Credit Suisse Credit Presentation Deck

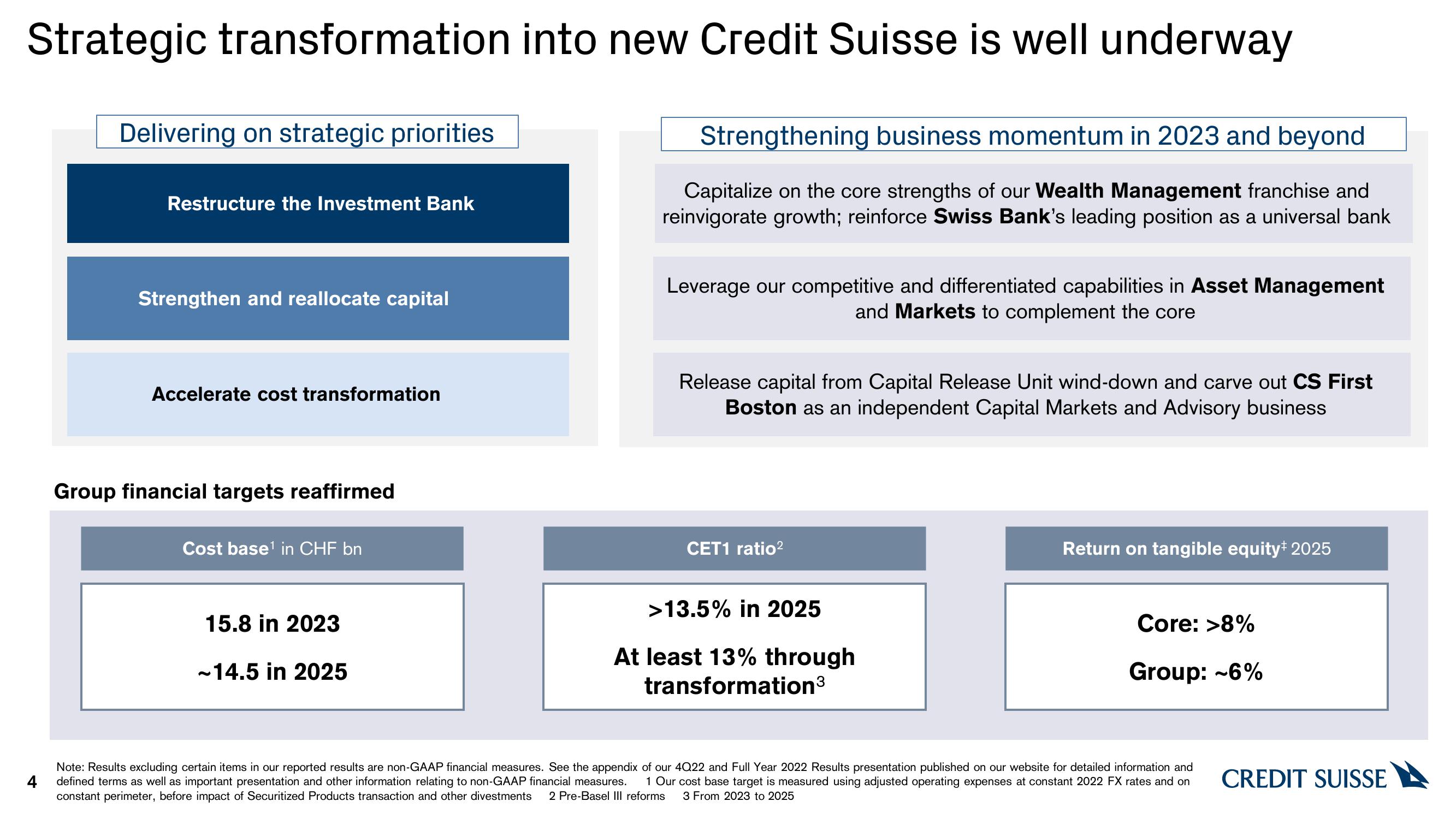

Strategic transformation into new Credit Suisse is well underway

4

Delivering on strategic priorities

Restructure the Investment Bank

Strengthen and reallocate capital

Accelerate cost transformation

Group financial targets reaffirmed

Cost base¹ in CHF bn

15.8 in 2023

-14.5 in 2025

Strengthening business momentum in 2023 and beyond

Capitalize on the core strengths of our Wealth Management franchise and

reinvigorate growth; reinforce Swiss Bank's leading position as a universal bank

Leverage our competitive and differentiated capabilities in Asset Management

and Markets to complement the core

Release capital from Capital Release Unit wind-down and carve out CS First

Boston as an independent Capital Markets and Advisory business

CET1 ratio²

>13.5% in 2025

At least 13% through

transformation³

Return on tangible equity# 2025

Core: >8%

Group: ~6%

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of our 4Q22 and Full Year 2022 Results presentation published on our website for detailed information and

defined terms as well as important presentation and other information relating to non-GAAP financial measures. 1 Our cost base target is measured using adjusted operating expenses at constant 2022 FX rates and on

constant perimeter, before impact of Securitized Products transaction and other divestments 2 Pre-Basel III reforms 3 From 2023 to 2025

CREDIT SUISSEView entire presentation