OppFi Results Presentation Deck

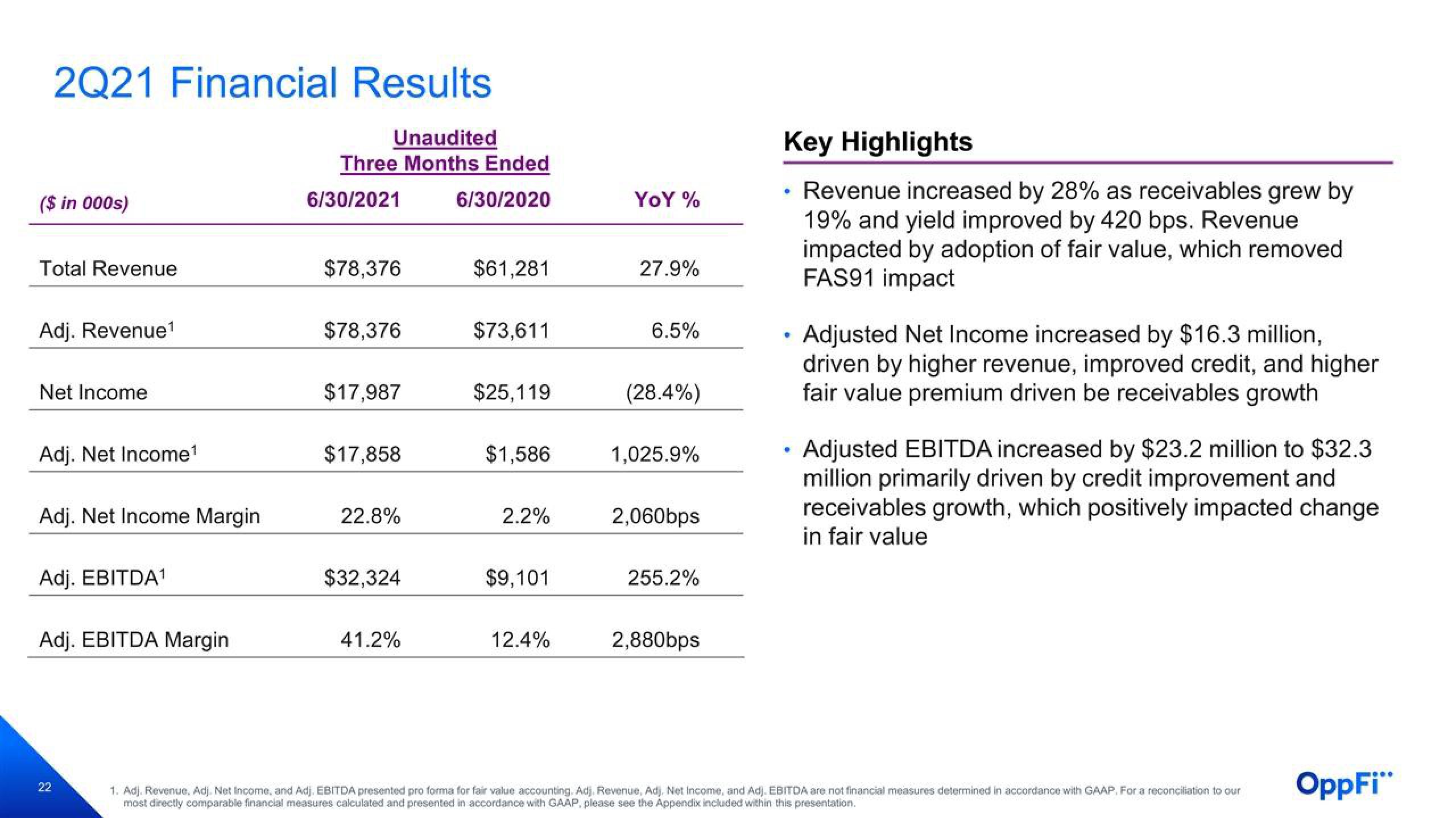

2Q21 Financial Results

($ in 000s)

Total Revenue

Adj. Revenue ¹

Net Income

Adj. Net Income ¹

Adj. Net Income Margin

Adj. EBITDA¹

Adj. EBITDA Margin

22

Unaudited

Three Months Ended

6/30/2020

6/30/2021

$78,376

$78,376

$17,987

$17,858

22.8%

$32,324

41.2%

$61,281

$73,611

$25,119

$1,586

2.2%

$9,101

12.4%

YoY%

27.9%

6.5%

(28.4%)

1,025.9%

2,060bps

255.2%

2,880bps

Key Highlights

Revenue increased by 28% as receivables grew by

19% and yield improved by 420 bps. Revenue

impacted by adoption of fair value, which removed

FAS91 impact

C

●

Adjusted Net Income increased by $16.3 million,

driven by higher revenue, improved credit, and higher

fair value premium driven be receivables growth

Adjusted EBITDA increased by $23.2 million to $32.3

million primarily driven by credit improvement and

receivables growth, which positively impacted change

in fair value

1. Adj. Revenue. Adj. Net Income, and Adj. EBITDA presented pro forma for fair value accounting. Adj. Revenue, Adj. Net Income, and Adj. EBITDA are not financial measures determined in accordance with GAAP. For a reconciliation to our

most directly comparable financial measures calculated and presented in accordance with GAAP, please see the Appendix included within this presentation.

OppFi"View entire presentation