Schroders Investor Day Presentation Deck

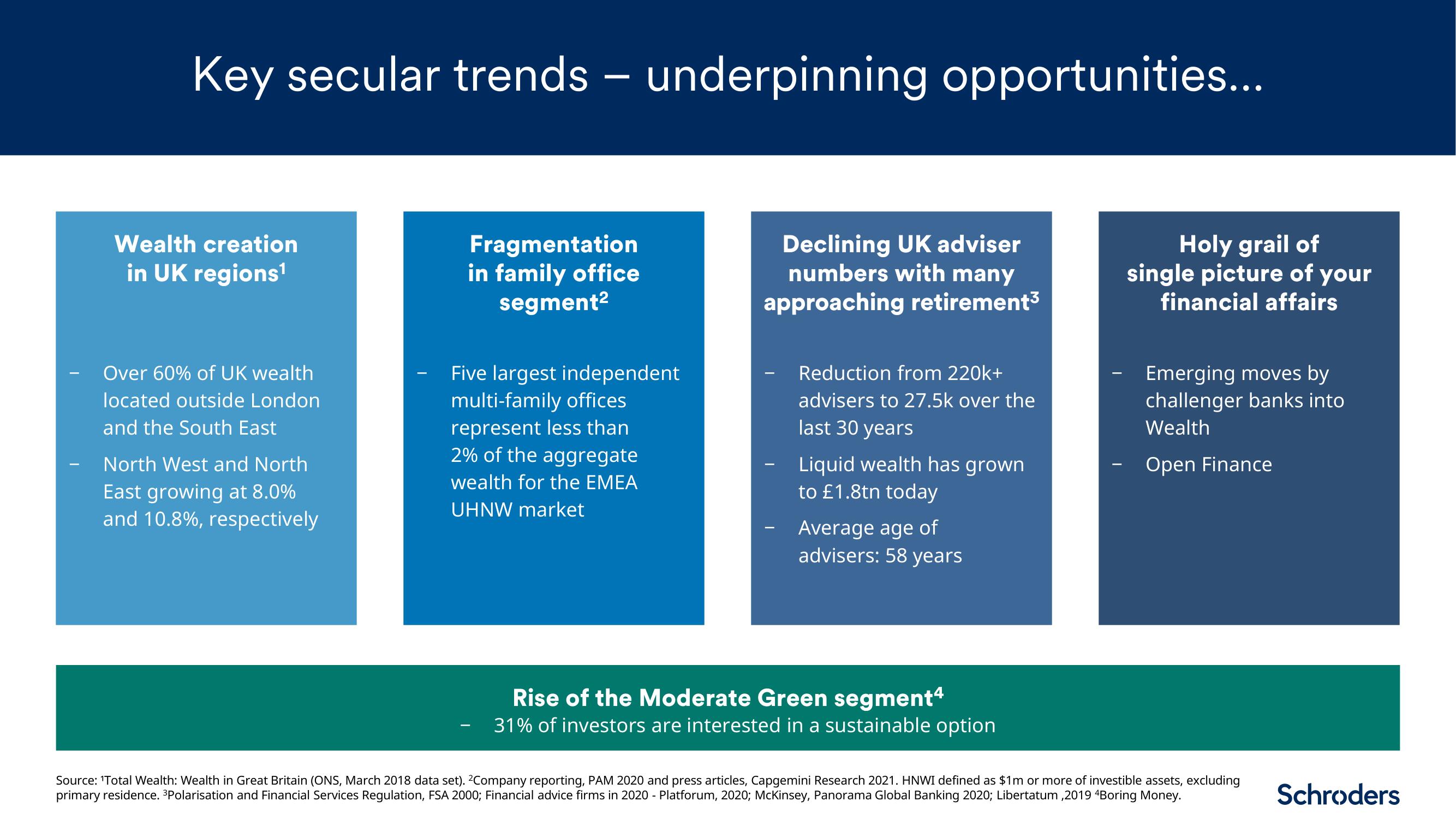

Key secular trends - underpinning opportunities...

Wealth creation

in UK regions¹

Over 60% of UK wealth

located outside London

and the South East

North West and North

East growing at 8.0%

and 10.8%, respectively

Fragmentation

in family office

segment²

Five largest independent

multi-family offices

represent less than

2% of the aggregate

wealth for the EMEA

UHNW market

Declining UK adviser

numbers with many

approaching retirement³

Reduction from 220k+

advisers to 27.5k over the

last 30 years

Liquid wealth has grown

to £1.8tn today

Average age of

advisers: 58 years

Rise of the Moderate Green segment4

31% of investors are interested in a sustainable option

Holy grail of

single picture of your

financial affairs

Emerging moves by

challenger banks into

Wealth

Open Finance

Source: 'Total Wealth: Wealth in Great Britain (ONS, March 2018 data set). ²Company reporting, PAM 2020 and press articles, Capgemini Research 2021. HNWI defined as $1m or more of investible assets, excluding

primary residence. ³Polarisation and Financial Services Regulation, FSA 2000; Financial advice firms in 2020 - Platforum, 2020; McKinsey, Panorama Global Banking 2020; Libertatum ,2019 4Boring Money.

SchrodersView entire presentation