Jefferies Financial Group Investor Day Presentation Deck

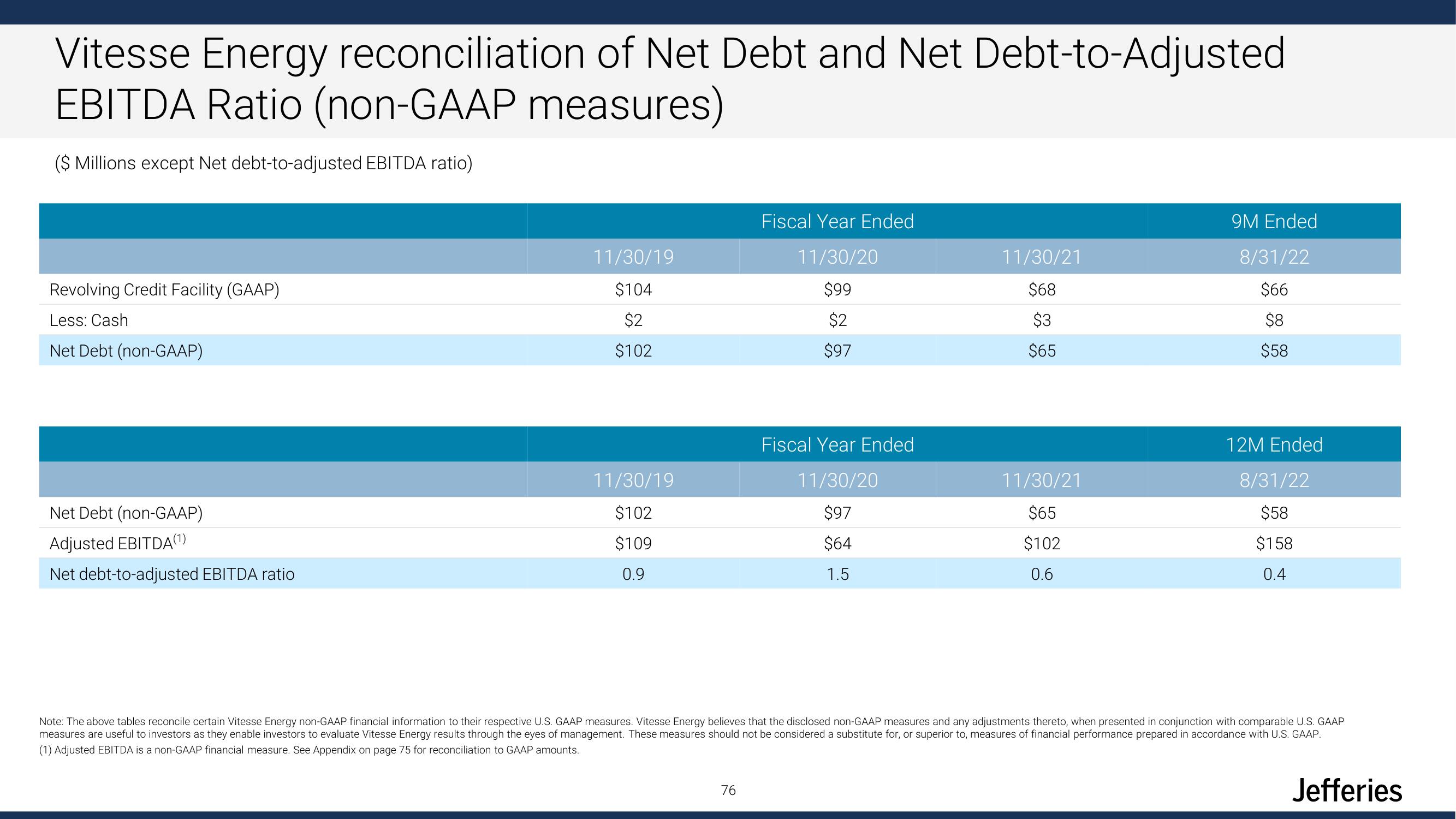

Vitesse Energy reconciliation of Net Debt and Net Debt-to-Adjusted

EBITDA Ratio (non-GAAP measures)

($ Millions except Net debt-to-adjusted EBITDA ratio)

Revolving Credit Facility (GAAP)

Less: Cash

Net Debt (non-GAAP)

Net Debt (non-GAAP)

Adjusted EBITDA(1)

Net debt-to-adjusted EBITDA ratio

11/30/19

$104

$2

$102

11/30/19

$102

$109

0.9

Fiscal Year Ended

11/30/20

$99

$2

$97

76

Fiscal Year Ended

11/30/20

$97

$64

1.5

11/30/21

$68

$3

$65

11/30/21

$65

$102

0.6

9M Ended

8/31/22

$66

$8

$58

12M Ended

8/31/22

$58

$158

0.4

Note: The above tables reconcile certain Vitesse Energy non-GAAP financial information to their respective U.S. GAAP measures. Vitesse Energy believes that the disclosed non-GAAP measures and any adjustments thereto, when presented in conjunction with comparable U.S. GAAP

measures are useful to investors as they enable investors to evaluate Vitesse Energy results through the eyes of management. These measures should not be considered a substitute for, or superior to, measures of financial performance prepared in accordance with U.S. GAAP.

(1) Adjusted EBITDA is a non-GAAP financial measure. See Appendix on page 75 for reconciliation to GAAP amounts.

JefferiesView entire presentation