The Urgent Need for Change and The Superior Path Forward

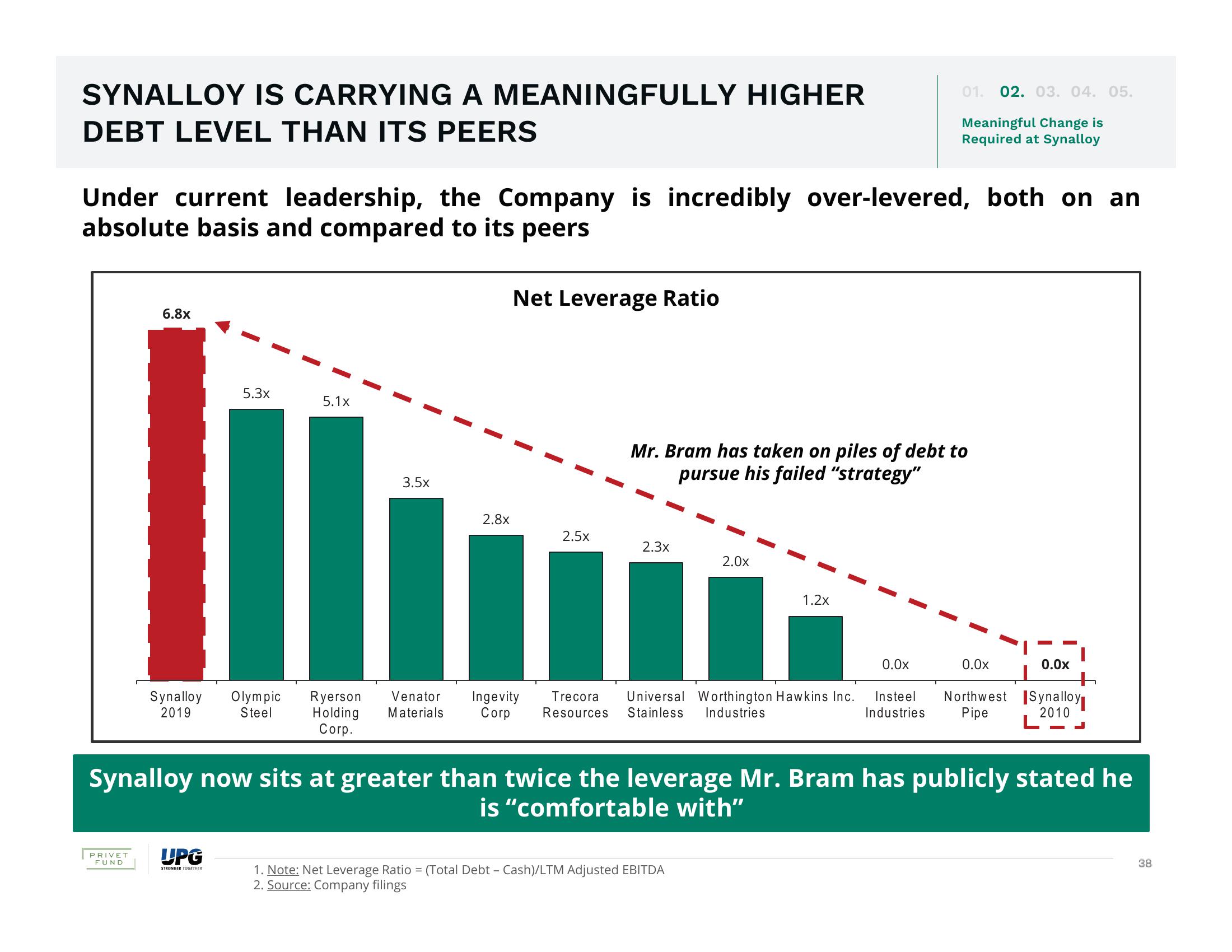

SYNALLOY IS CARRYING A MEANINGFULLY HIGHER

DEBT LEVEL THAN ITS PEERS

Under current leadership, the Company is incredibly over-levered, both on an

absolute basis and compared to its peers

6.8x

PRIVET

FUND

Synalloy

2019

5.3x

UPG

STRONGER TOGETHER

5.1x

3.5x

2.8x

Net Leverage Ratio

2.5x

Olympic Ryerson Venator Ingevity

Steel Holding Materials

Corp.

2.3x

Mr. Bram has taken on piles of debt to

pursue his failed "strategy"

2.0x

Trecora Universal Worthington Hawkins Inc.

Corp Resources Stainless Industries

1.2x

1. Note: Net Leverage Ratio = (Total Debt - Cash)/LTM Adjusted EBITDA

Source: Company filings

01. 02. 03. 04. 05.

0.0x

Meaningful Change is

Required at Synalloy

Insteel

Industries

Synalloy now sits at greater than twice the leverage Mr. Bram has publicly stated he

is "comfortable with"

0.0x

0.0x

Northwest Synalloy

Pipe

2010

38View entire presentation