J.P.Morgan Investment Banking Pitch Book

PROCESS CONSIDERATIONS

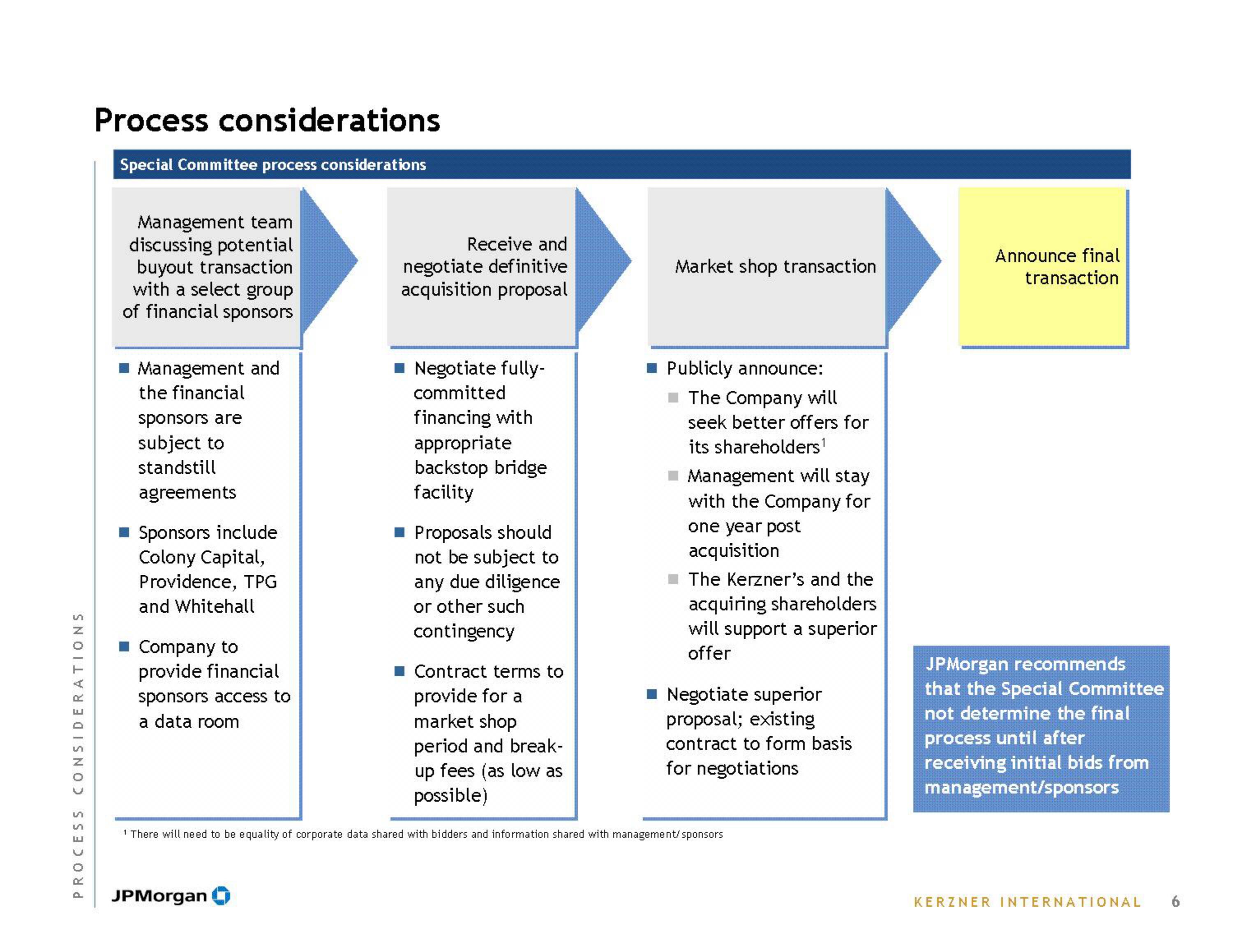

Process considerations

Special Committee process considerations

Management team

discussing potential

buyout transaction

with a select group

of financial sponsors

Management and

the financial

sponsors are

subject to

standstill

agreements

■ Sponsors include

Colony Capital,

Providence, TPG

and Whitehall

Company to

provide financial

sponsors access to

a data room

Receive and

negotiate definitive

acquisition proposal

JPMorgan

Negotiate fully-

committed

financing with

appropriate

backstop bridge

facility

■ Proposals should

not be subject to

any due diligence

or other such

contingency

Contract terms to

provide for a

market shop

period and break-

up fees (as low as

possible)

Market shop transaction

Publicly announce:

The Company will

seek better offers for

its shareholders¹

Management will stay

with the Company for

one year post

acquisition

■ The Kerzner's and the

acquiring shareholders

will support a superior

offer

Negotiate superior

proposal; existing

contract to form basis

for negotiations

1 There will need to be equality of corporate data shared with bidders and information shared with management/ sponsors

Announce final

transaction

JPMorgan recommends

that the Special Committee

not determine the final

process until after

receiving initial bids from

management/sponsors

KERZNER INTERNATIONAL 6View entire presentation