Bank of America Results Presentation Deck

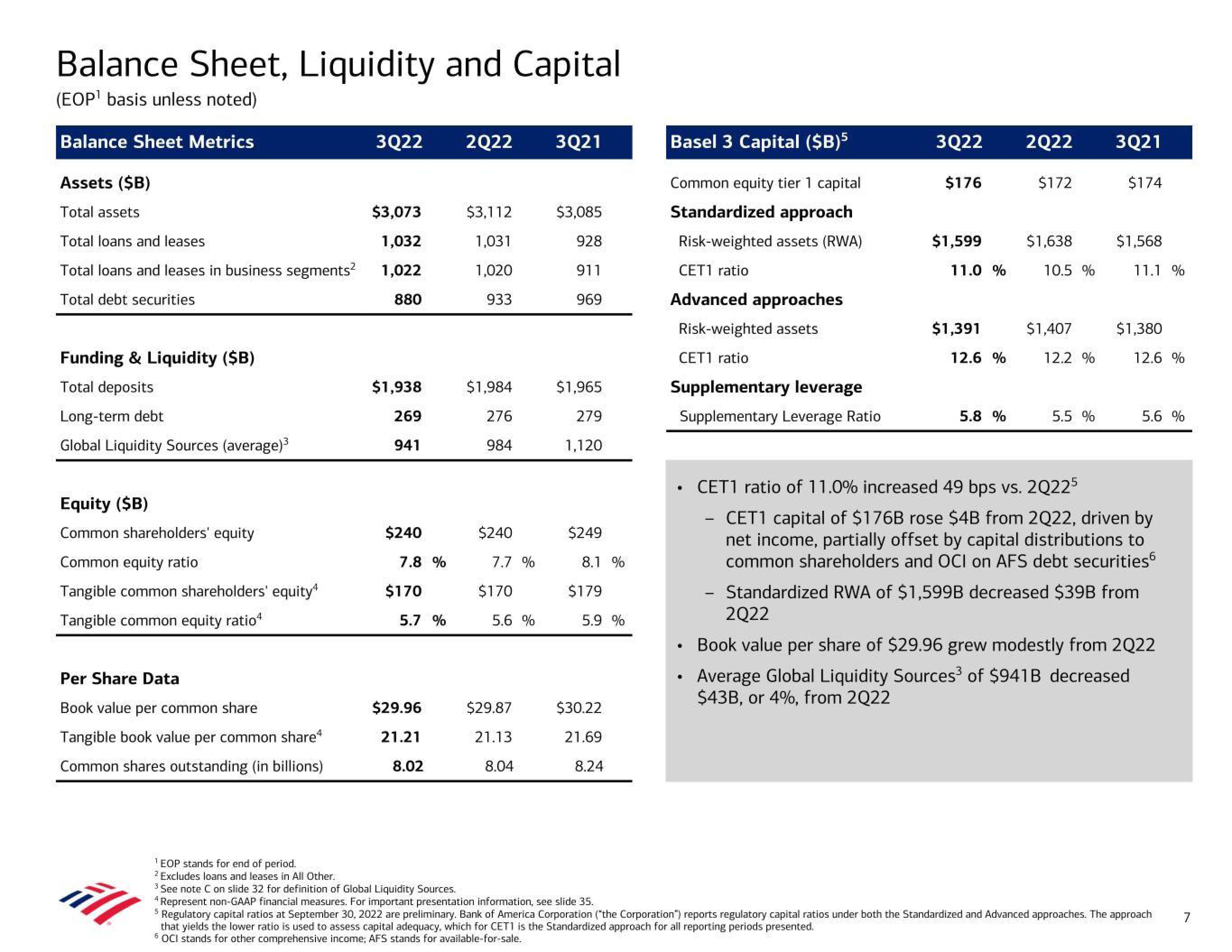

Balance Sheet, Liquidity and Capital

(EOP¹ basis unless noted)

Balance Sheet Metrics

Assets ($B)

Total assets

Total loans and leases

Total loans and leases in business segments²

Total debt securities

Funding & Liquidity ($B)

Total deposits

Long-term debt

Global Liquidity Sources (average)³

Equity ($B)

Common shareholders' equity

Common equity ratio

Tangible common shareholders' equity4

Tangible common equity ratio

3Q22

$3,073

1,032

1,022

880

¹EOP stands for end of period.

2 Excludes loans and leases in All Other.

$1,938

269

941

$240

7.8 %

$170

5.7 %

Per Share Data

Book value per common share

$29.96

Tangible book value per common share*

21.21

Common shares outstanding (in billions) 8.02

2Q22

$3,112

1,031

1,020

933

$1,984

276

984

$240

7.7 %

$170

5.6 %

$29.87

21.13

8.04

3Q21

$3,085

928

911

969

$1,965

279

1,120

$249

8.1 %

$179

5.9 %

$30.22

21.69

8.24

Basel 3 Capital ($B)5

Common equity tier 1 capital

Standardized approach

Risk-weighted assets (RWA)

CET1 ratio

Advanced approaches

Risk-weighted assets

CET1 ratio

Supplementary leverage

Supplementary Leverage Ratio

●

3Q22

$176

$1,599

11.0 %

$1,391

12.6 %

5.8 %

2Q22

$172

$1,638

10.5 %

$1,407

12.2 %

5.5 %

3Q21

$174

$1,568

11.1 %

$1,380

12.6 %

5.6 %

CET1 ratio of 11.0% increased 49 bps vs. 2Q225

CET1 capital of $176B rose $4B from 2022, driven by

net income, partially offset by capital distributions to

common shareholders and OCI on AFS debt securities

Standardized RWA of $1,599B decreased $39B from

2Q22

Book value per share of $29.96 grew modestly from 2022

Average Global Liquidity Sources³ of $941B decreased

$43B, or 4%, from 2Q22

3 See note C on slide 32 for definition of Global Liquidity Sources.

All

4 Represent non-GAAP financial measures. For important presentation information, see slide 35.

5 Regulatory capital ratios at September 30, 2022 are preliminary. Bank of America Corporation ("the Corporation") reports regulatory capital ratios under both the Standardized and Advanced approaches. The approach

that yields the lower ratio is used to assess capital adequacy, which for CET1 is the Standardized approach for all reporting periods presented.

6 OCI stands for other comprehensive income; AFS stands for available-for-sale.

7View entire presentation