Investor Insights: Q1 MCR Corp

THE TRICK IS MITIGATING THE VOLATILITY

Hotels (daily leases) are more volatile than other real estate asset classes (longer-term leases)

MCR mitigates that volatility via:

#1) Experienced in-house operations team

MCR runs hotels better than its competitors

#2) Low leverage

Borrow at <65% LTV/1.5x debt service coverage; can withstand recession and not breach loan covenants

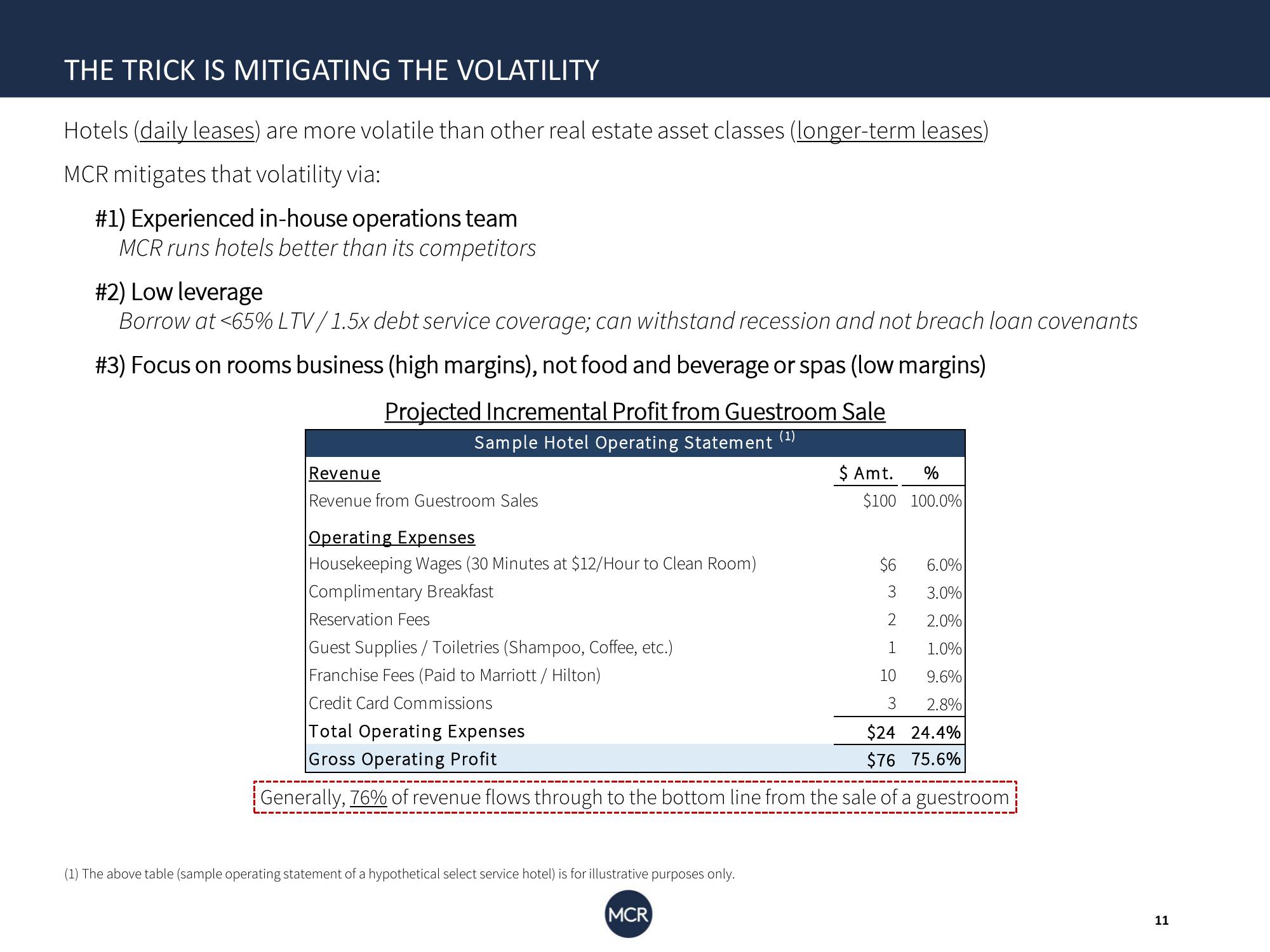

#3) Focus on rooms business (high margins), not food and beverage or spas (low margins)

Projected Incremental Profit from Guestroom Sale

Sample Hotel Operating Statement

(1)

Revenue

Revenue from Guestroom Sales

Operating Expenses

Housekeeping Wages (30 Minutes at $12/Hour to Clean Room)

Complimentary Breakfast

Reservation Fees

Guest Supplies / Toiletries (Shampoo, Coffee, etc.)

Franchise Fees (Paid to Marriott / Hilton)

Credit Card Commissions

$ Amt. %

(1) The above table (sample operating statement of a hypothetical select service hotel) is for illustrative purposes only.

MCR

$100 100.0%

6.0%

3.0%

2.0%

1.0%

9.6%

2.8%

$24 24.4%

$76 75.6%

$6

3

2

1

10

3

Total Operating Expenses

Gross Operating Profit

Generally, 76% of revenue flows through to the bottom line from the sale of a guestroom

11View entire presentation