AngloAmerican Results Presentation Deck

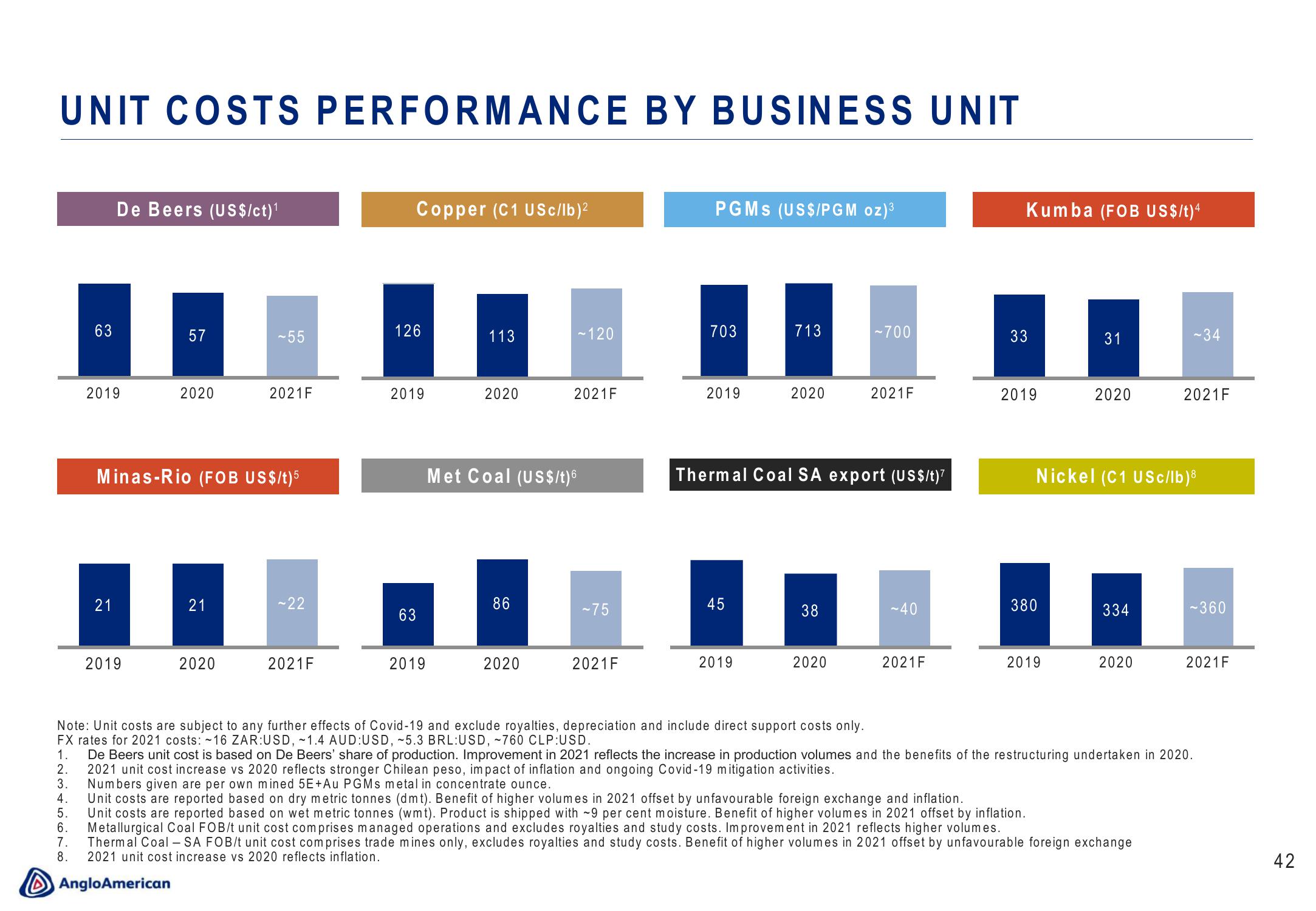

UNIT COSTS PERFORMANCE BY BUSINESS UNIT

63

5.

6.

7.

8.

De Beers (US$/ct)¹

2019

21

57

2019

2020

Minas-Rio (FOB US$/t)5

21

~55

2020

2021F

~22

2021F

Copper (C1 US c/lb)²

126

2019

63

2019

113

2020

Met Coal (US$/t)6

86

2020

-120

2021F

~75

2021F

PGMS (US$/PGM oz)³

703

2019

45

713

2019

2020

Thermal Coal SA export (US$/t)7

38

~700

2020

2021F

~40

2021F

Kumba (FOB US$/t)4

33

2019

380

31

2019

2020

Nickel (C1 US c/lb)8

334

2020

-34

2021F

Metallurgical Coal FOB/t unit cost comprises managed operations and excludes royalties and study costs. Improvement in 2021 reflects higher volumes.

Thermal Coal - SA FOB/t unit cost comprises trade mines only, excludes royalties and study costs. Benefit of higher volumes in 2021 offset by unfavourable foreign exchange

2021 unit cost increase vs 2020 reflects inflation.

AngloAmerican

Note: Unit costs are subject to any further effects of Covid-19 and exclude royalties, depreciation and include direct support costs only.

FX rates for 2021 costs: ~16 ZAR:USD, -1.4 AUD:USD, ~5.3 BRL:USD, ~760 CLP:USD.

1. De Beers unit cost is based on De Beers' share of production. Improvement in 2021 reflects the increase in production volumes and the benefits of the restructuring undertaken in 2020.

2. 2021 unit cost increase vs 2020 reflects stronger Chilean peso, impact of inflation and ongoing Covid-19 mitigation activities.

3.

Numbers given are per own mined 5E+Au PGMs metal in concentrate ounce.

4.

Unit costs are reported based on dry metric tonnes (dmt). Benefit of higher volumes in 2021 offset by unfavourable foreign exchange and inflation.

Unit costs are reported based on wet metric tonnes (wmt). Product is shipped with ~9 per cent moisture. Benefit of higher volumes in 2021 offset by inflation.

-360

2021F

42View entire presentation