HSBC Results Presentation Deck

4021 results summary

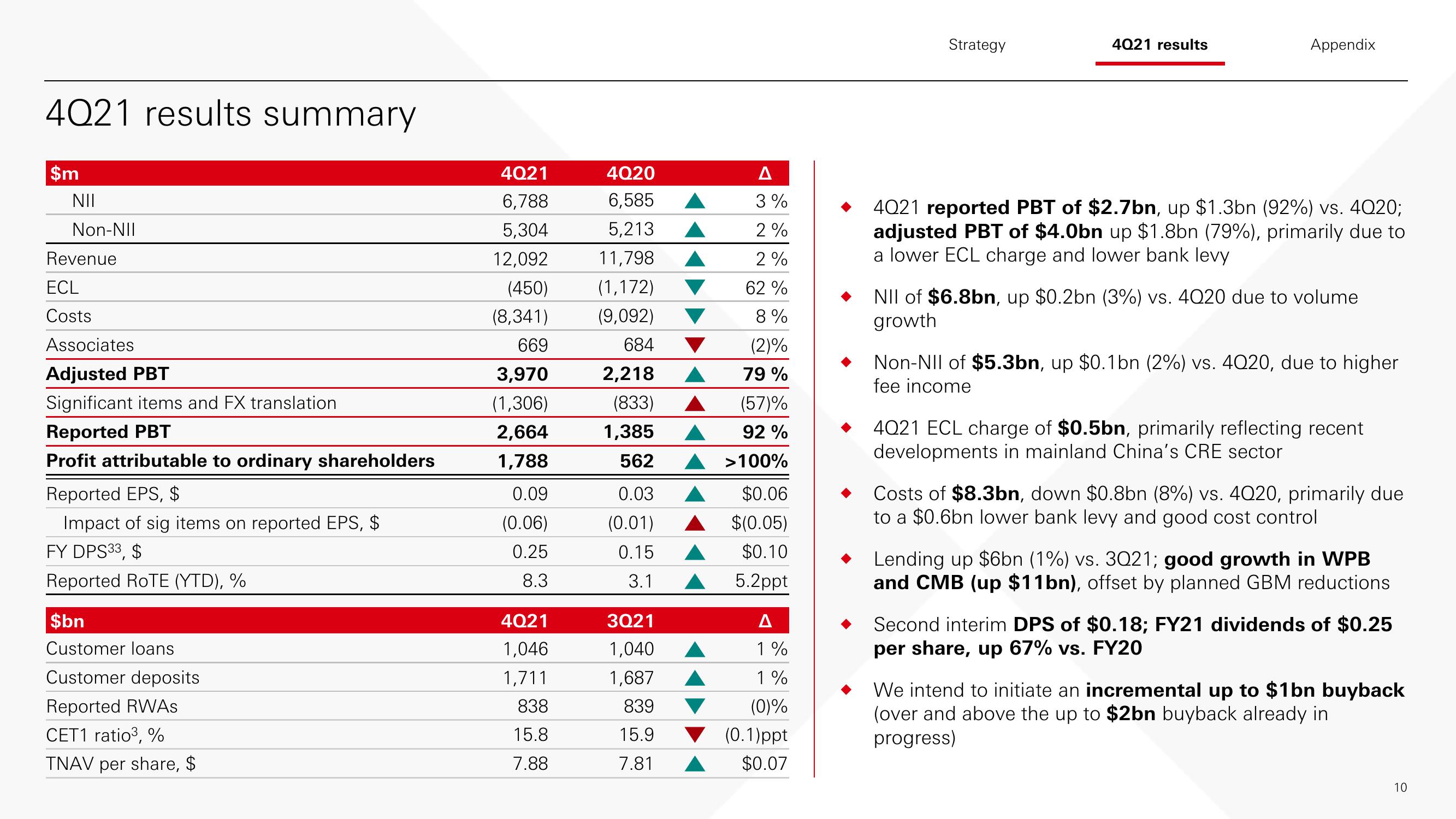

$m

NII

Non-NII

Revenue

ECL

Costs

Associates

Adjusted PBT

Significant items and FX translation

Reported PBT

Profit attributable to ordinary shareholders

Reported EPS, $

Impact of sig items on reported EPS, $

FY DPS33, $

Reported ROTE (YTD), %

$bn

Customer loans

Customer deposits

Reported RWAS

CET1 ratio³, %

TNAV per share, $

4Q21

6,788

5,304

12,092

(450)

(8,341)

669

3,970

(1,306)

2,664

1,788

0.09

(0.06)

0.25

8.3

4Q21

1,046

1,711

838

15.8

7.88

4Q20

6,585

5,213

11,798

(1,172)

(9,092)

684

2,218

(833)

1,385

562

0.03

(0.01)

0.15

3.1

3Q21

1,040

1,687

839

15.9

7.81

3%

2%

2%

62%

8%

(2)%

79 %

(57)%

92 %

>100%

$0.06

$(0.05)

$0.10

5.2ppt

A

1%

1%

(0)%

(0.1)ppt

$0.07

Strategy

4021 results

Appendix

4021 reported PBT of $2.7bn, up $1.3bn (92%) vs. 4Q20;

adjusted PBT of $4.0bn up $1.8bn (79%), primarily due to

a lower ECL charge and lower bank levy

NII of $6.8bn, up $0.2bn (3%) vs. 4Q20 due to volume

growth

Non-NII of $5.3bn, up $0.1bn (2%) vs. 4Q20, due to higher

fee income

4021 ECL charge of $0.5bn, primarily reflecting recent

developments in mainland China's CRE sector

Costs of $8.3bn, down $0.8bn (8%) vs. 4Q20, primarily due

to a $0.6bn lower bank levy and good cost control

Lending up $6bn (1%) vs. 3Q21; good growth in WPB

and CMB (up $11bn), offset by planned GBM reductions

Second interim DPS of $0.18; FY21 dividends of $0.25

per share, up 67% vs. FY20

We intend to initiate an incremental up to $1bn buyback

(over and above the up to $2bn buyback already in

progress)

10View entire presentation