Babylon SPAC Presentation Deck

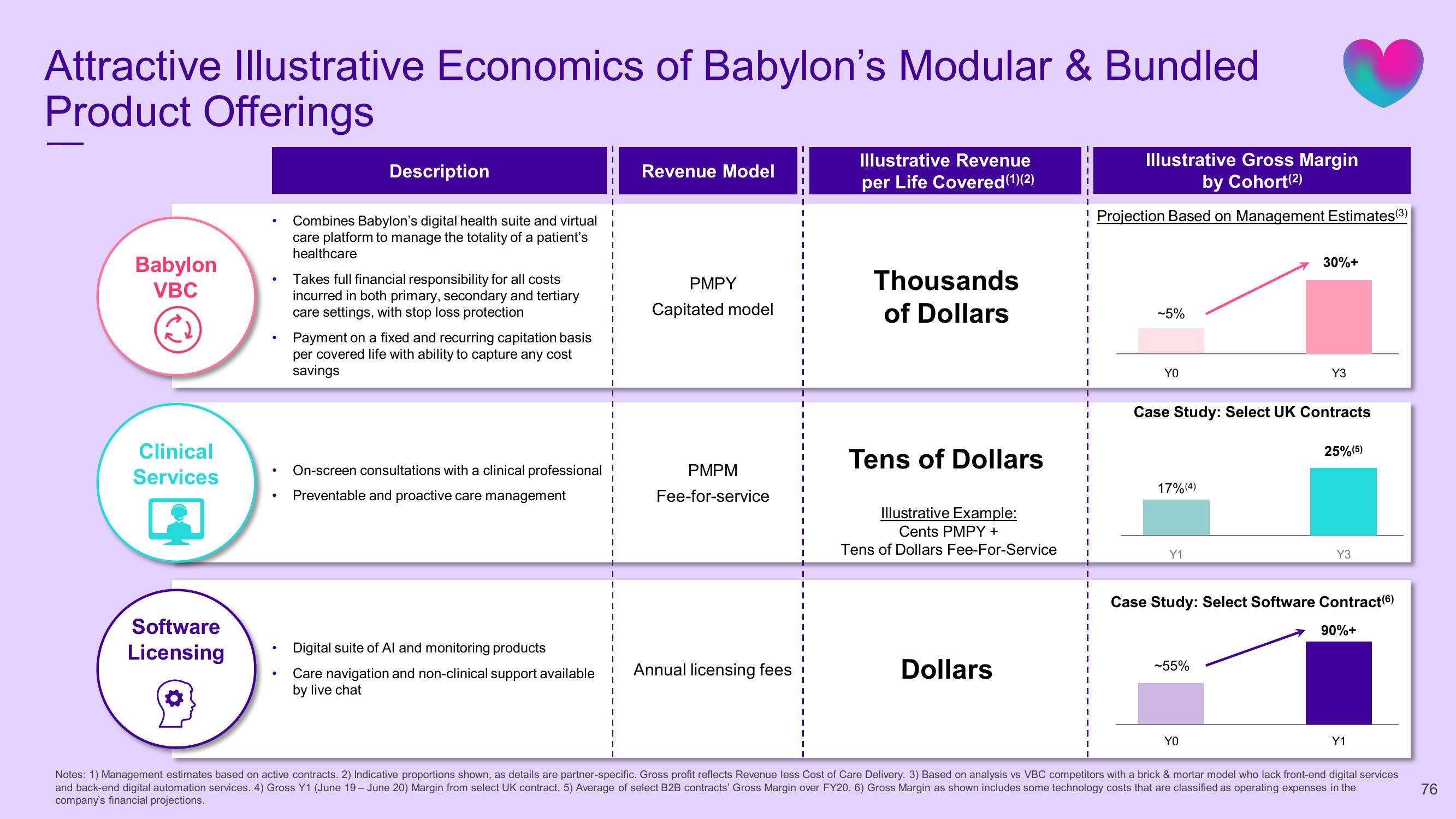

Attractive Illustrative Economics of Babylon's Modular & Bundled

Product Offerings

Babylon

VBC

Clinical

Services

Software

Licensing

●

•

●

●

●

Description

Combines Babylon's digital health suite and virtual

care platform to manage the totality of a patient's

healthcare

Takes full financial responsibility for all costs

incurred in both primary, secondary and tertiary

care settings, with stop loss protection

Payment on a fixed and recurring capitation basis

per covered life with ability to capture any cost

savings

On-screen consultations with a clinical professional

Preventable and proactive care management

Digital suite of Al and monitoring products

Care navigation and non-clinical support available

by live chat

1

I

I

T

I

I

I

I

I

I

I

I

I

I

1

I

I

Revenue Model

PMPY

Capitated model

PMPM

Fee-for-service

I

I

Annual licensing fees!

I

Illustrative Revenue

per Life Covered (1)(2)

Thousands

of Dollars

Tens of Dollars

Illustrative Example:

Cents PMPY +

Tens of Dollars Fee-For-Service

Dollars

! Projection Based on Management Estimates (³)

1

I

1

I

I

I

I

I

I

I

I

I

I

I

I

Illustrative Gross Margin

by Cohort(2)

I

I

~5%

YO

17% (4)

Case Study: Select UK Contracts

Y1

30%+

-55%

Y3

YO

25% (5)

Case Study: Select Software Contract(6)

Y3

90%+

Y1

Notes: 1) Management estimates based on active contracts. 2) Indicative proportions shown, as details are partner-specific. Gross profit reflects Revenue less Cost of Care Delivery. 3) Based on analysis vs VBC competitors with a brick & mortar model who lack front-end digital services

and back-end digital automation services. 4) Gross Y1 (June 19 - June 20) Margin from select UK contract. 5) Average of select B2B contracts' Gross Margin over FY20. 6) Gross Margin as shown includes some technology costs that are classified as operating expenses in the

company's financial projections.

76View entire presentation