J.P. Morgan 2016 Auto Conference

FY 2016 Performance Update

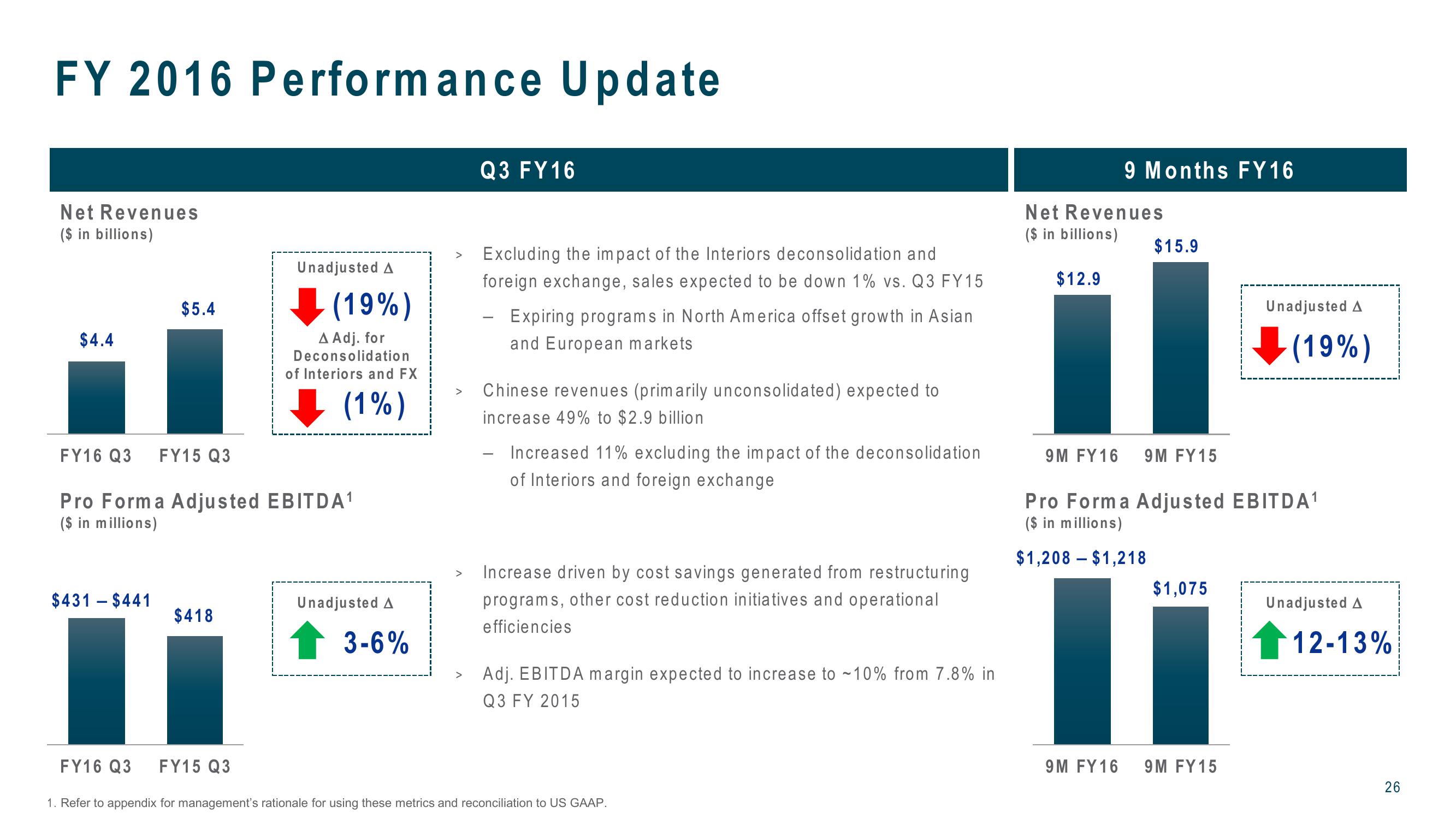

Net Revenues

($ in billions)

$4.4

$5.4

>

Unadjusted A

(19%)

▲ Adj. for

Deconsolidation

of Interiors and FX

(1%)

FY16 Q3 FY15 Q3

Pro Forma Adjusted EBITDA¹

($ in millions)

$431 - $441

Unadjusted A

$418

3-6%

>

>

Q3 FY 16

Excluding the impact of the Interiors deconsolidation and

foreign exchange, sales expected to be down 1% vs. Q3 FY15

- Expiring programs in North America offset growth in Asian

and European markets

Chinese revenues (primarily unconsolidated) expected to

increase 49% to $2.9 billion

Increased 11% excluding the impact of the deconsolidation

of Interiors and foreign exchange

Increase driven by cost savings generated from restructuring

programs, other cost reduction initiatives and operational

efficiencies

9 Months FY16

Net Revenues

($ in billions)

$12.9

$15.9

9M FY 16 9M FY15

Unadjusted A

(19%)

Pro Forma Adjusted EBITDA1

($ in millions)

$1,208 $1,218

$1,075

Unadjusted A

12-13%

FY16 Q3

FY15 Q3

>

Adj. EBITDA margin expected to increase to -10% from 7.8% in

Q3 FY 2015

1. Refer to appendix for management's rationale for using these metrics and reconciliation to US GAAP.

9M FY 16

9M FY15

26View entire presentation