Investor Presentation

Energy Storage System ("ESS") Initiative

Opportunity Overview

Various value drivers such as charging during peak renewable times / discharging during peak non-renewable times

Allows energy price arbitrage (i.e., 'buy low, sell high') as well as other revenue drivers

Takes advantage of incentives offered by utilities and government authorities

UGE Prospects

Additional growth lever to complement existing platform

Notable addition to Mass. market entry (>100MW early-stage projects)1

MA Clean Peak Program Incentive: Provides certificates to eligible

storage resources that can reduce load during peak demand hours²

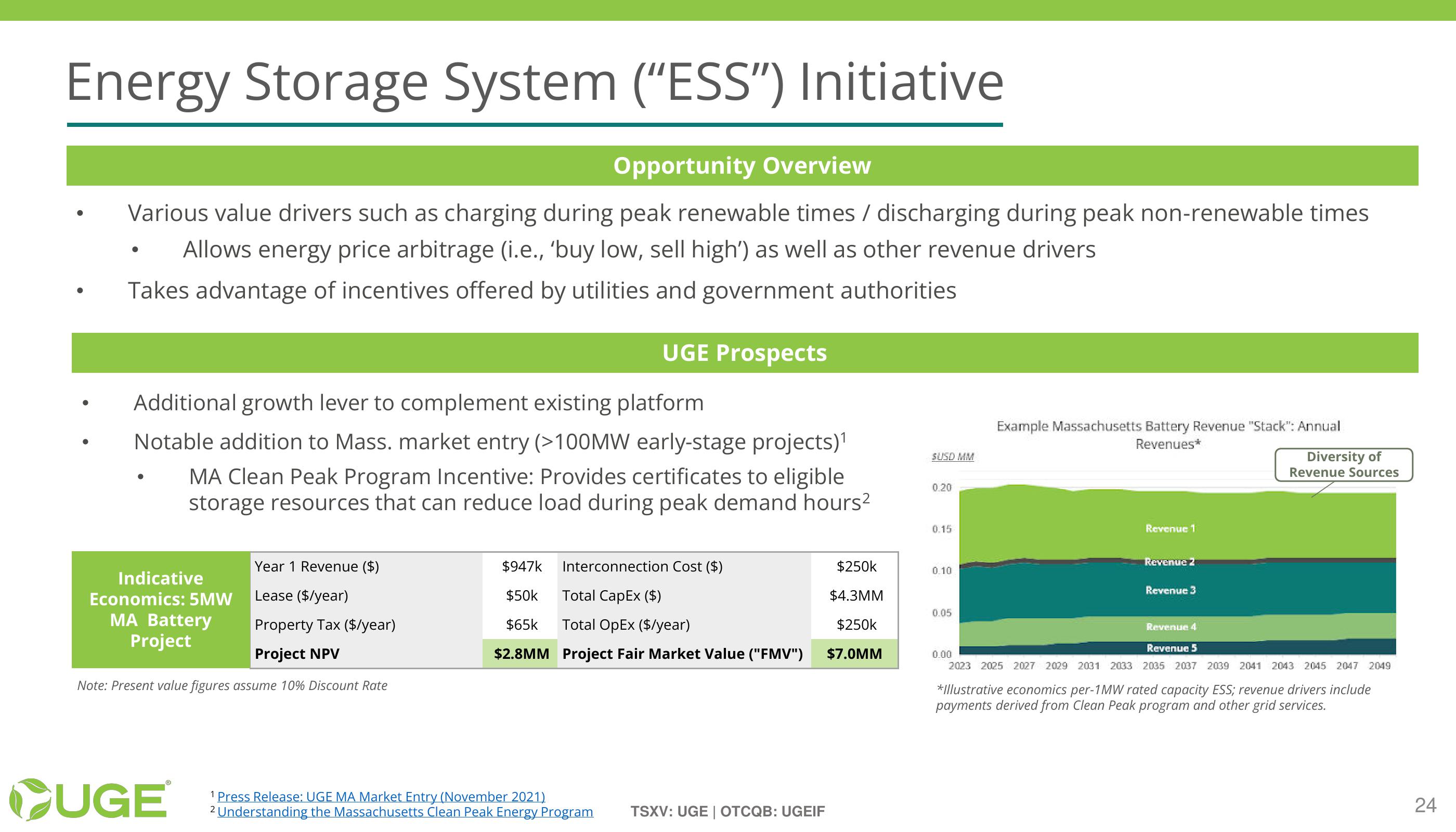

SUSD MM

0.20

Example Massachusetts Battery Revenue "Stack": Annual

Revenues*

Diversity of

Revenue Sources

0.15

Revenue 1

Revenue 2

Revenue 3

Revenue 4

Revenue 5

2023 2025 2027 2029 2031 2033 2035 2037 2039 2041 2043 2045 2047 2049

*Illustrative economics per-1MW rated capacity ESS; revenue drivers include

payments derived from Clean Peak program and other grid services.

Indicative

Economics: 5MW

Year 1 Revenue ($)

Lease ($/year)

$947k

Interconnection Cost ($)

$250k

0.10

$50k

MA Battery

Project

Property Tax ($/year)

Project NPV

$65k

Total CapEx ($)

Total OpEx ($/year)

$4.3MM

0.05

$250k

$2.8MM Project Fair Market Value ("FMV")

$7.0MM

0.00

Note: Present value figures assume 10% Discount Rate

UGE

Press Release: UGE MA Market Entry (November 2021)

2 Understanding the Massachusetts Clean Peak Energy Program TSXV: UGE | OTCQB: UGEIF

24

24View entire presentation