Hydrafacial Results Presentation Deck

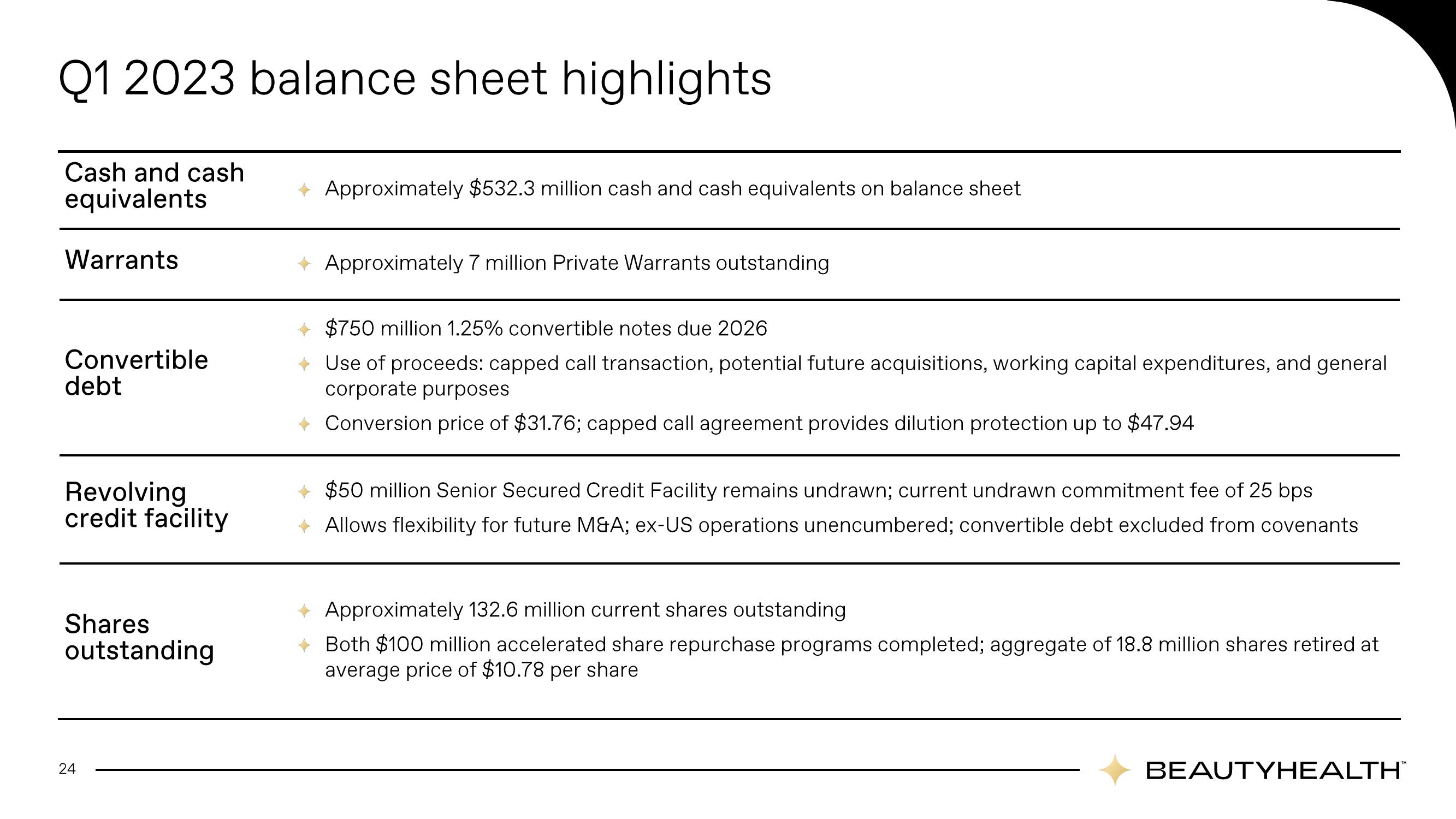

Q1 2023 balance sheet highlights

Cash and cash

equivalents

Warrants

Convertible

debt

Revolving

credit facility

Shares

outstanding

24

Approximately $532.3 million cash and cash equivalents on balance sheet

Approximately 7 million Private Warrants outstanding

$750 million 1.25% convertible notes due 2026

→ Use of proceeds: capped call transaction, potential future acquisitions, working capital expenditures, and general

corporate purposes

→ Conversion price of $31.76; capped call agreement provides dilution protection up to $47.94

$50 million Senior Secured Credit Facility remains undrawn; current undrawn commitment fee of 25 bps

Allows flexibility for future M&A; ex-US operations unencumbered; convertible debt excluded from covenants

Approximately 132.6 million current shares outstanding

Both $100 million accelerated share repurchase programs completed; aggregate of 18.8 million shares retired at

average price of $10.78 per share

BEAUTYHEALTH™View entire presentation