Spotify Results Presentation Deck

Executive Summary

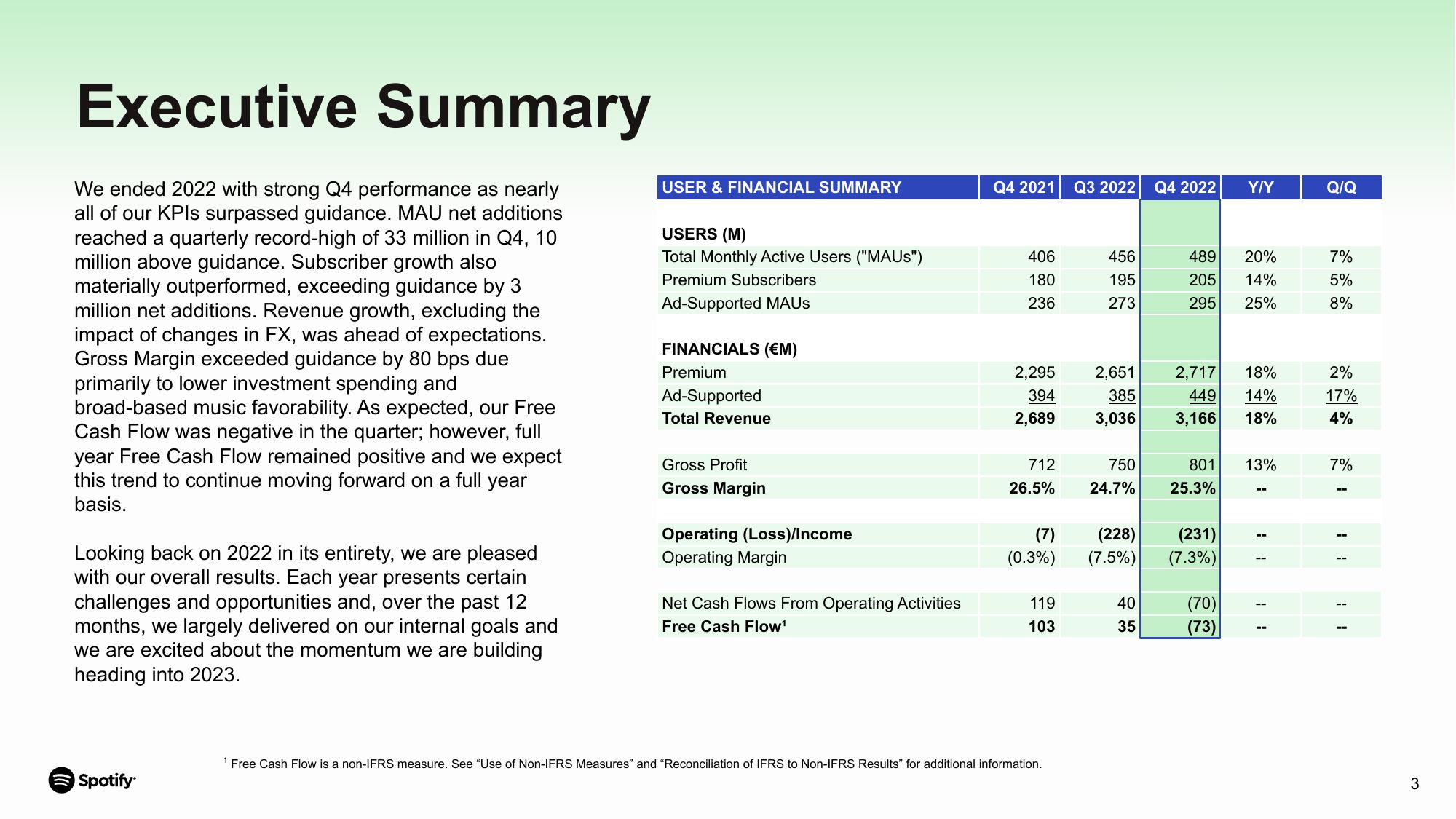

We ended 2022 with strong Q4 performance as nearly

all of our KPIs surpassed guidance. MAU net additions

reached a quarterly record-high of 33 million in Q4, 10

million above guidance. Subscriber growth also

materially outperformed, exceeding guidance by 3

million net additions. Revenue growth, excluding the

impact of changes in FX, was ahead of expectations.

Gross Margin exceeded guidance by 80 bps due

primarily to lower investment spending and

broad-based music favorability. As expected, our Free

Cash Flow was negative in the quarter; however, full

year Free Cash Flow remained positive and we expect

this trend to continue moving forward on a full year

basis.

Looking back on 2022 in its entirety, we are pleased

with our overall results. Each year presents certain

challenges and opportunities and, over the past 12

months, we largely delivered on our internal goals and

we are excited about the momentum we are building

heading into 2023.

Spotify

USER & FINANCIAL SUMMARY

USERS (M)

Total Monthly Active Users ("MAUS")

Premium Subscribers

Ad-Supported MAUS

FINANCIALS (€M)

Premium

Ad-Supported

Total Revenue

Gross Profit

Gross Margin

Operating (Loss)/Income

Operating Margin

Net Cash Flows From Operating Activities

Free Cash Flow¹

Q4 2021 Q3 2022

406

180

236

2,295

394

2,689

712

26.5%

(7)

(0.3%)

119

103

1 Free Cash Flow is a non-IFRS measure. See "Use of Non-IFRS Measures" and "Reconciliation of IFRS to Non-IFRS Results" for additional information.

456

195

273

2,651

385

3,036

(228)

(7.5%)

Q4 2022

40

35

489

205

295

750

801

24.7% 25.3%

2,717

18%

14%

449

3,166 18%

(231)

(7.3%)

Y/Y

(70)

(73)

20%

14%

25%

13%

--

--

Q/Q

7%

5%

8%

2%

17%

4%

7%

3View entire presentation