Bright Machines SPAC

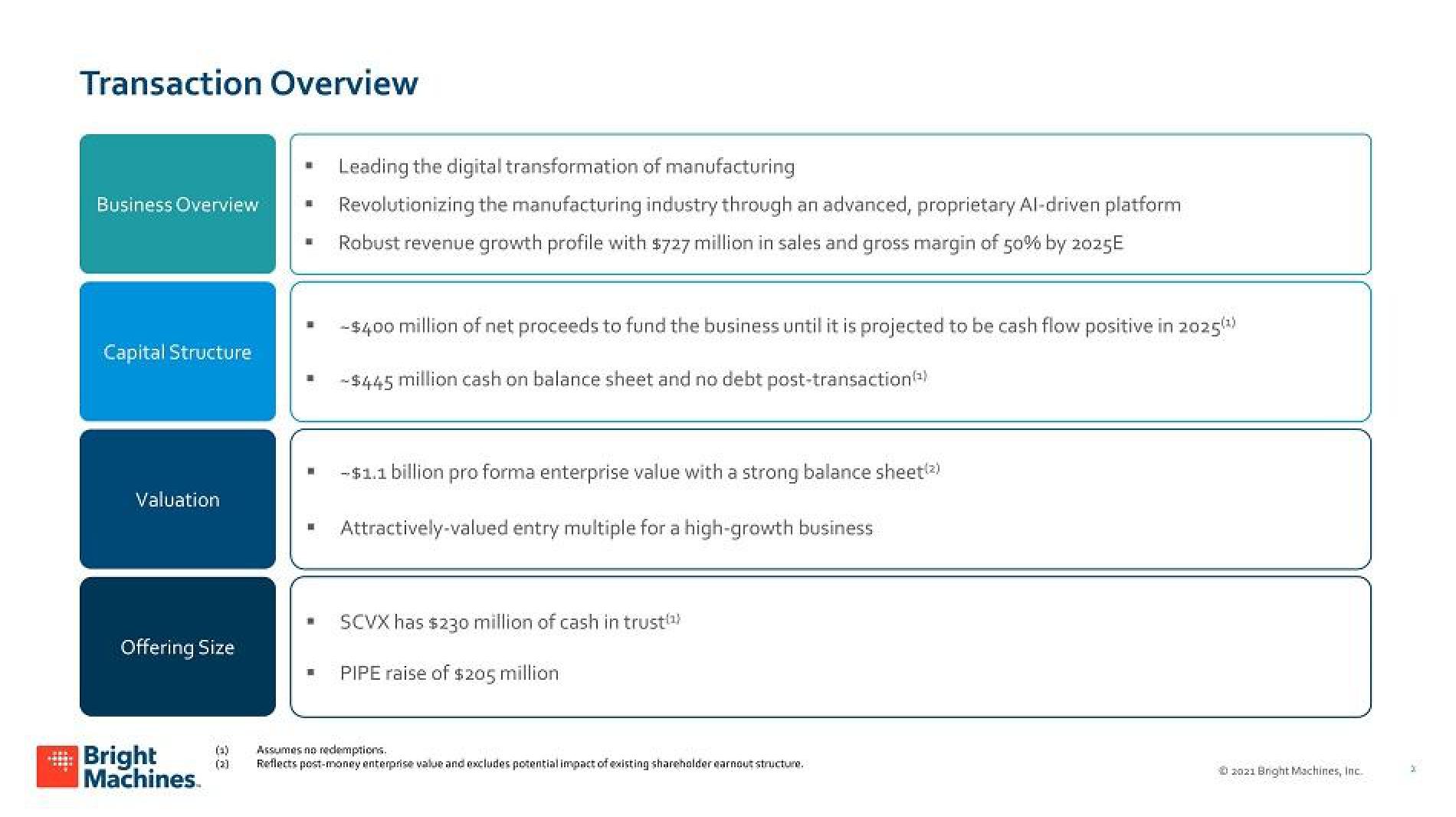

Transaction Overview

Business Overview

Capital Structure

Valuation

Offering Size

Bright

Machines

(4)

(3)

1

Leading the digital transformation of manufacturing

Revolutionizing the manufacturing industry through an advanced, proprietary Al-driven platform

Robust revenue growth profile with $727 million in sales and gross margin of 50% by 2025E

-$400 million of net proceeds to fund the business until it is projected to be cash flow positive in 2025(¹)

--$445 million cash on balance sheet and no debt post-transaction (¹)

--$1.1 billion pro forma enterprise value with a strong balance sheet(²)

Attractively-valued entry multiple for a high-growth business

SCVX has $230 million of cash in trust)

PIPE raise of $205 million

Assumes no redemptions.

Reflects post-money enterprise value and excludes potential impact of existing shareholder earnout structure.

Ⓒ2021 Bright Machines, Inc.View entire presentation