Engine No. 1 Activist Presentation Deck

ExxonMobil's Position on Power Generation

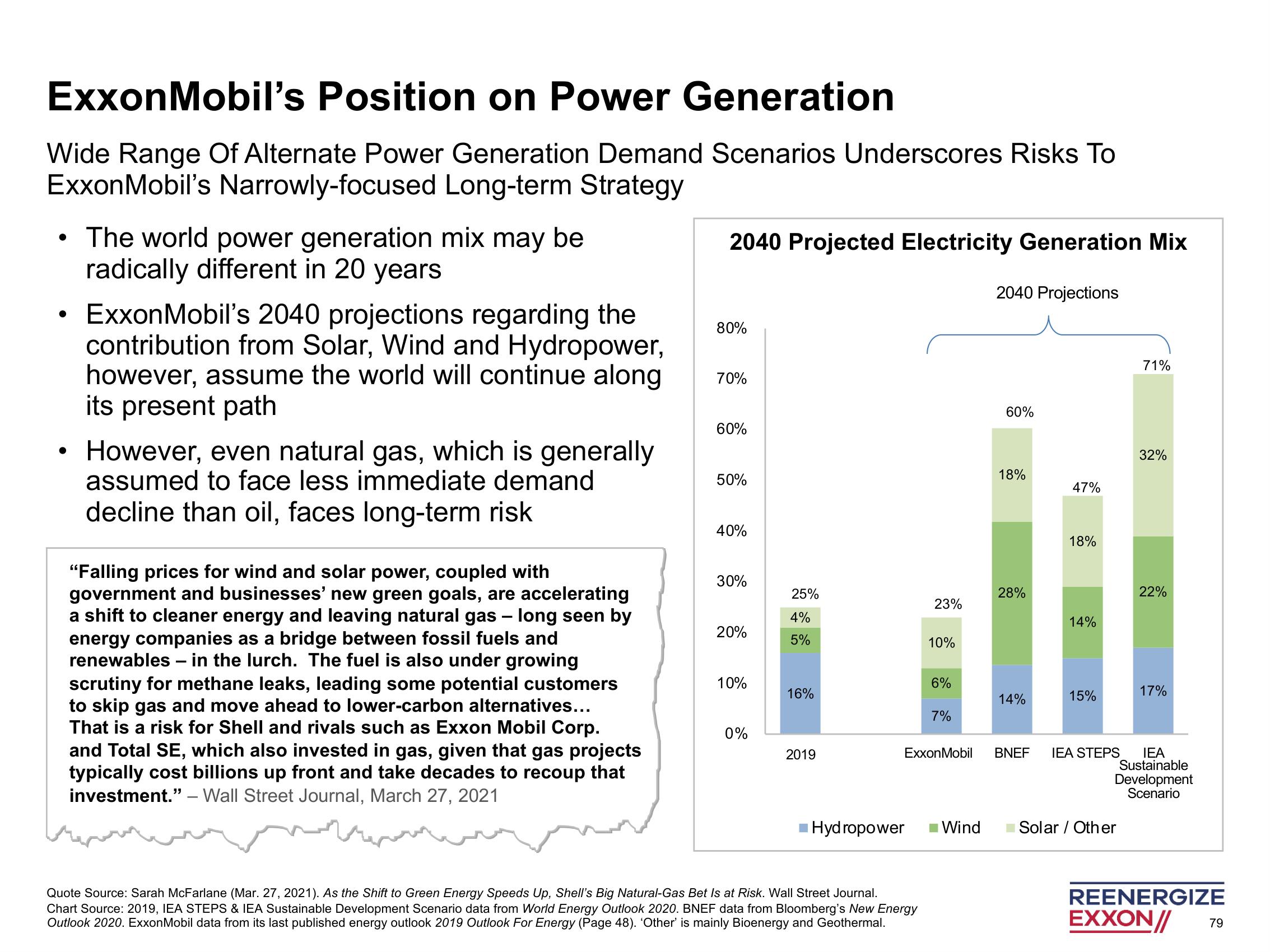

Wide Range Of Alternate Power Generation Demand Scenarios Underscores Risks To

ExxonMobil's Narrowly-focused Long-term Strategy

• The world power generation mix may be

radically different in 20 years

●

ExxonMobil's 2040 projections regarding the

contribution from Solar, Wind and Hydropower,

however, assume the world will continue along

its present path

• However, even natural gas, which is generally

assumed to face less immediate demand

decline than oil, faces long-term risk

"Falling prices for wind and solar power, coupled with

government and businesses' new green goals, are accelerating

a shift to cleaner energy and leaving natural gas - long seen by

energy companies as a bridge between fossil fuels and

renewables - in the lurch. The fuel is also under growing

scrutiny for methane leaks, leading some potential customers

to skip gas and move ahead to lower-carbon alternatives...

That is a risk for Shell and rivals such as Exxon Mobil Corp.

and Total SE, which also invested in gas, given that gas projects

typically cost billions up front and take decades to recoup that

investment." - Wall Street Journal, March 27, 2021

2040 Projected Electricity Generation Mix

80%

70%

60%

50%

40%

30%

20%

10%

0%

25%

4%

5%

16%

2019

Hydropower

23%

Quote Source: Sarah McFarlane (Mar. 27, 2021). As the Shift to Green Energy Speeds Up, Shell's Big Natural-Gas Bet Is at Risk. Wall Street Journal.

Chart Source: 2019, IEA STEPS & IEA Sustainable Development Scenario data from World Energy Outlook 2020. BNEF data from Bloomberg's New Energy

Outlook 2020. ExxonMobil data from its last published energy outlook 2019 Outlook For Energy (Page 48). 'Other' is mainly Bioenergy and Geothermal.

10%

6%

7%

2040 Projections

Wind

60%

18%

28%

14%

47%

18%

14%

15%

71%

ExxonMobil BNEF IEA STEPS IEA

32%

Solar / Other

22%

17%

Sustainable

Development

Scenario

REENERGIZE

EXXON//

79View entire presentation