1Q22 Investor Update

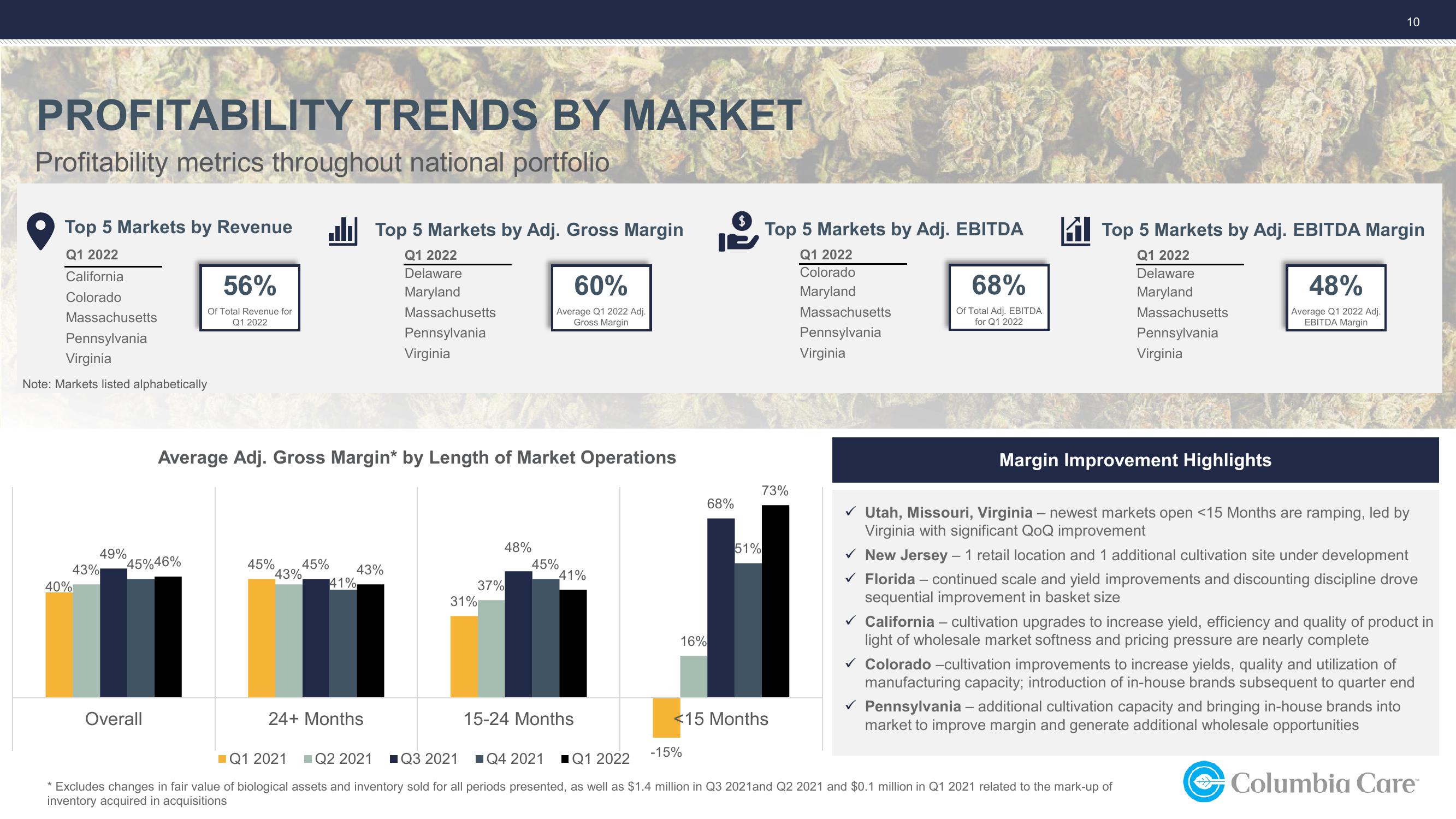

PROFITABILITY TRENDS BY MARKET

Profitability metrics throughout national portfolio

Top 5 Markets by Revenue

Q1 2022

California

Colorado

Massachusetts

Pennsylvania

Virginia

Note: Markets listed alphabetically

40%

43%

49%

45%46%

Overall

56%

Of Total Revenue for

Q1 2022

Average Adj. Gross Margin* by Length of Market Operations

45% 45%

43%.

41%

Top 5 Markets by Adj. Gross Margin

Q1 2022

Delaware

Maryland

Massachusetts

Pennsylvania

Virginia

43%

24+ Months

31%

37%

60%

Average Q1 2022 Adj.

Gross Margin

48%

45%

41%

15-24 Months

16%

68%

-15%

Top 5 Markets by Adj. EBITDA

Q1 2022

Colorado

Maryland

Massachusetts

Pennsylvania

Virginia

73%

51%

<15 Months

68%

Of Total Adj. EBITDA

for Q1 2022

Top 5 Markets by Adj. EBITDA Margin

Q1 2022

Delaware

Maryland

Massachusetts

Pennsylvania

Virginia

Margin Improvement Highlights

48%

Average Q1 2022 Adj.

EBITDA Margin

10

✓ Utah, Missouri, Virginia - newest markets open <15 Months are ramping, led by

Virginia with significant QoQ improvement

✓ New Jersey - 1 retail location and 1 additional cultivation site under development

✓ Florida - continued scale and yield improvements and discounting discipline drove

sequential improvement in basket size

✓ California - cultivation upgrades to increase yield, efficiency and quality of product in

light of wholesale market softness and pricing pressure are nearly complete

✓ Colorado -cultivation improvements to increase yields, quality and utilization of

manufacturing capacity; introduction of in-house brands subsequent to quarter end

✓ Pennsylvania - additional cultivation capacity and bringing in-house brands into

market to improve margin and generate additional wholesale opportunities

Q1 2021 Q2 2021 ■Q3 2021

Q4 2021 ■Q1 2022

* Excludes changes in fair value of biological assets and inventory sold for all periods presented, as well as $1.4 million in Q3 2021and Q2 2021 and $0.1 million in Q1 2021 related to the mark-up of

inventory acquired in acquisitions

Columbia Care™View entire presentation