T-Mobile Investor Day Presentation Deck

1)

2)

3)

4)

5)

6)

7)

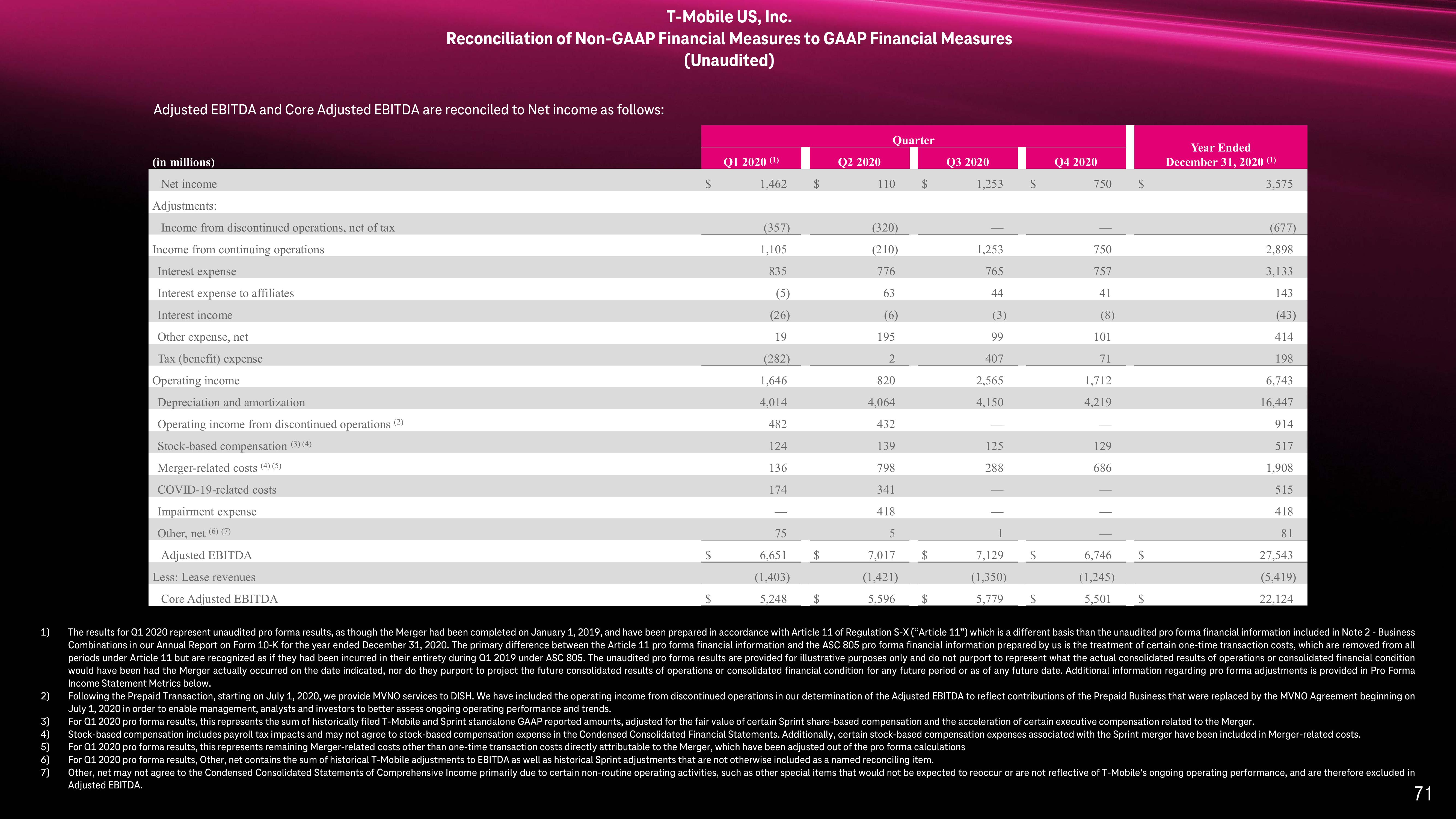

Adjusted EBITDA and Core Adjusted EBITDA are reconciled to Net income as follows:

