Bakkt Results Presentation Deck

3Q23 Key performance indicators

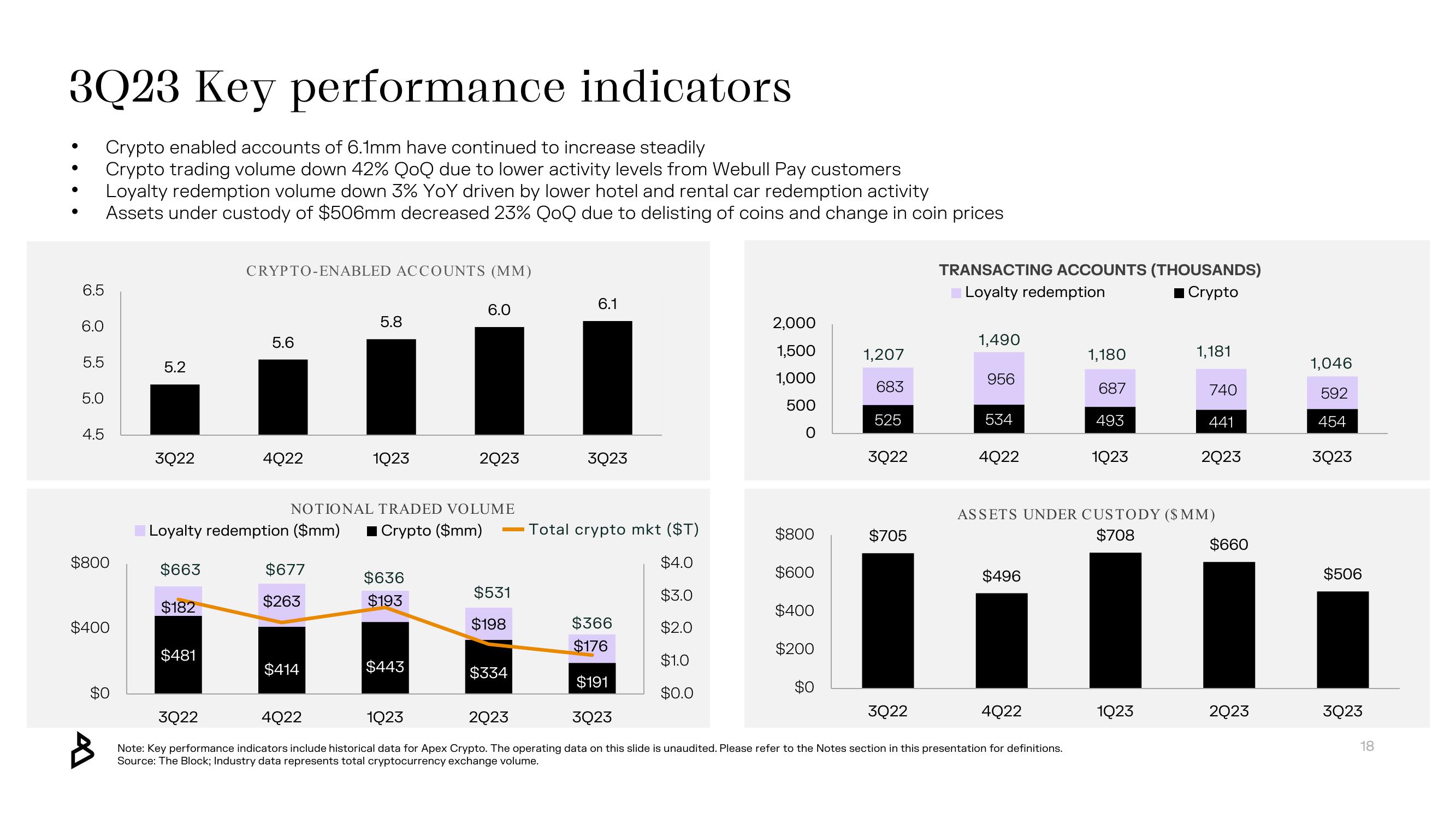

Crypto enabled accounts of 6.1mm have continued to increase steadily

Crypto trading volume down 42% QoQ due to lower activity levels from Webull Pay customers

Loyalty redemption volume down 3% YoY driven by lower hotel and rental car redemption activity

Assets under custody of $506mm decreased 23% QoQ due to delisting of coins and change in coin prices

6.5

6.0

5.5

5.0

4.5

$800

$400

$0

5.2

3Q22

CRYPTO-ENABLED ACCOUNTS (MM)

5.6

$481

4Q22

$677

$263

5.8

1Q23

NOTIONAL TRADED VOLUME

Loyalty redemption ($mm) ■Crypto ($mm)

$663

$182

$414

$636

$193

6.0

2Q23

$443

$531

$198

6.1

$334

3Q23

Total crypto mkt ($T)

$4.0

$3.0

$2.0

$1.0

$0.0

2,000

1,500

1,000

500

$800

$600

$400

$200

1,207

683

$0

525

3022

$705

TRANSACTING ACCOUNTS (THOUSANDS)

Loyalty redemption

■Crypto

$366

$176

$191

3Q22

4Q22

1Q23

2023

3Q23

Note: Key performance indicators include historical data for Apex Crypto. The operating data on this slide is unaudited. Please refer to the Notes section in this presentation for definitions.

Source: The Block; Industry data represents total cryptocurrency exchange volume.

3Q22

1,490

956

534

4022

$496

1,180

687

493

4Q22

1Q23

1,181

ASSETS UNDER CUSTODY ($ MM)

$708

1Q23

740

441

2023

$660

2Q23

1,046

592

454

3Q23

$506

3Q23

18View entire presentation