Nepc Private Markets Investment Due Diligence Report

Penwood Select Industrial Partners VII

NON-CORE REAL ESTATE

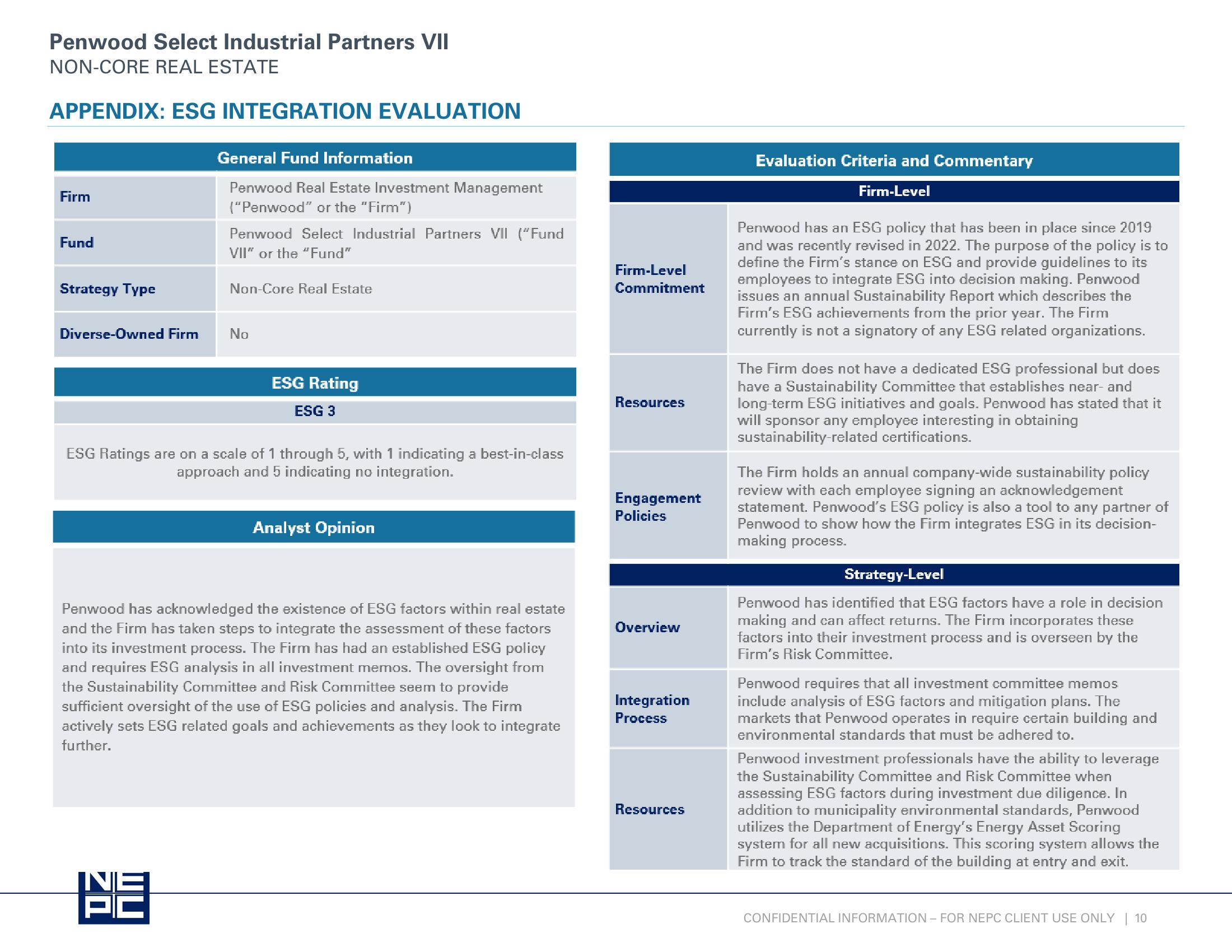

APPENDIX: ESG INTEGRATION EVALUATION

Firm

Fund

Strategy Type

Diverse-Owned Firm

General Fund Information

Penwood Real Estate Investment Management

("Penwood" or the "Firm")

Penwood Select Industrial Partners VII ("Fund

VII" or the "Fund"

INE

PC

Non-Core Real Estate

No

ESG Rating

ESG 3

ESG Ratings are on a scale of 1 through 5, with 1 indicating a best-in-class

approach and 5 indicating no integration.

Analyst Opinion

Penwood has acknowledged the existence of ESG factors within real estate

and the Firm has taken steps to integrate the assessment of these factors

into its investment process. The Firm has had an established ESG policy

and requires ESG analysis in all investment memos. The oversight from

the Sustainability Committee and Risk Committee seem to provide

sufficient oversight of the use of ESG policies and analysis. The Firm

actively sets ESG related goals and achievements as they look to integrate

further.

Firm-Level

Commitment

Resources

Engagement

Policies

Overview

Integration

Process

Resources

Evaluation Criteria and Commentary

Firm-Level

Penwood has an ESG policy that has been in place since 2019

and was recently revised in 2022. The purpose of the policy is to

define the Firm's stance on ESG and provide guidelines to its

employees to integrate ESG into decision making. Penwood

issues an annual Sustainability Report which describes the

Firm's ESG achievements from the prior year. The Firm

currently is not a signatory of any ESG related organizations.

The Firm does not have a dedicated ESG professional but does

have a Sustainability Committee that establishes near- and

long-term ESG initiatives and goals. Penwood has stated that it

will sponsor any employee interesting in obtaining

sustainability-related certifications.

The Firm holds an annual company-wide sustainability policy

review with each employee signing an acknowledgement

statement. Penwood's ESG policy is also a tool to any partner of

Penwood to show how the Firm integrates ESG in its decision-

making process.

Strategy-Level

Penwood has identified that ESG factors have a role in decision

making and can affect returns. The Firm incorporates these

factors into their investment process and is overseen by the

Firm's Risk Committee.

Penwood requires that all investment committee memos

include analysis of ESG factors and mitigation plans. The

markets that Penwood operates in require certain building and

environmental standards that must be adhered to.

Penwood investment professionals have the ability to leverage

the Sustainability Committee and Risk Committee when

assessing ESG factors during investment due diligence. In

addition to municipality environmental standards, Penwood

utilizes the Department of Energy's Energy Asset Scoring

system for all new acquisitions. This scoring system allows the

Firm to track the standard of the building at entry and exit.

CONFIDENTIAL INFORMATION - FOR NEPC CLIENT USE ONLY | 10View entire presentation