HSBC Investor Day Presentation Deck

Risk: Commercial real estate (CRE) in focus

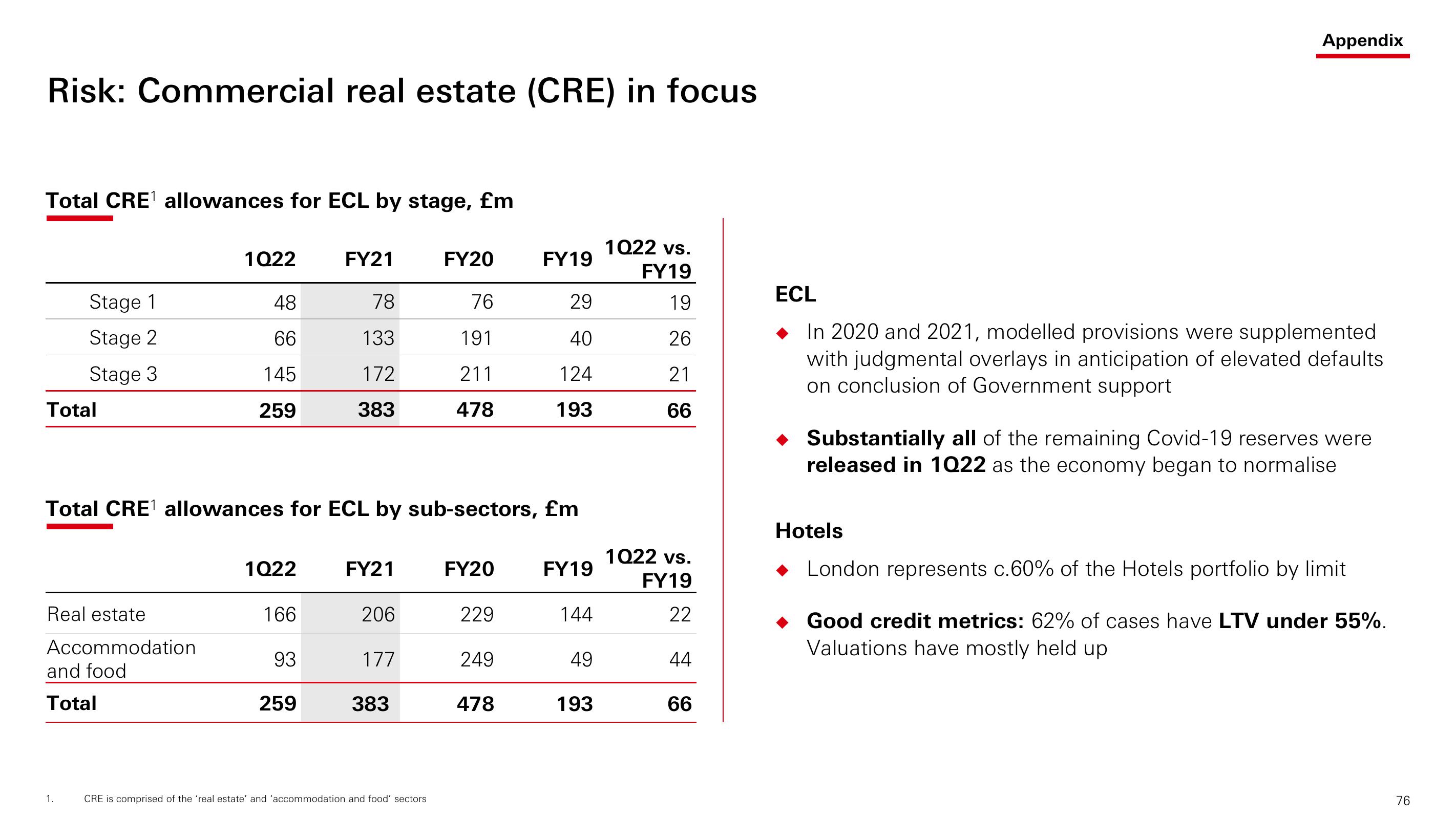

Total CRE¹ allowances for ECL by stage, £m

Stage 1

Stage 2

Stage 3

Total

Real estate

Accommodation

and food

Total

1.

1Q22

48

66

145

259

1Q22

166

93

FY21

Total CRE¹ allowances for ECL by sub-sectors, £m

259

78

133

172

383

FY21

206

177

383

FY20

CRE is comprised of the 'real estate' and 'accommodation and food' sectors

76

191

211

478

FY20

229

249

FY19

478

29

40

124

193

FY19

144

49

193

1022 vs.

FY19

19

26

21

66

1022 vs.

FY19

22

44

66

Appendix

ECL

In 2020 and 2021, modelled provisions were supplemented

with judgmental overlays in anticipation of elevated defaults

on conclusion of Government support

◆ Substantially all of the remaining Covid-19 reserves were

released in 1Q22 as the economy began to normalise

Hotels

◆ London represents c.60% of the Hotels portfolio by limit

Good credit metrics: 62% of cases have LTV under 55%.

Valuations have mostly held up

76View entire presentation