Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

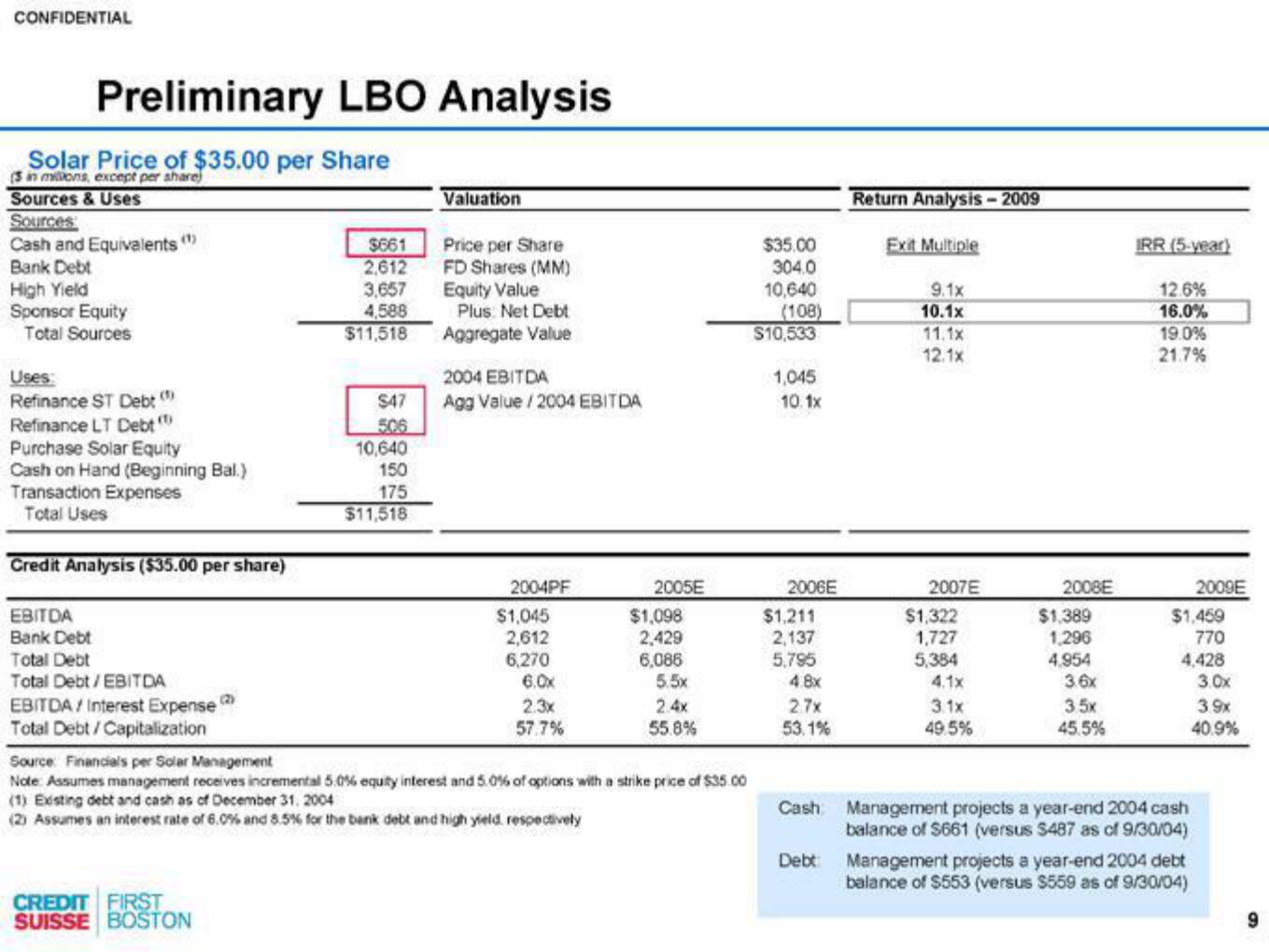

Preliminary LBO Analysis

Solar Price of $35.00 per Share

(3 in milions, except per share

Sources & Uses

Sources

Cash and Equivalents (¹)

Bank Debt

High Yield

Sponsor Equity

Total Sources

Uses:

Refinance ST Debt (¹)

Refinance LT Debt

Purchase Solar Equity

Cash on Hand (Beginning Bal.)

Transaction Expenses

Total Uses

Credit Analysis ($35.00 per share)

EBITDA

Bank Debt

Total Debt

Total Debt/EBITDA

EBITDA / Interest Expense

Total Debt/Capitalization

B

CREDIT FIRST

SUISSE BOSTON

$661

2,612

3,657

4,588

$11,518

$47

10,640

150

175

$11,518

Valuation

Price per Share

FD Shares (MM)

Equity Value

Plus: Net Debt

Aggregate Value

2004 EBITDA

Agg Value/2004 EBITDA

2004PF

$1,045

2,612

6,270

6.0x

2.3x

57.7%

2005E

$1,098

2,429

6,086

5.5x

2.4x

55.8%

Source: Financials per Solar Management

Note: Assumes management receives incremental 5.0% equity interest and 5.0% of options with a strike price of $35.00

(1) Existing debt and cash as of December 31, 2004

(2) Assumes an interest rate of 6.0% and 8.5% for the bank debt and high yield respectively

$35.00

304.0

10,640

(108)

$10,533

1,045

10.1x

2006E

$1,211

2,137

5,795

4.8x

2.7x

53.1%

Return Analysis - 2009

Debt:

Exit Multiple

9.1x

10.1x

11.1x

12.1x

2007E

$1,322

1,727

5,384

4.1x

3.1x

49.5%

2008E

$1,389

1,296

4.954

3.6x

3.5x

45.5%

IRR (5-year)

12.6%

16.0%

19.0%

21.7%

Cash Management projects a year-end 2004 cash

balance of $661 (versus $487 as of 9/30/04)

$1,459

770

4,428

2009E

Management projects a year-end 2004 debt

balance of $553 (versus $559 as of 9/30/04)

3.0x

3.9x

40.9%

9View entire presentation