(in millions)

Net income

Adjustments:

Income from discontinued operations, net of tax

Income from continuing operations

Interest expense

Interest expense to affiliates

Interest income

Other expense, net

Tax (benefit) expense

Operating income

Depreciation and amortization

Operating income from discontinued operations (2)

Stock-based compensation (3) (4)

Merger-related costs (4) (5)

COVID-19-related costs

Impairment expense

Other, net (6) (7)

T-Mobile US, Inc.

Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures

Adjusted EBITDA

Less: Lease revenues

Core Adjusted EBITDA

(Unaudited)

$

Q1 2020 (¹)

1,462

(357)

1,105

835

(5)

(26)

19

(282)

1,646

4,014

482

124

136

174

75

6,651

(1,403)

5,248

S

Q2 2020

Quarter

110

(320)

(210)

776

63

(6)

195

2

820

4,064

432

139

798

341

418

$

7,017

(1,421)

5,596 $

$

Q3 2020

1,253 $

1,253

765

44

(3)

99

407

2.565

4,150

125

288

7,129 $

(1,350)

5,779 $

Q4 2020

750

750

757

41

(8)

101

71

1,712

4.219

129

686

6.746

(1,245)

5.501

$

$

$

Year Ended

December 31, 2020 (¹)

3,575

(677)

2,898

3,133

143

(43)

414

198

6,743

16,447

914

517

1,908

515

418

81

27,543

(5,419)

22,124

The results for Q1 2020 represent unaudited pro forma results, as though the Merger had been completed on January 1, 2019, and have been prepared in accordance with Article 11 of Regulation S-X ("Article 11") which is a different basis than the unaudited pro forma financial information included in Note 2 - Business

Combinations in our Annual Report on Form 10-K for the year ended December 31, 2020. The primary difference between the Article 11 pro forma financial information and the ASC 805 pro forma financial information prepared by us is the treatment of certain one-time transaction costs, which are removed from all

periods under Article 11 but are recognized as if they had been incurred in their entirety during Q1 2019 under ASC 805. The unaudited pro forma results are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations or consolidated financial condition

would have been had the Merger actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. Additional information regarding pro forma adjustments is provided in Pro Forma

Income Statement Metrics below.

Following the Prepaid Transaction, starting on July 1, 2020, we provide MVNO services to DISH. We have included the operating income from discontinued operations in our determination of the Adjusted EBITDA to reflect contributions of the Prepaid Business that were replaced by the MVNO Agreement beginning on

July 1, 2020 in order to enable management, analysts and investors to better assess ongoing operating performance and trends.

For Q1 2020 pro forma results, this represents the sum of historically filed T-Mobile and Sprint standalone GAAP reported amounts, adjusted for the fair value of certain Sprint share-based compensation and the acceleration of certain executive compensation related to the Merger.

Stock-based compensation includes payroll tax impacts and may not agree to stock-based compensation expense in the Condensed Consolidated Financial Statements. Additionally, certain stock-based compensation expenses associated with the Sprint merger have been included in Merger-related costs.

For Q1 2020 pro forma results, this represents remaining Merger-related costs other than one-time transaction costs directly attributable to the Merger, which have been adjusted out of the pro forma calculations

For Q1 2020 pro forma results, Other, net contains the sum of historical T-Mobile adjustments to EBITDA as well as historical Sprint adjustments that are not otherwise included as a named reconciling item.

Other, net may not agree to the Condensed Consolidated Statements of Comprehensive Income primarily due to certain non-routine operating activities, such as other special items that would not be expected to reoccur or are not reflective of T-Mobile's ongoing operating performance, and are therefore excluded in

Adjusted EBITDA.

71View entire presentation