Paysafe Results Presentation Deck

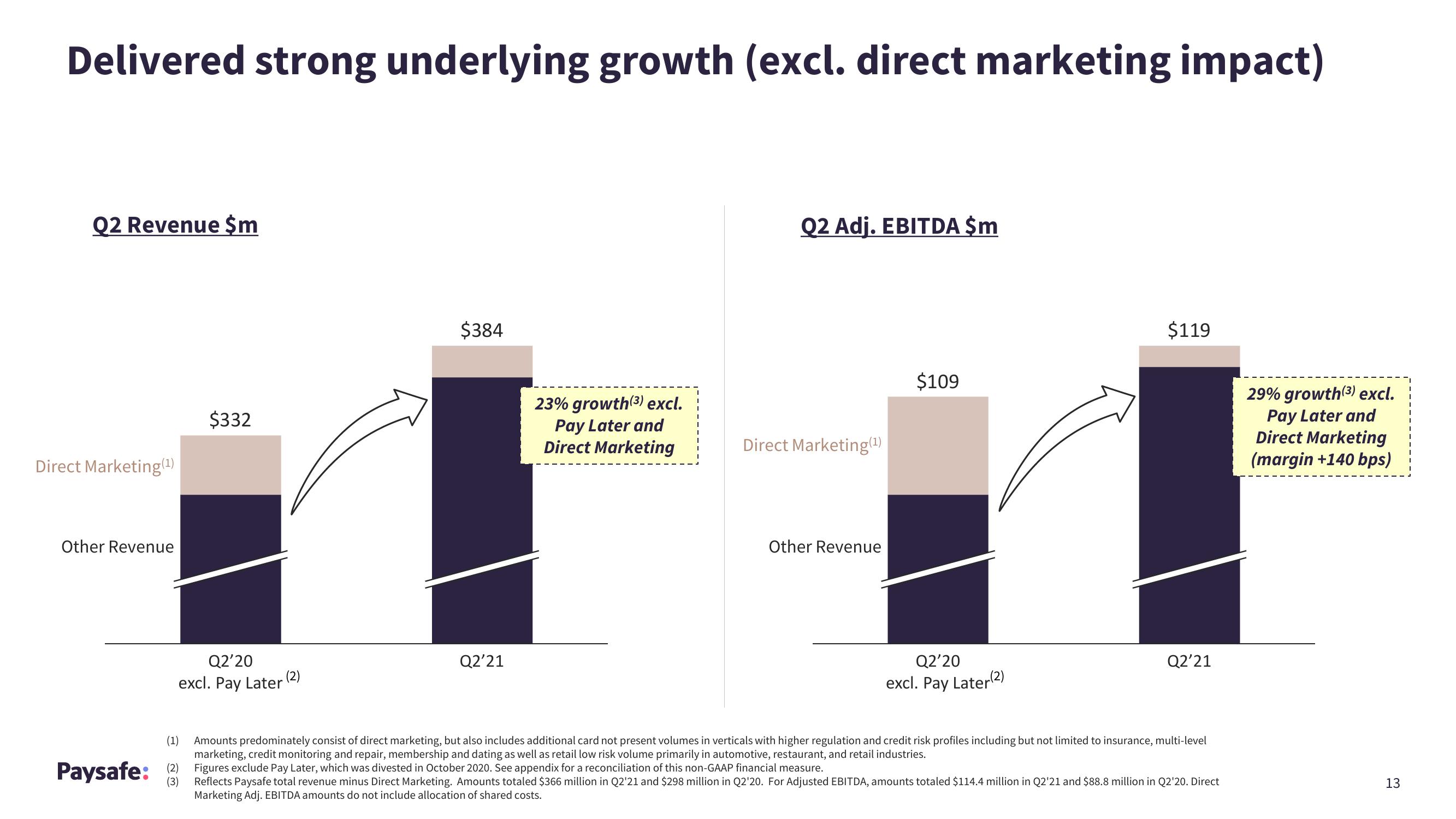

Delivered strong underlying growth (excl. direct marketing impact)

Q2 Revenue $m

Direct Marketing (¹)

Other Revenue

$332

Q2'20

excl. Pay Later

(1)

Paysafe: (2)

(2)

$384

Q2'21

23% growth(3) excl.

Pay Later and

Direct Marketing

Q2 Adj. EBITDA $m

Direct Marketing (¹)

Other Revenue

$109

Q2'20

excl. Pay Later (2)

$119

Q2'21

Amounts predominately consist of direct marketing, but also includes additional card not present volumes in verticals with higher regulation and credit risk profiles including but not limited to insurance, multi-level

marketing, credit monitoring and repair, membership and dating as well as retail low risk volume primarily in automotive, restaurant, and retail industries.

Figures exclude Pay Later, which was divested in October 2020. See appendix for a reconciliation of this non-GAAP financial measure.

Reflects Paysafe total revenue minus Direct Marketing. Amounts totaled $366 million in Q2'21 and $298 million in Q2'20. For Adjusted EBITDA, amounts totaled $114.4 million in Q2'21 and $88.8 million in Q2'20. Direct

Marketing Adj. EBITDA amounts do not include allocation of shared costs.

29% growth (3) excl.

Pay Later and

Direct Marketing

(margin +140 bps)

13View entire presentation