FIGS Results Presentation Deck

OFIGS

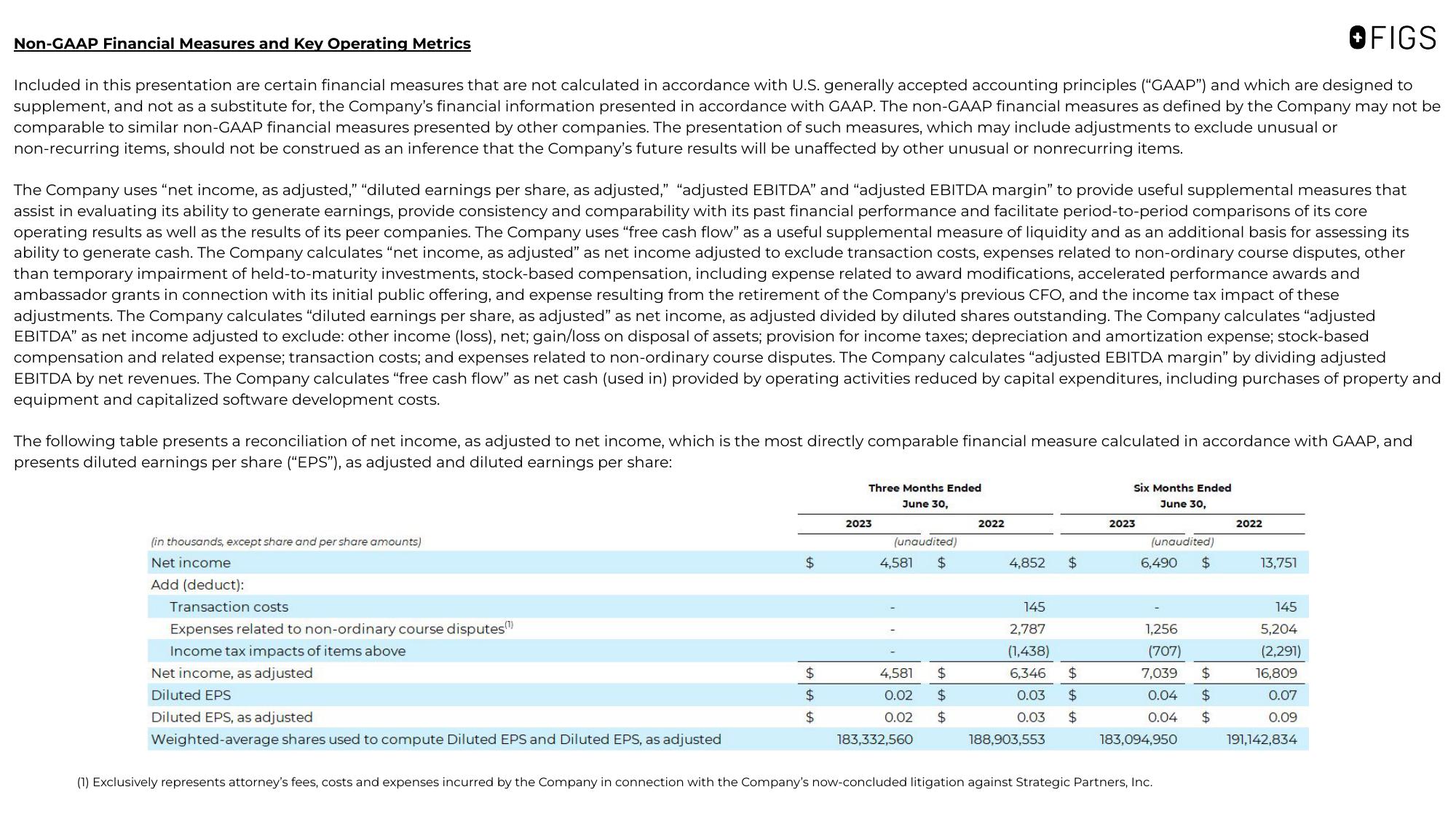

Included in this presentation are certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP") and which are designed to

supplement, and not as a substitute for, the Company's financial information presented in accordance with GAAP. The non-GAAP financial measures as defined by the Company may not be

comparable to similar non-GAAP financial measures presented by other companies. The presentation of such measures, which may include adjustments to exclude unusual or

non-recurring items, should not be construed as an inference that the Company's future results will be unaffected by other unusual or nonrecurring items.

Non-GAAP Financial Measures and Key Operating Metrics

The Company uses "net income, as adjusted," "diluted earnings per share, as adjusted," "adjusted EBITDA" and "adjusted EBITDA margin" to provide useful supplemental measures that

assist in evaluating its ability to generate earnings, provide consistency and comparability with its past financial performance and facilitate period-to-period comparisons of its core

operating results as well as the results of its peer companies. The Company uses "free cash flow" as a useful supplemental measure of liquidity and as an additional basis for assessing its

ability to generate cash. The Company calculates "net income, as adjusted" as net income adjusted to exclude transaction costs, expenses related to non-ordinary course disputes, other

than temporary impairment of held-to-maturity investments, stock-based compensation, including expense related to award modifications, accelerated performance awards and

ambassador grants in connection with its initial public offering, and expense resulting from the retirement of the Company's previous CFO, and the income tax impact of these

adjustments. The Company calculates "diluted earnings per share, as adjusted" as net income, as adjusted divided by diluted shares outstanding. The Company calculates "adjusted

EBITDA" as net income adjusted to exclude: other income (loss), net; gain/loss on disposal of assets; provision for income taxes; depreciation and amortization expense; stock-based

compensation and related expense; transaction costs; and expenses related to non-ordinary course disputes. The Company calculates "adjusted EBITDA margin" by dividing adjusted

EBITDA by net revenues. The Company calculates "free cash flow" as net cash (used in) provided by operating activities reduced by capital expenditures, including purchases of property and

equipment and capitalized software development costs.

The following table presents a reconciliation of net income, as adjusted to net income, which is the most directly comparable financial measure calculated in accordance with GAAP, and

presents diluted earnings per share ("EPS"), as adjusted and diluted earnings per share:

(in thousands, except share and per share amounts)

Net income

Add (deduct):

Transaction costs

Expenses related to non-ordinary course disputes(™)

Income tax impacts of items above

Net income, as adjusted

Diluted EPS

Diluted EPS, as adjusted

Weighted-average shares used to compute Diluted EPS and Diluted EPS, as adjusted

$

$

$

Three Months Ended

June 30,

2023

(unaudited)

$

4,581

4,581 $

0.02 $

0.02 $

183,332,560

2022

4,852

$

145

2,787

(1,438)

6,346 $

0.03 $

0.03 $

188,903,553

Six Months Ended

June 30,

2023

(unaudited)

6,490 $

1,256

(707)

7,039

0.04

0.04

183,094,950

(1) Exclusively represents attorney's fees, costs and expenses incurred by the Company in connection with the Company's now-concluded litigation against Strategic Partners, Inc.

$

$

$

2022

13,751

145

5,204

(2,291)

16,809

0.07

0.09

191,142,834View entire presentation