XP Inc Results Presentation Deck

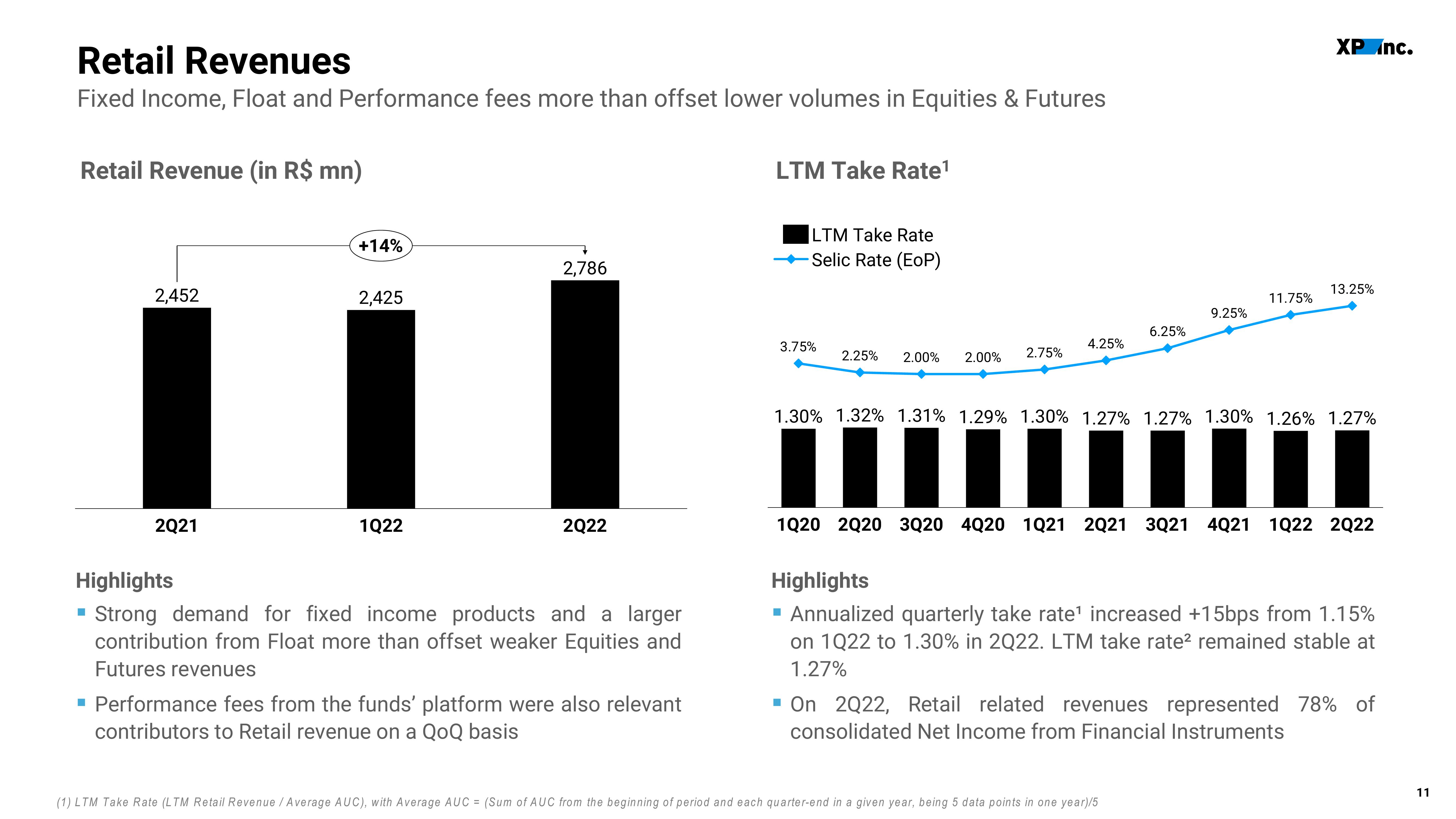

Retail Revenues

Fixed Income, Float and Performance fees more than offset lower volumes in Equities & Futures

Retail Revenue (in R$ mn)

2,452

2Q21

+14%

2,425

1Q22

2,786

2Q22

Highlights

Strong demand for fixed income products and a larger

contribution from Float more than offset weaker Equities and

Futures revenues

▪ Performance fees from the funds' platform were also relevant

contributors to Retail revenue on a QoQ basis

LTM Take Rate¹

LTM Take Rate

Selic Rate (EOP)

3.75%

2.25% 2.00% 2.00% 2.75%

4.25%

6.25%

9.25%

11.75%

XP Inc.

(1) LTM Take Rate (LTM Retail Revenue / Average AUC), with Average AUC = (Sum of AUC from the beginning of period and each quarter-end in a given year, being 5 data points in one year)/5

13.25%

1.30% 1.32% 1.31% 1.29% 1.30% 1.27% 1.27% 1.30% 1.26% 1.27%

1020 2020 3Q20 4Q20 1021 2021 3Q21 4Q21 1022 2022

Highlights

▪ Annualized quarterly take rate¹ increased +15bps from 1.15%

on 1022 to 1.30% in 2Q22. LTM take rate² remained stable at

1.27%

▪ On 2Q22, Retail related revenues represented 78% of

consolidated Net Income from Financial Instruments

11View entire presentation