2) Includes primarily unrealized mark-to-market adjustment to CMBS B-Pieces held through an equity method investment

KREF

19,394 $

2,040

(190)

11,798

90

33,132

68,549,049

$

Per Diluted

Share (¹)

0.28

0.03

0.17

0.48

$

$

September 30, 2021

31,989

2,027

(748)

$

1,165

91

34,524 $

56,011,243

Per Diluted

Share (1)

0.57

0.04

(0.01)

0.02

0.62

41View entire presentation