Ashtead Group Results Presentation Deck

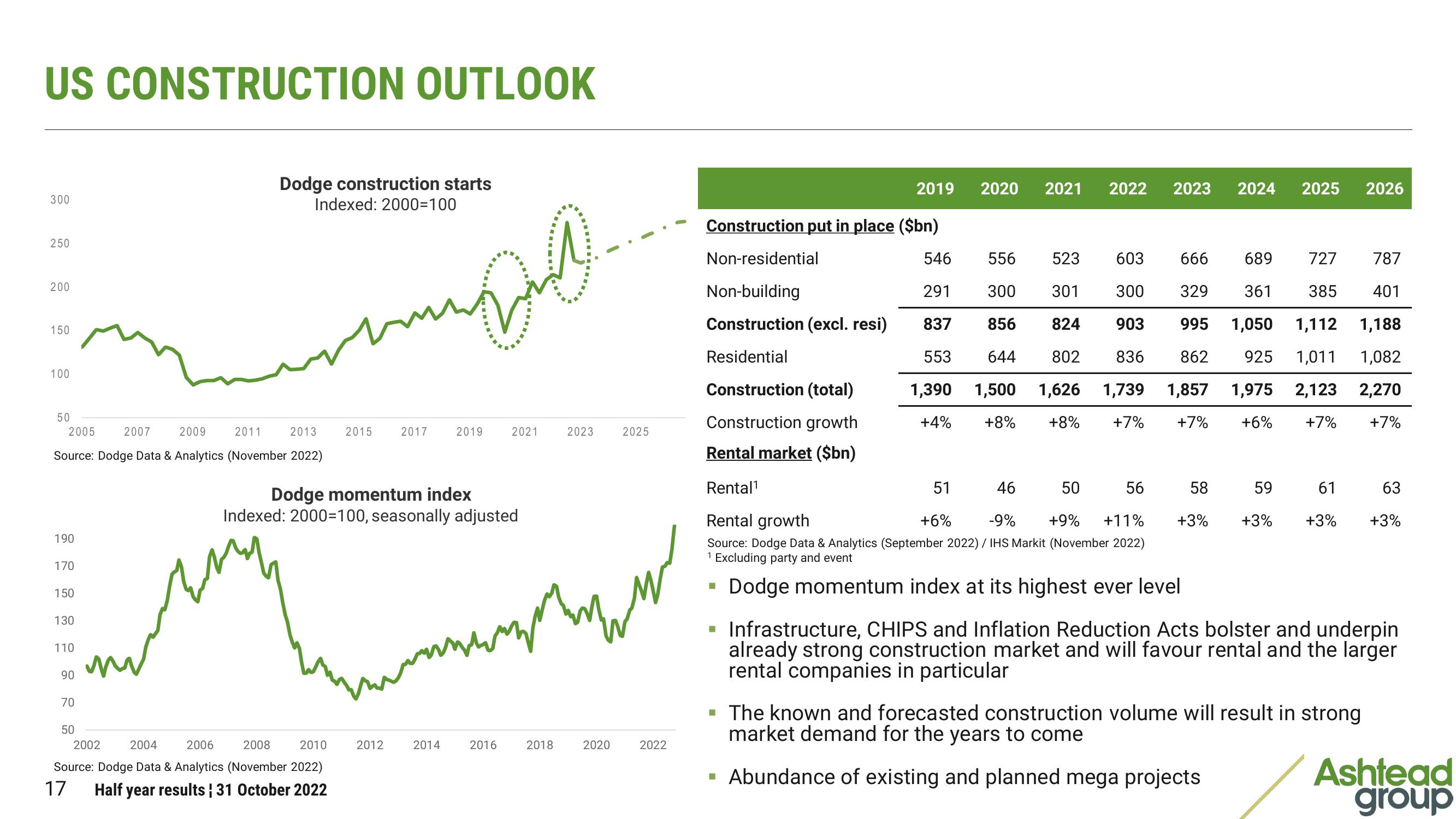

US CONSTRUCTION OUTLOOK

300

250

200

150

100

50

2005

2007 2009 2011 2013

Source: Dodge Data & Analytics (November 2022)

190

170

150

130

110

90

Dodge construction starts

Indexed: 2000=100

70

2015

50

2002 2004 2006 2008 2010

Source: Dodge Data & Analytics (November 2022)

17

Half year results ¦ 31 October 2022

2017

2012

BD

Dodge momentum index

Indexed: 2000=100, seasonally adjusted

2014

2019

2021

2016

научи

2023

2018

2020

2025

2022

2019 2020

Construction put in place ($bn)

Non-residential

■

2021

2022 2023 2024

Non-building

Construction (excl. resi)

Residential

Construction (total)

Construction growth

Rental market ($bn)

Rental¹

46 50

Rental growth

-9% +9% +11%

Source: Dodge Data & Analytics (September 2022) / IHS Markit (November 2022)

¹ Excluding party and event

51

+6%

Dodge momentum index at its highest ever level

546

556

523

603

666 689 727

787

291

300

301

300

361

385

401

837

856

824

903

329

995

1,050 1,112 1,188

862 925 1,011 1,082

644 802 836

553

1,390 1,500 1,626 1,739 1,857 1,975 2,123 2,270

+4% +8% +8% +7% +7% +6% +7% +7%

56

2025 2026

58

+3%

59 61 63

+3% +3% +3%

Infrastructure, CHIPS and Inflation Reduction Acts bolster and underpin

already strong construction market and will favour rental and the larger

rental companies in particular

The known and forecasted construction volume will result in strong

market demand for the years to come

▪ Abundance of existing and planned mega projects

Ashtead

groupView entire presentation