Evercore Investment Banking Pitch Book

Unitholder Tax Analysis

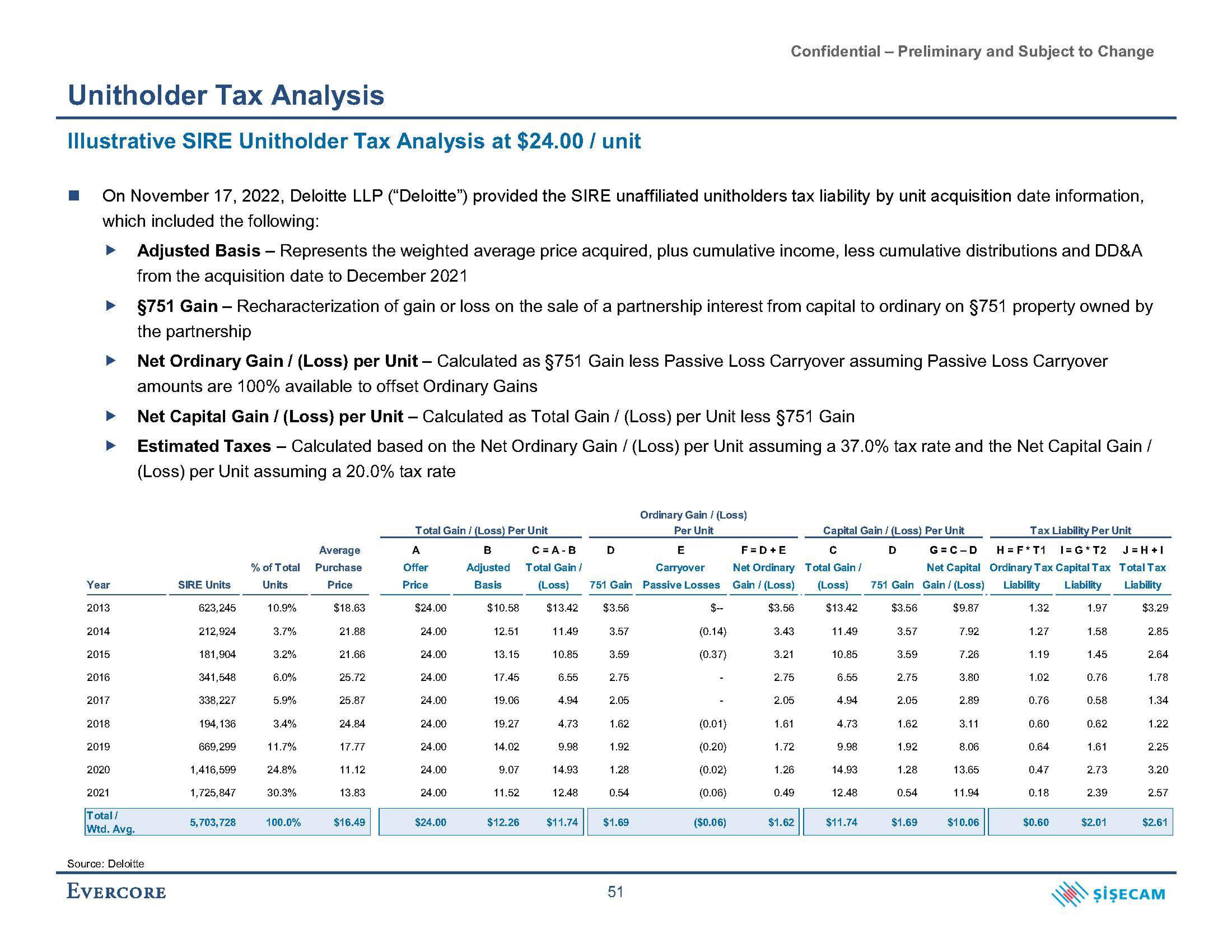

Illustrative SIRE Unitholder Tax Analysis at $24.00 / unit

On November 17, 2022, Deloitte LLP ("Deloitte") provided the SIRE unaffiliated unitholders tax liability by unit acquisition date information,

which included the following:

Year

2013

2014

2015

2016

2017

2018

2019

2020

2021

Total /

Wtd. Avg.

Adjusted Basis - Represents the weighted average price acquired, plus cumulative income, less cumulative distributions and DD&A

from the acquisition date to December 2021

$751 Gain - Recharacterization of gain or loss on the sale of a partnership interest from capital to ordinary on §751 property owned by

the partnership

Net Ordinary Gain / (Loss) per Unit - Calculated as §751 Gain less Passive Loss Carryover assuming Passive Loss Carryover

amounts are 100% available to offset Ordinary Gains

Net Capital Gain / (Loss) per Unit - Calculated as Total Gain / (Loss) per Unit less §751 Gain

Estimated Taxes Calculated based on the Net Ordinary Gain / (Loss) per Unit assuming a 37.0% tax rate and the Net Capital Gain /

(Loss) per Unit assuming a 20.0% tax rate

Source: Deloitte

EVERCORE

SIRE Units

623,245

212,924

181,904

341,548

338,227

194,136

669,299

1,416,599

1,725,847

5,703,728

% of Total

Units

10.9%

3.7%

3.2%

6.0%

5.9%

3.4%

11.7%

24.8%

30.3%

100.0%

Average

Purchase

Price

$18.63

21.88

21.66

25.72

25.87

24.84

17.77

11.12

13.83

$16.49

Total Gain / (Loss) Per Unit

B

Adjusted

Basis

A

Offer

Price

$24.00

24.00

24.00

24.00

24.00

24.00

24.00

24.00

24.00

$24.00

$10.58

12.51

13.15

17.45

19.06

19.27

14.02

9.07

11.52

$12.26

C=A-B

Total Gain/

(Loss) 751 Gain

$13.42 $3.56

11.49

3.57

10.85

3.59

6.55

4.94

4.73

9.98

14.93

12.48

$11.74

D

2.75

2.05

1.62

1.92

1.28

0.54

$1.69

51

Ordinary Gain / (Loss)

Per Unit

E

Carryover

Passive Losses

Confidential - Preliminary and Subject to Change

$--

(0.14)

(0.37)

(0.01)

(0.20)

(0.02)

(0.06)

($0.06)

F =D + E

Net Ordinary

Gain / (Loss)

$3.56

3.43

3.21

2.75

2.05

1.61

1.72

1.26

0.49

$1.62

Capital Gain / (Loss) Per Unit

D

G=C-D

Net Capital

с

Total Gain/

(Loss)

$13.42

11.49

10.85

6.55

4.94

4.73

9.98

14.93

$11.74

751 Gain

$3.56

3.57

3.59

2.75

2.05

1.62

1.92

1.28

$1.69

Tax Liability Per Unit

H = F*T1 I=G* T2 J=H+I

Ordinary Tax Capital Tax Total Tax

Gain / (Loss) Liability Liability Liability

$9.87

$3.29

7.92

2.85

7.26

3.80

2.89

3.11

8.06

13.65

11.94

$10.06

1.32

1.27

1.19

1.02

0.76

0.60

0.64

0.47

0.18

$0.60

1.97

1.58

1.45

0.76

0.58

0.62

1.61

2.73

2.39

$2.01

2.64

1.78

1.34

1.22

2.25

3.20

2.57

$2.61

ŞİŞECAMView entire presentation