Zegna Results Presentation Deck

Non-IFRS Financial Measures

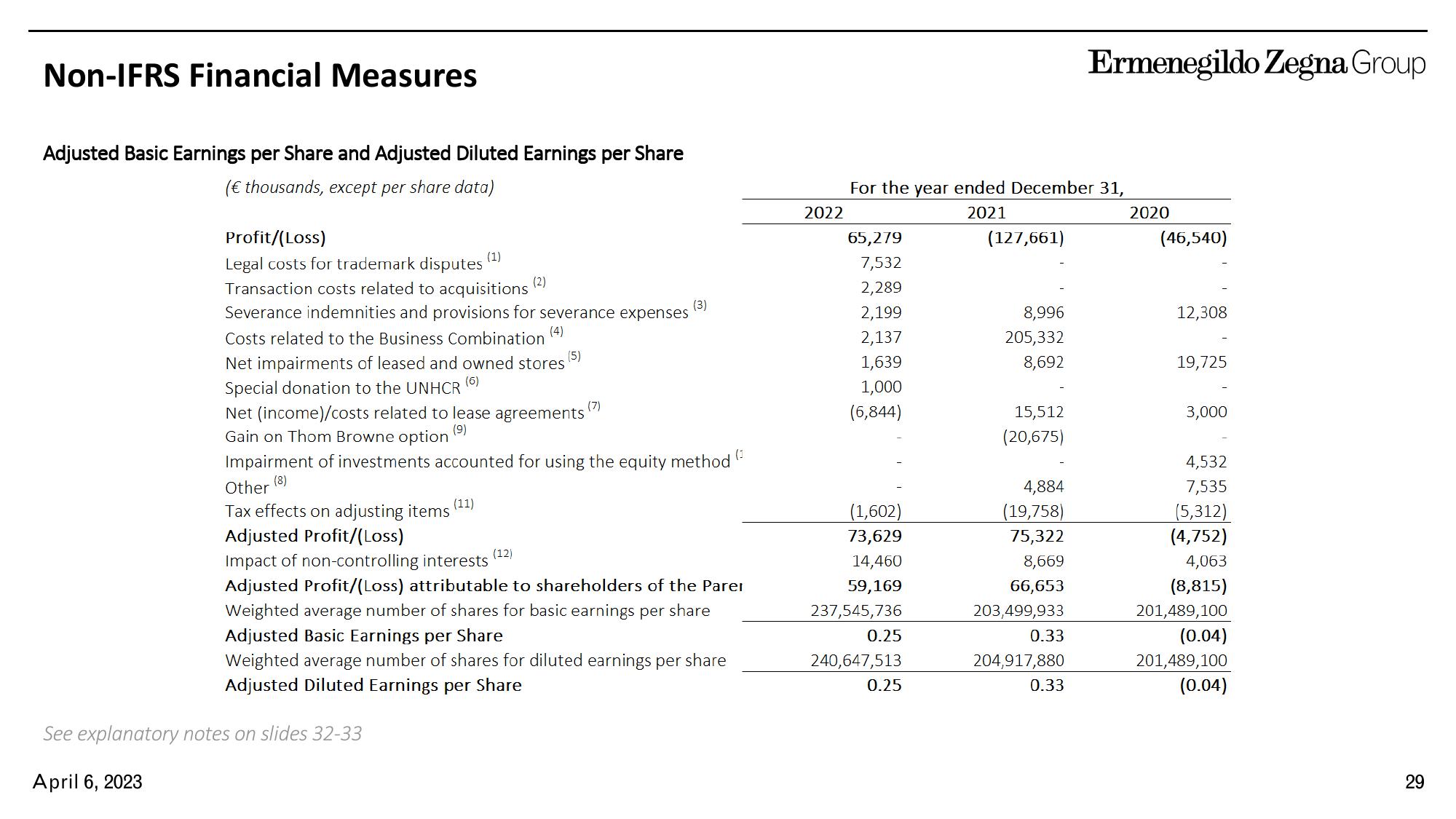

Adjusted Basic Earnings per Share and Adjusted Diluted Earnings per Share

(€ thousands, except per share data)

Profit/(Loss)

Legal costs for trademark disputes

Transaction costs related to acquisitions

Severance indemnities and provisions for severance expenses

Costs related to the Business Combination

(5)

Net impairments of leased and owned stores

Special donation to the UNHCR

(6)

(1)

See explanatory notes on slides 32-33

April 6, 2023

(11)

(2)

Net (income)/costs related to lease agreements

Gain on Thom Browne option

(9)

Impairment of investments accounted for using the equity method (3

(1

(8)

(7)

Other

Tax effects on adjusting items

Adjusted Profit/(Loss)

Impact of non-controlling interests

Adjusted Profit/(Loss) attributable to shareholders of the Parer

Weighted average number of shares for basic earnings per share

Adjusted Basic Earnings per Share

Weighted average number of shares for diluted earnings per share

Adjusted Diluted Earnings per Share

(12)

(3)

2022

For the year ended December 31,

2021

65,279

7,532

2,289

2,199

2,137

1,639

1,000

(6,844)

(1,602)

73,629

14,460

59,169

237,545,736

0.25

240,647,513

0.25

(127,661)

8,996

205,332

8,692

15,512

(20,675)

4,884

(19,758)

75,322

8,669

66,653

203,499,933

0.33

Ermenegildo Zegna Group

204,917,880

0.33

2020

(46,540)

12,308

19,725

3,000

4,532

7,535

(5,312)

(4,752)

4,063

(8,815)

201,489,100

(0.04)

201,489,100

(0.04)

29View entire presentation