SoftBank Results Presentation Deck

SVF1

SVF2

LATAM

PROGRESS & HIGHLIGHTS

Footnotes:

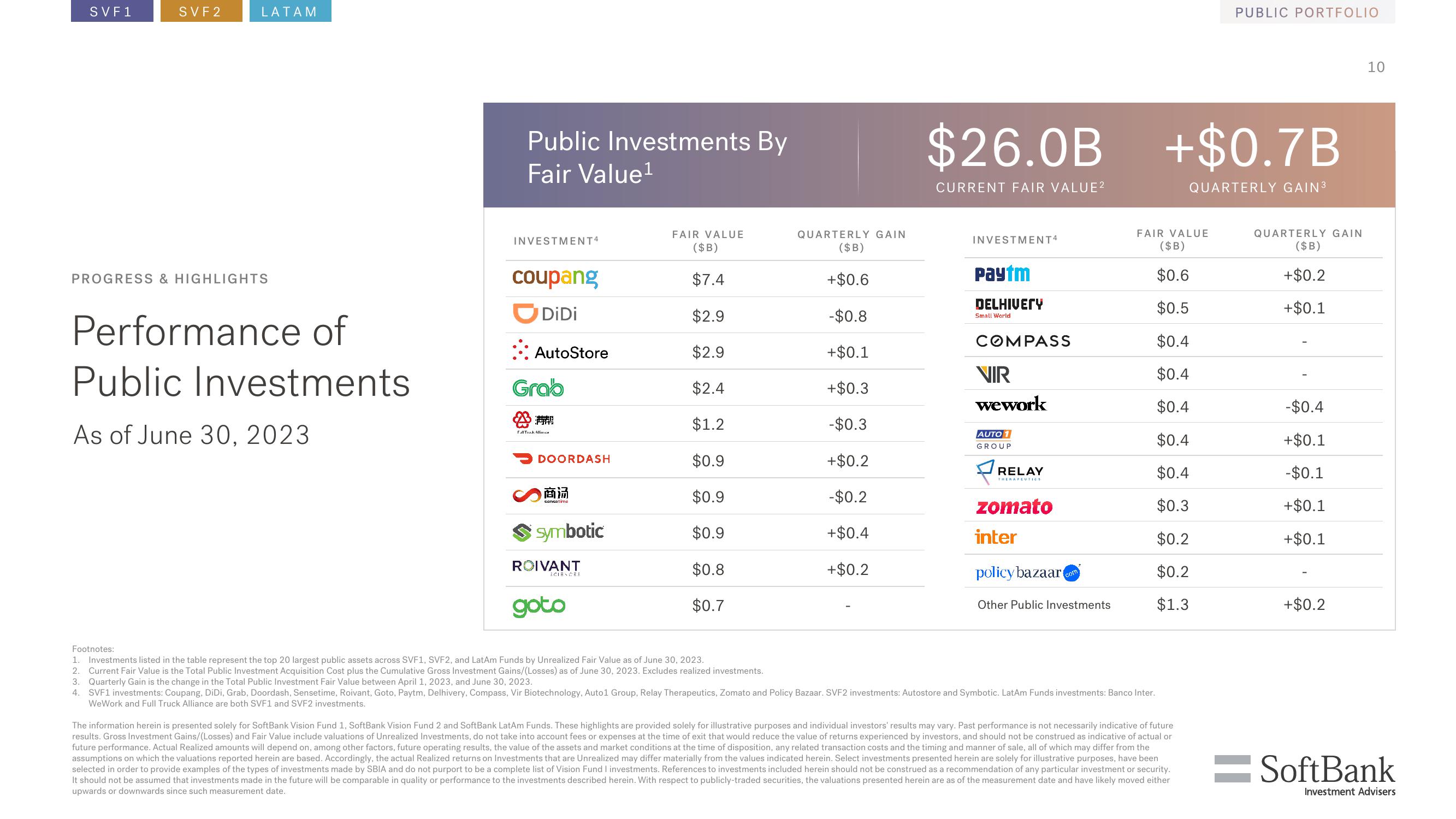

Performance of

Public Investments

As of June 30, 2023

Public Investments By

Fair Value¹

INVESTMENT4

coupang

DiDi

AutoStore

Grab

#!

Full Truck Alli

DOORDASH

商汤

sensatime

symbotic

RÕIVANT

SCIENCES

goto

FAIR VALUE

($B)

$7.4

$2.9

$2.9

$2.4

$1.2

$0.9

$0.9

$0.9

$0.8

$0.7

1. Investments listed in the table represent the top 20 largest public assets across SVF1, SVF2, and LatAm Funds by Unrealized Fair Value as of June 30, 2023.

2. Current Fair Value is the Total Public Investment Acquisition Cost plus the Cumulative Gross Investment Gains/(Losses) as of June 30, 2023. Excludes realized investments.

QUARTERLY GAIN

($B)

+$0.6

-$0.8

+$0.1

+ $0.3

- $0.3

+ $0.2

- $0.2

+$0.4

+ $0.2

$26.0B

CURRENT FAIR VALUE²

INVESTMENT4

Paytm

DELHIVERY

Small World

COMPASS

VIR

wework

AUTO 1

GROUP

RELAY

THERAPEUTICS

zomato

inter

policy bazaar

com

Other Public Investments

FAIR VALUE

($B)

$0.6

$0.5

$0.4

$0.4

$0.4

$0.4

$0.4

$0.3

$0.2

$0.2

$1.3

3. Quarterly Gain is the change in the Total Public Investment Fair Value between April 1, 2023, and June 30, 2023.

4. SVF1 investments: Coupang, DiDi, Grab, Doordash, Sensetime, Roivant, Goto, Paytm, Delhivery, Compass, Vir Biotechnology, Auto1 Group, Relay Therapeutics, Zomato and Policy Bazaar. SVF2 investments: Autostore and Symbotic. LatAm Funds investments: Banco Inter.

WeWork and Full Truck Alliance are both SVF1 and SVF2 investments.

+$0.7B

QUARTERLY GAIN³

PUBLIC PORTFOLIO

The information herein is presented solely for SoftBank Vision Fund 1, SoftBank Vision Fund 2 and SoftBank LatAm Funds. These highlights are provided solely for illustrative purposes and individual investors' results may vary. Past performance is not necessarily indicative of future

results. Gross Investment Gains/(Losses) and Fair Value include valuations of Unrealized Investments, do not take into account fees or expenses at the time of exit that would reduce the value of returns experienced by investors, and should not be construed as indicative of actual or

future performance. Actual Realized amounts will depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the

assumptions on which the valuations reported herein are based. Accordingly, the actual Realized returns on Investments that are Unrealized may differ materially from the values indicated herein. Select investments presented herein are solely for illustrative purposes, have been

selected in order to provide examples of the types of investments made by SBIA and do not purport to be a complete list of Vision Fund I investments. References to investments included herein should not be construed as a recommendation of any particular investment or security.

It should not be assumed that investments made in the future will be comparable in quality or performance to the investments described herein. With respect to publicly-traded securities, the valuations presented herein are as of the measurement date and have likely moved either

upwards or downwards since such measurement date.

QUARTERLY GAIN

($B)

+ $0.2

+ $0.1

-$0.4

+$0.1

-$0.1

+ $0.1

+ $0.1

+ $0.2

10

SoftBank

Investment AdvisersView entire presentation