Hanmi Financial Results Presentation Deck

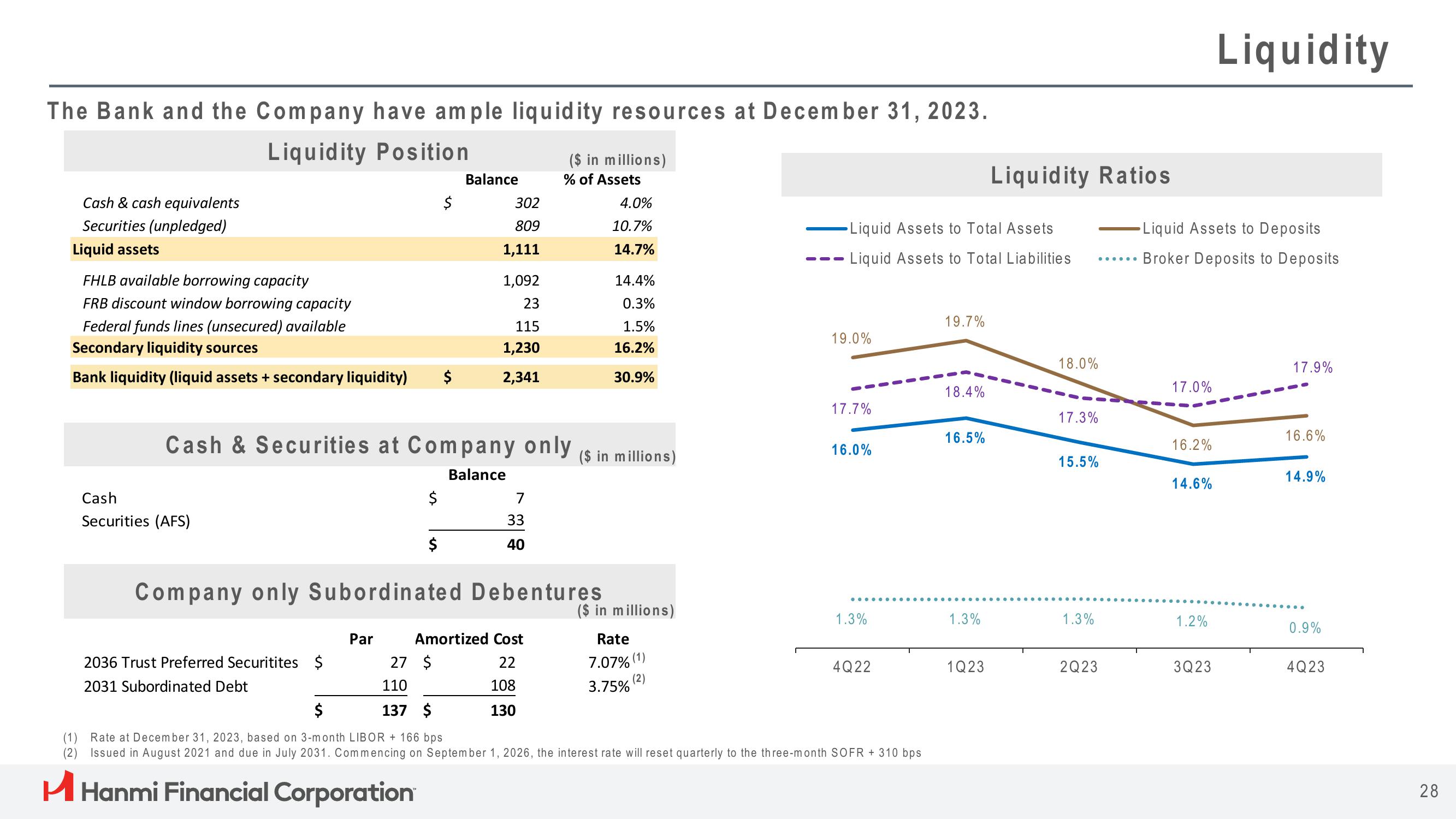

The Bank and the Company have ample liquidity resources at December 31, 2023.

Liquidity Position

Cash & cash equivalents

Securities (unpledged)

Liquid assets

FHLB available borrowing capacity

FRB discount window borrowing capacity

Federal funds lines (unsecured) available

Secondary liquidity sources

Bank liquidity (liquid assets + secondary liquidity) $

Cash

Securities (AFS)

2036 Trust Preferred Securitites $

2031 Subordinated Debt

Cash & Securities at Company only

Balance

$

Par

Balance

$

302

809

1,111

1,092

23

115

1,230

2,341

7

33

40

($ in millions)

% of Assets

4.0%

10.7%

14.7%

Company only Subordinated Debentures

Amortized Cost

27 $

22

110

108

137 $

130

14.4%

0.3%

1.5%

16.2%

30.9%

($ in millions)

($ in millions)

Rate

7.07% (1)

3.75%

(2)

-Liquid Assets to Total Assets

Liquid Assets to Total Liabilities

19.0%

17.7%

16.0%

......

1.3%

4Q22

$

(1) Rate at December 31, 2023, based on 3-month LIBOR + 166 bps.

(2) Issued in August 2021 and due in July 2031. Commencing on September 1, 2026, the interest rate will reset quarterly to the three-month SOFR + 310 bps

H Hanmi Financial Corporation

19.7%

18.4%

16.5%

1.3%

Liquidity Ratios

1Q23

18.0%

17.3%

......

15.5%

1.3%

2Q23

Liquid Assets to Deposits

Broker Deposits to Deposits

17.0%

16.2%

14.6%

1.2%

Liquidity

3Q23

17.9%

16.6%

14.9%

0.9%

4Q23

28View entire presentation