Cboe Results Presentation Deck

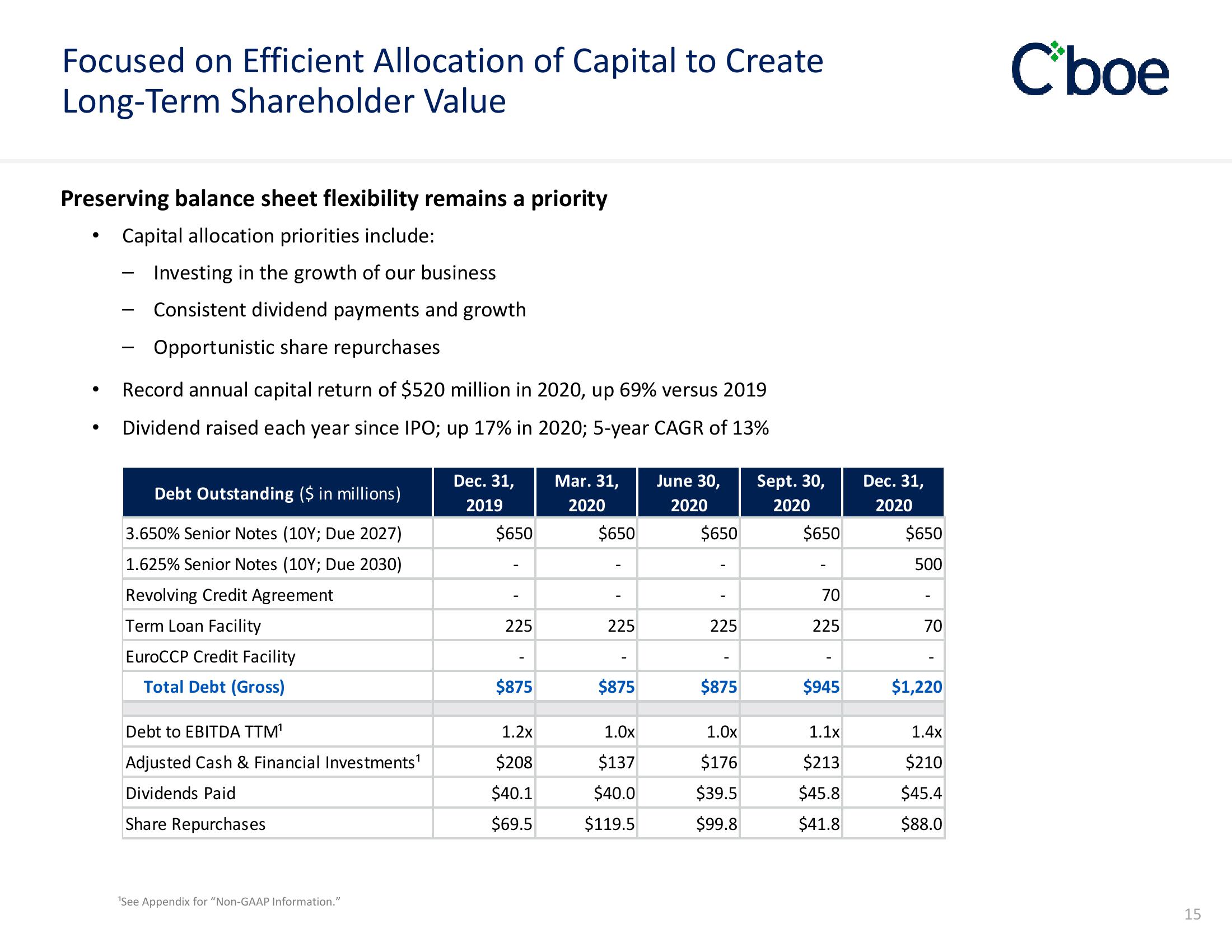

Focused on Efficient Allocation of Capital to Create

Long-Term Shareholder Value

Preserving balance sheet flexibility remains a priority

Capital allocation priorities include:

Investing in the growth of our business

Consistent dividend payments and growth

Opportunistic share repurchases

●

●

Record annual capital return of $520 million in 2020, up 69% versus 2019

Dividend raised each year since IPO; up 17% in 2020; 5-year CAGR of 13%

Debt Outstanding ($ in millions)

3.650% Senior Notes (10Y; Due 2027)

1.625% Senior Notes (10Y; Due 2030)

Revolving Credit Agreement

Term Loan Facility

EuroCCP Credit Facility

Total Debt (Gross)

Debt to EBITDA TTM¹

Adjusted Cash & Financial Investments¹

Dividends Paid

Share Repurchases

¹See Appendix for "Non-GAAP Information."

Dec. 31,

2019

$650

225

$875

1.2x

$208

$40.1

$69.5

Mar. 31,

2020

$650

225

$875

1.0x

$137

$40.0

$119.5

June 30,

2020

$650

225

$875

1.0x

$176

$39.5

$99.8

Sept. 30,

2020

$650

70

225

$945

1.1x

$213

$45.8

$41.8

Dec. 31,

2020

$650

500

70

$1,220

1.4x

$210

$45.4

$88.0

Cboe

15View entire presentation