Netstreit Investor Presentation Deck

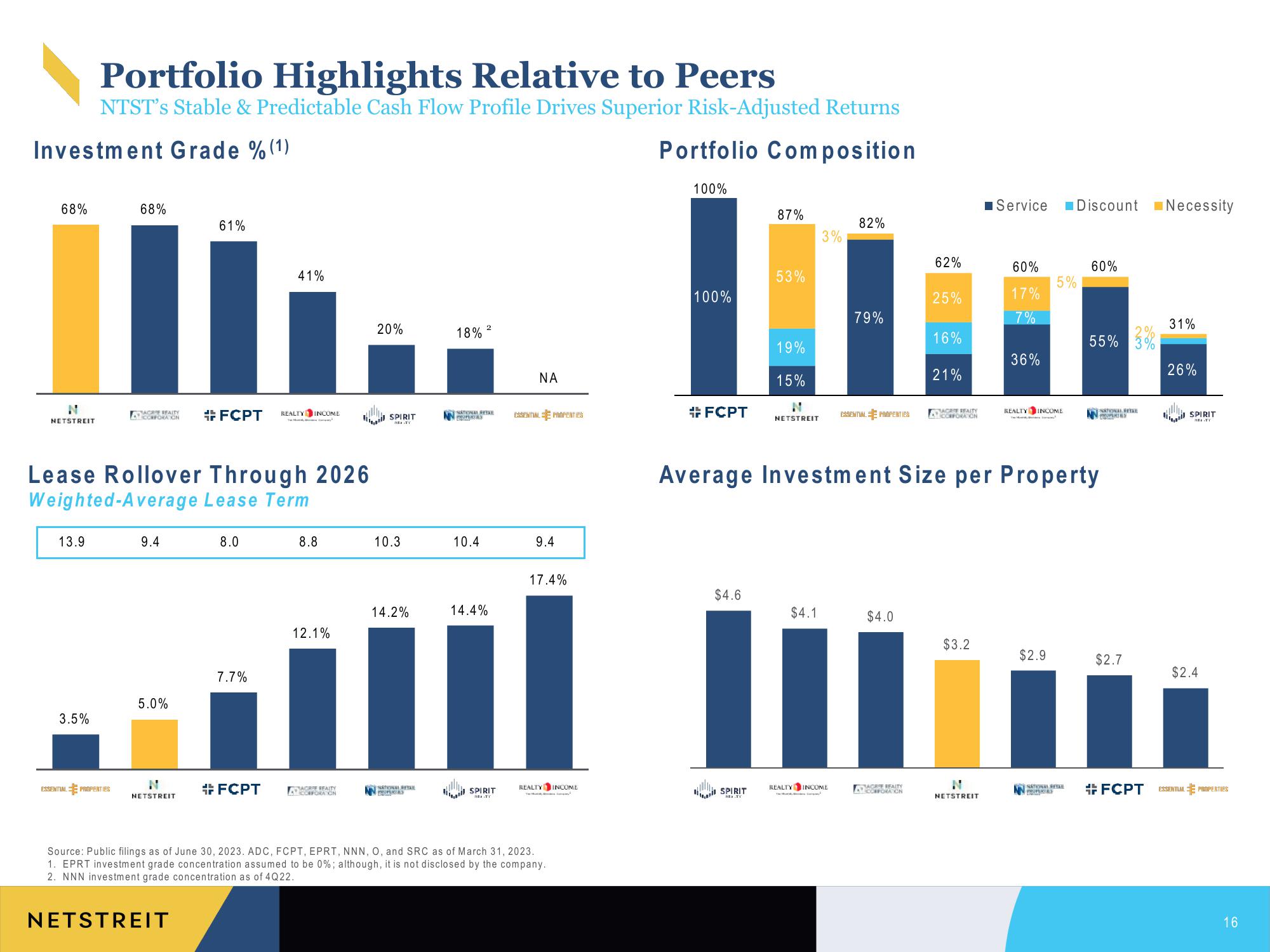

Portfolio Highlights Relative to Peers

NTST's Stable & Predictable Cash Flow Profile Drives Superior Risk-Adjusted Returns

Investment Grade % (¹)

68%

||

N

NETSTREIT

13.9

68%

3.5%

ESSENTIAL PROPERTIES

#FCPT

A CORPORA ON

AGRIE REAITY

Lease Rollover Through 2026

Weighted-Average Lease Term

9.4

61%

5.0%

N

NETSTREIT

8.0

7.7%

41%

#FCPT

REALTY INCOME

8.8

12.1%

will

ROTAGE REALTY

CORPORA ON

20%

SPIRIT

ALTY

10.3

14.2%

NN NATIONAL RETAR

PROPERERS

18% 2

NÁTIONAL RETAR

FORSIPURIALS

10.4

14.4%

SPIRIT

ABATT

ΝΑ

ESSENTIAL PROPERTIES

9.4

17.4%

REALTY INCOME

Source: Public filings as of June 30, 2023. ADC, FCPT, EPRT, NNN, O, and SRC as of March 31, 2023.

1. EPRT investment grade concentration assumed to be 0%; although, it is not disclosed by the company.

2. NNN investment grade concentration as of 4Q22.

NETSTREIT

Portfolio Composition

100%

100%

#FCPT

$4.6

87%

SPIRIT

nà

53%

19%

15%

N

NETSTREIT

3%

$4.1

82%

REALTY INCOME

79%

ESSENTIAL HMOPERTIES

$4.0

62%

AGREE REALTY

CORPORA ON

25%

16%

21%

AGREE REALTY

$3.2

■Service Discount Necessity

Average Investment Size per Property

N

NETSTREIT

60%

17%

7%

36%

5%

REALTY INCOME

$2.9

60%

2%

55% 3%

NATIONAL RETAR

PROPRIAS

NATIONAL RETAR

PROPERSEY

$2.7

1

31%

26%

SPIRIT

MEATY

$2.4

#FCPT ESSENTIAL PROPERTIES

16View entire presentation