Zegna Results Presentation Deck

●

●

●

●

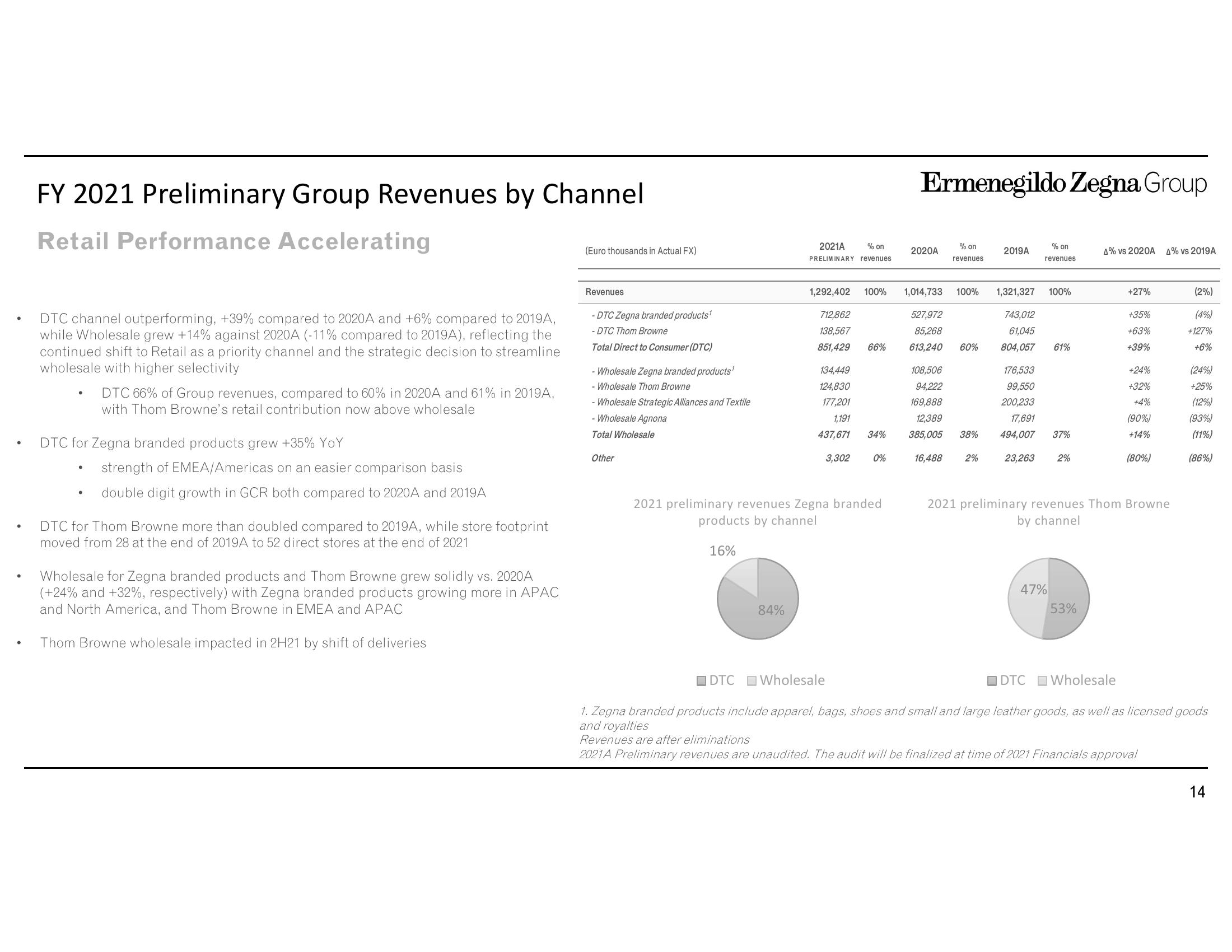

FY 2021 Preliminary Group Revenues by Channel

Retail Performance Accelerating

DTC channel outperforming, +39% compared to 2020A and +6% compared to 2019A,

while Wholesale grew +14% against 2020A (-11% compared to 2019A), reflecting the

continued shift to Retail as a priority channel and the strategic decision to streamline

wholesale with higher selectivity

DTC 66% of Group revenues, compared to 60% in 2020A and 61% in 2019A,

with Thom Browne's retail contribution now above wholesale

DTC for Zegna branded products grew +35% YoY

strength of EMEA/Americas on an easier comparison basis

double digit growth in GCR both compared to 2020A and 2019A

DTC for Thom Browne more than doubled compared to 2019A, while store footprint

moved from 28 at the end of 2019A to 52 direct stores at the end of 2021

Wholesale for Zegna branded products and Thom Browne grew solidly vs. 2020A

(+24% and +32%, respectively) with Zegna branded products growing more in APAC

and North America, and Thom Browne in EMEA and APAC

Thom Browne wholesale impacted in 2H21 by shift of deliveries

(Euro thousands in Actual FX)

Revenues

-DTC Zegna branded products¹

-DTC Thom Browne

Total Direct to Consumer (DTC)

- Wholesale Zegna branded products¹

- Wholesale Thom Browne

- Wholesale Strategic Alliances and Textile

- Wholesale Agnona

Total Wholesale

Other

2021A % on

PRELIMINARY revenues

84%

1,292,402 100%

712,862

138,567

851,429

2021 preliminary revenues Zegna branded

products by channel

16%

66%

Ermenegildo Zegna Group

1,014,733 100%

527,972

85,268

613,240 60%

108,506

94,222

134,449

124,830

177,201

169,888

1,191

12,389

437,671 34% 385,005 38%

3,302 0%

DTCWholesale

2020A

% on

16,488 2%

2019A

% on

revenues

1,321,327 100%

743,012

61,045

804,057 61%

176,533

99,550

200,233

17,691

494,007 37%

23,263 2%

47%

4% vs 2020A 4% vs 2019A

53%

+27%

+35%

+63%

+39%

2021 preliminary revenues Thom Browne

by channel

+24%

+32%

+4%

(90%)

+14%

(80%)

DTC Wholesale

1. Zegna branded products include apparel, bags, shoes and small and large leather goods, as well as licensed goods

and royalties

(2%)

(4%)

+127%

+6%

(24%)

+25%

(12%)

(93%)

(11%)

(86%)

Revenues are after eliminations

2021A Preliminary revenues are unaudited. The audit will be finalized at time of 2021 Financials approval

14View entire presentation