Allwyn Investor Presentation Deck

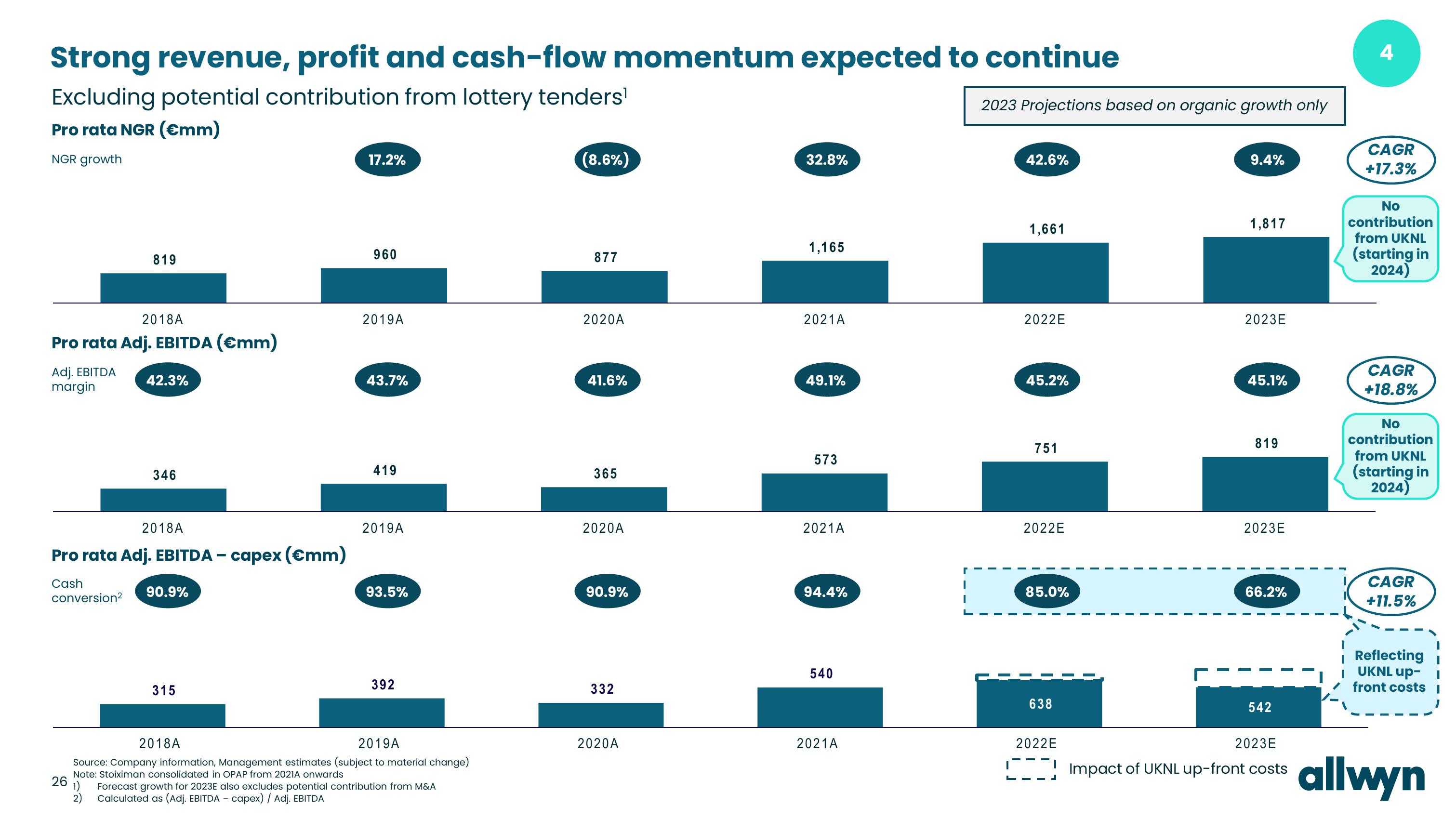

Strong revenue, profit and cash-flow momentum expected to continue

Excluding potential contribution from lottery tenders¹

Pro rata NGR (€mm)

NGR growth

2018A

Pro rata Adj. EBITDA (€mm)

Adj. EBITDA

margin

819

26

42.3%

2018A

Pro rata Adj. EBITDA - capex (€mm)

Cash

conversion²

1)

2)

346

90.9%

315

2018A

17.2%

960

2019A

43.7%

419

2019A

93.5%

392

2019A

Source: Company information, Management estimates (subject to material change)

Note: Stoiximan consolidated in OPAP from 2021A onwards

Forecast growth for 2023E also excludes potential contribution from M&A

Calculated as (Adj. EBITDA - capex) / Adj. EBITDA

(8.6%)

877

2020A

41.6%

365

2020A

90.9%

332

2020A

32.8%

1,165

2021A

49.1%

573

2021A

94.4%

540

2021A

2023 Projections based on organic growth only

42.6%

1,661

2022E

45.2%

751

2022E

85.0%

638

2022E

9.4%

1,817

2023E

45.1%

819

2023E

66.2%

542

2023E

Impact of UKNL up-front costs

4

CAGR

+17.3%

No

contribution

from UKNL

(starting in

2024)

CAGR

+18.8%

No

contribution

from UKNL

(starting in

2024)

CAGR

+11.5%

Reflecting

UKNL up-

front costs I

allwynView entire presentation