Hilltop Holdings Results Presentation Deck

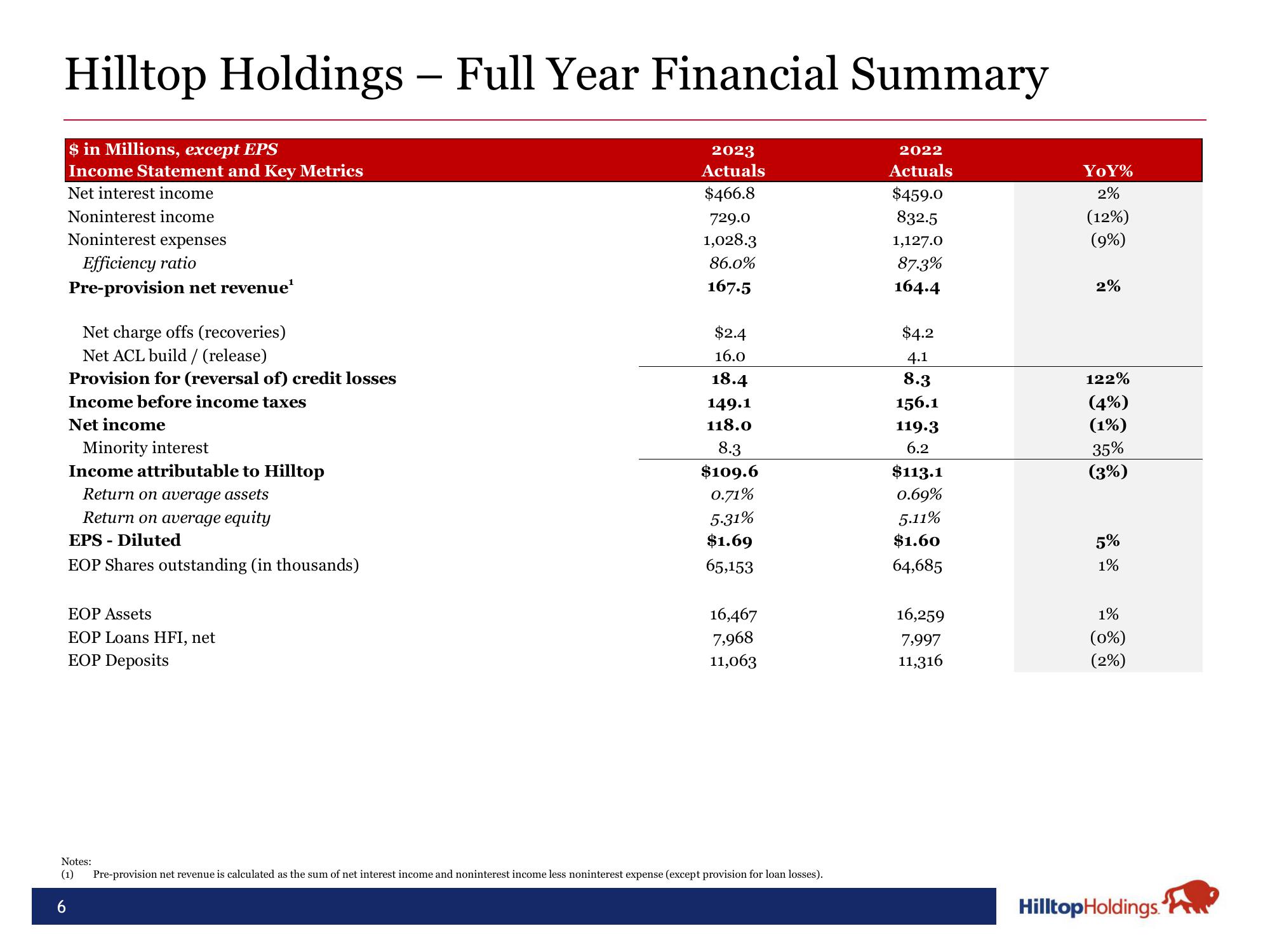

Hilltop Holdings - Full Year Financial Summary

$ in Millions, except EPS

Income Statement and Key Metrics

Net interest income

Noninterest income

Noninterest expenses

Efficiency ratio

Pre-provision net revenue¹

Net charge offs (recoveries)

Net ACL build / (release)

Provision for (reversal of) credit losses

Income before income taxes

Net income

Minority interest

Income attributable to Hilltop

Return on average assets

Return on average equity

EPS-Diluted

EOP Shares outstanding (in thousands)

EOP Assets

EOP Loans HFI, net

EOP Deposits

2023

Actuals

$466.8

729.0

1,028.3

86.0%

167.5

$2.4

16.0

18.4

149.1

118.0

8.3

$109.6

0.71%

5.31%

$1.69

65,153

16,467

7,968

11,063

Notes:

(1) Pre-provision net revenue is calculated as the sum of net interest income and noninterest income less noninterest expense (except provision for loan losses).

2022

Actuals

$459.0

832.5

1,127.0

87.3%

164.4

$4.2

4.1

8.3

156.1

119.3

6.2

$113.1

0.69%

5.11%

$1.60

64,685

16,259

7,997

11,316

YoY%

2%

(12%)

(9%)

2%

122%

(4%)

(1%)

35%

(3%)

5%

1%

1%

(0%)

(2%)

Hilltop Holdings.View entire presentation