Baird Investment Banking Pitch Book

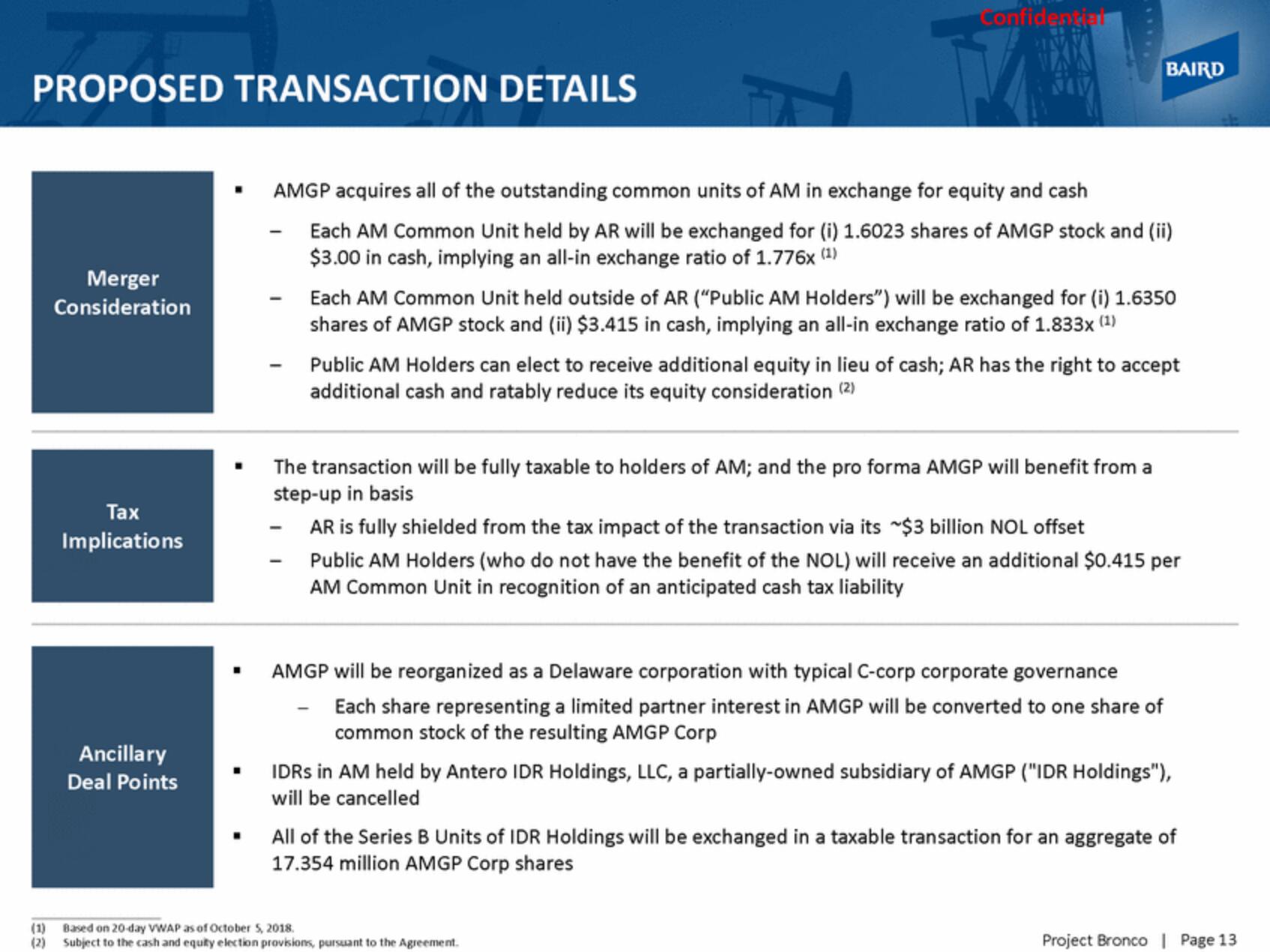

PROPOSED TRANSACTION DETAILS

Merger

Consideration

Tax

Implications

Ancillary

Deal Points

-

Confidential

AMGP acquires all of the outstanding common units of AM in exchange for equity and cash

Each AM Common Unit held by AR will be exchanged for (i) 1.6023 shares of AMGP stock and (ii)

$3.00 in cash, implying an all-in exchange ratio of 1.776x (1)

BAIRD

Each AM Common Unit held outside of AR ("Public AM Holders") will be exchanged for (i) 1.6350

shares of AMGP stock and (ii) $3.415 in cash, implying an all-in exchange ratio of 1.833x (1)

Public AM Holders can elect to receive additional equity in lieu of cash; AR has the right to accept

additional cash and ratably reduce its equity consideration (2)

The transaction will be fully taxable to holders of AM; and the pro forma AMGP will benefit from a

step-up in basis

AR is fully shielded from the tax impact of the transaction via its ~$3 billion NOL offset

Public AM Holders (who do not have the benefit of the NOL) will receive an additional $0.415 per

AM Common Unit in recognition of an anticipated cash tax liability

AMGP will be reorganized as a Delaware corporation with typical C-corp corporate governance

Each share representing a limited partner interest in AMGP will be converted to one share of

common stock of the resulting AMGP Corp

IDRS in AM held by Antero IDR Holdings, LLC, a partially-owned subsidiary of AMGP ("IDR Holdings"),

will be cancelled

(1)

Based on 20-day VWAP as of October 5, 2018.

(2) Subject to the cash and equity election provisions, pursuant to the Agreement.

All of the Series B Units of IDR Holdings will be exchanged in a taxable transaction for an aggregate of

17.354 million AMGP Corp shares

Project Bronco | Page 13View entire presentation