Spirit Mergers and Acquisitions Presentation Deck

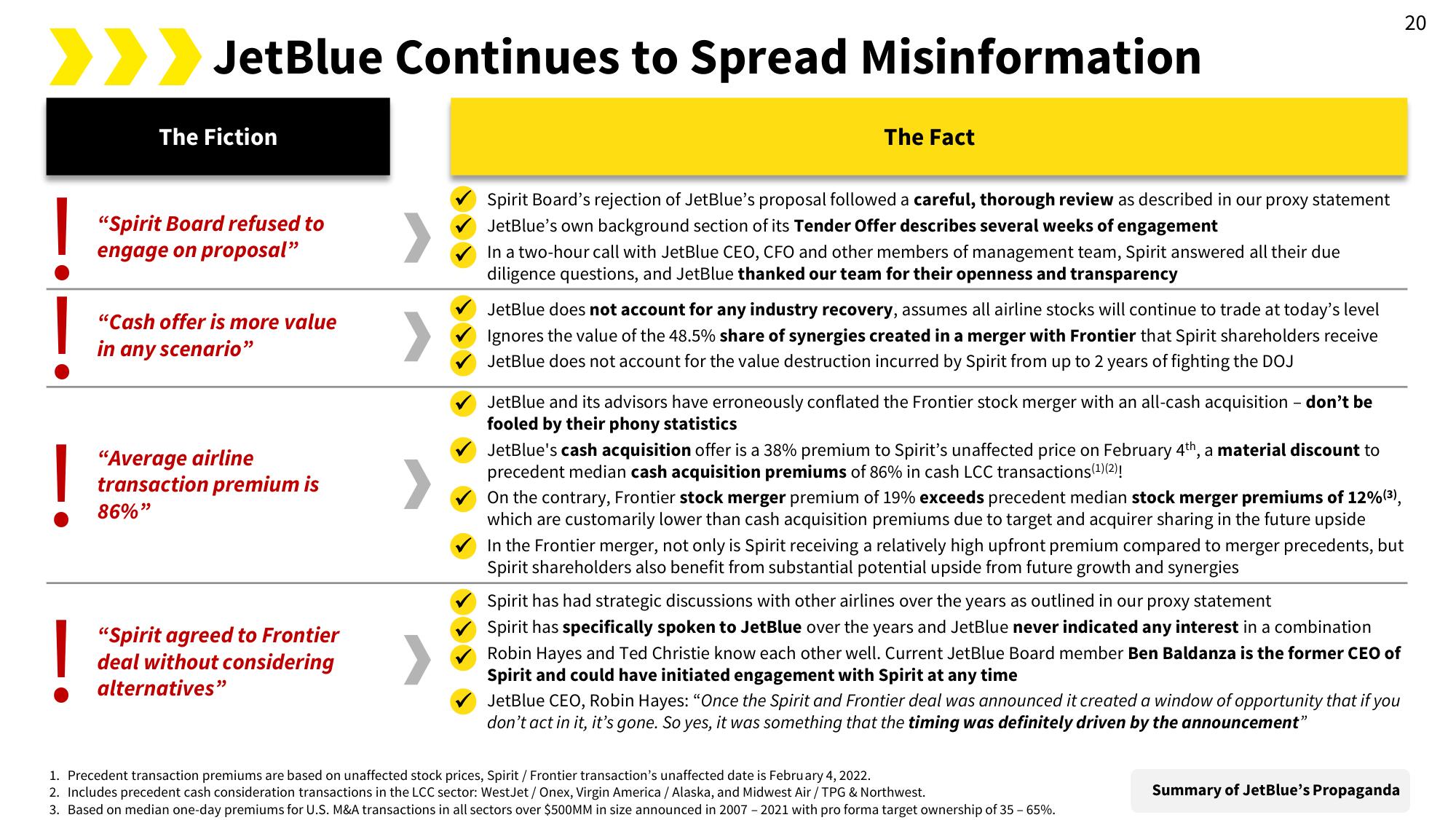

> JetBlue Continues to Spread Misinformation

!

!

The Fiction

"Spirit Board refused to

engage on proposal"

"Cash offer is more value

in any scenario"

"Average airline

transaction premium is

86%"

"Spirit agreed to Frontier

deal without considering

alternatives"

The Fact

Spirit Board's rejection of JetBlue's proposal followed a careful, thorough review as described in our proxy statement

JetBlue's own background section of its Tender Offer describes several weeks of engagement

In a two-hour call with JetBlue CEO, CFO and other members of management team, Spirit answered all their due

diligence questions, and JetBlue thanked our team for their openness and transparency

JetBlue does not account for any industry recovery, assumes all airline stocks will continue to trade at today's level

Ignores the value of the 48.5% share of synergies created in a merger with Frontier that Spirit shareholders receive

JetBlue does not account for the value destruction incurred by Spirit from up to 2 years of fighting the DOJ

JetBlue and its advisors have erroneously conflated the Frontier stock merger with an all-cash acquisition - don't be

fooled by their phony statistics

JetBlue's cash acquisition offer is a 38% premium to Spirit's unaffected price on February 4th, a material discount to

precedent median cash acquisition premiums of 86% in cash LCC transactions(¹)(2)!

>

On the contrary, Frontier stock merger premium of 19% exceeds precedent median stock merger premiums of 12%(³),

which are customarily lower than cash acquisition premiums due to target and acquirer sharing in the future upside

In the Frontier merger, not only is Spirit receiving a relatively high upfront premium compared to merger precedents, but

Spirit shareholders also benefit from substantial potential upside from future growth and synergies

Spirit has had strategic discussions with other airlines over the years as outlined in our proxy statement

Spirit has specifically spoken to JetBlue over the years and JetBlue never indicated any interest in a combination

Robin Hayes and Ted Christie know each other well. Current JetBlue Board member Ben Baldanza is the former CEO of

Spirit and could have initiated engagement with Spirit at any time

JetBlue CEO, Robin Hayes: "Once the Spirit and Frontier deal was announced it created a window of opportunity that if you

don't act in it, it's gone. So yes, it was something that the timing was definitely driven by the announcement"

1. Precedent transaction premiums are based on unaffected stock prices, Spirit / Frontier transaction's unaffected date is February 4, 2022.

2. Includes precedent cash consideration transactions in the LCC sector: WestJet / Onex, Virgin America/Alaska, and Midwest Air / TPG & Northwest.

3. Based on median one-day premiums for U.S. M&A transactions in all sectors over $500MM in size announced in 2007 - 2021 with pro forma target ownership of 35 - 65%.

20

Summary of JetBlue's PropagandaView entire presentation