Melrose Results Presentation Deck

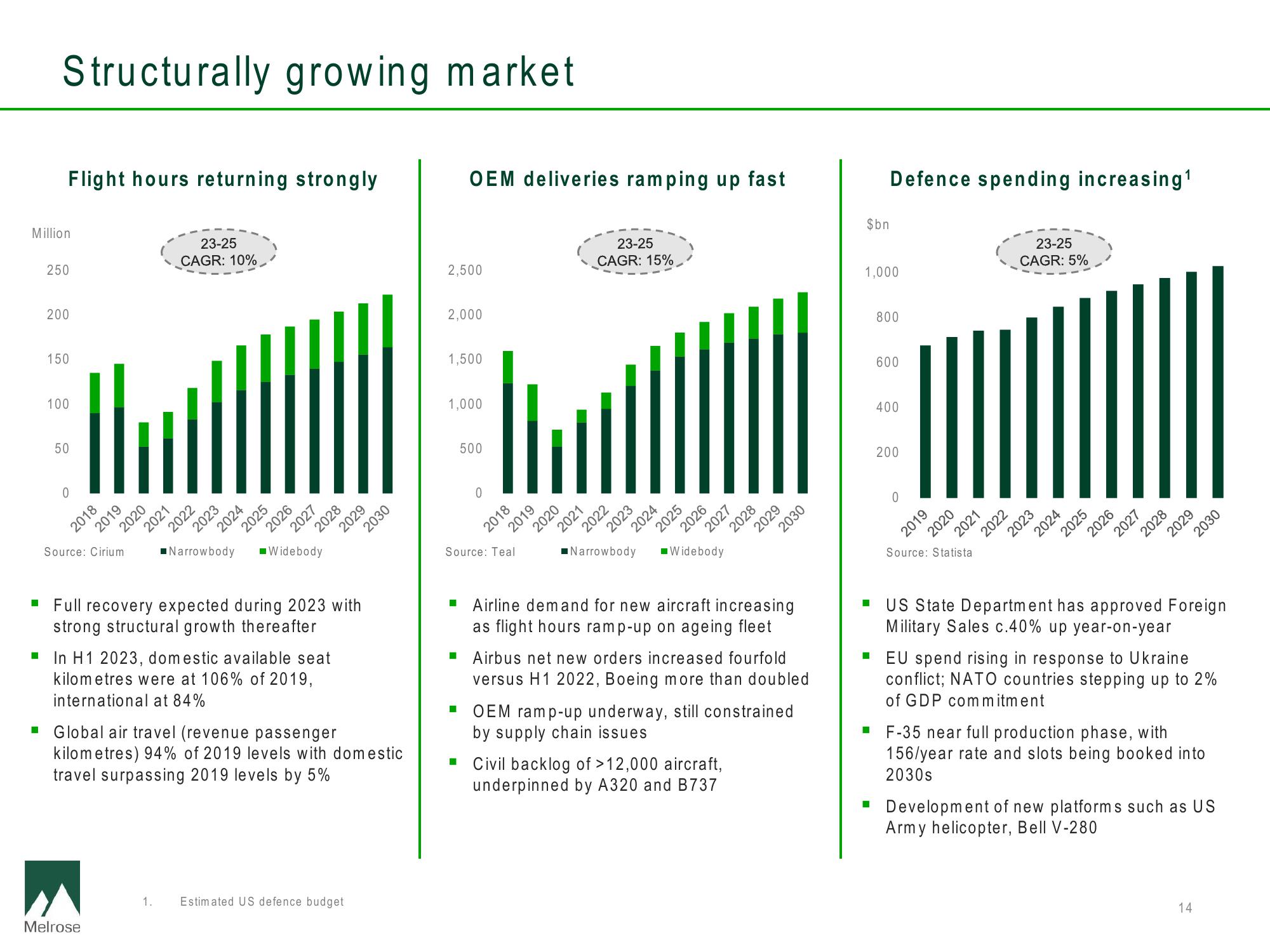

Structurally growing market

■

Flight hours returning strongly

Million

250

200

150

100

50

0

2018

2019

Source: Cirium

2020

Melrose

2021

23-25

CAGR: 10%

2022

2023

2024

2025

2026

2027

Narrowbody ■Widebody

In H1 2023, domestic available seat

kilometres were at 106% of 2019,

international at 84%

2028

Full recovery expected during 2023 with

strong structural growth thereafter

2029

■ Global air travel (revenue passenger

kilometres) 94% of 2019 levels with domestic

travel surpassing 2019 levels by 5%

1. Estimated US defence budget

2030

2,500

OEM deliveries ramping up fast

2,000

1,500

1,000

■

■

500

0

Source: Teal

bol

2018

23-25

CAGR: 15%

2019

2020

2021

2022

2023

Narrowbody

2024

2025

2026

■Widebody

2027

2028

■ Civil backlog of >12,000 aircraft,

underpinned by A320 and B737

2029

Airline demand for new aircraft increasing

as flight hours ramp-up on ageing fleet

Airbus net new orders increased fourfold

versus H1 2022, Boeing more than doubled

OEM ramp-up underway, still constrained

by supply chain issues

2030

$bn

Defence spending increasing¹

1,000

■

■

800

600

400

200

0

2019

2020

2021

Source: Statista

2022

23-25

CAGR: 5%

2023

2024

2025

2026

2027

2028

2029

■ US State Department has approved Foreign

Military Sales c.40% up year-on-year

2030

EU spend rising in response to Ukraine

conflict; NATO countries stepping up to 2%

of GDP commitment

F-35 near full production phase, with

156/year rate and slots being booked into

2030s

▪ Development of new platforms such as US

Army helicopter, Bell V-280

14View entire presentation