Credit Suisse Credit Presentation Deck

Swiss Resolution Regime

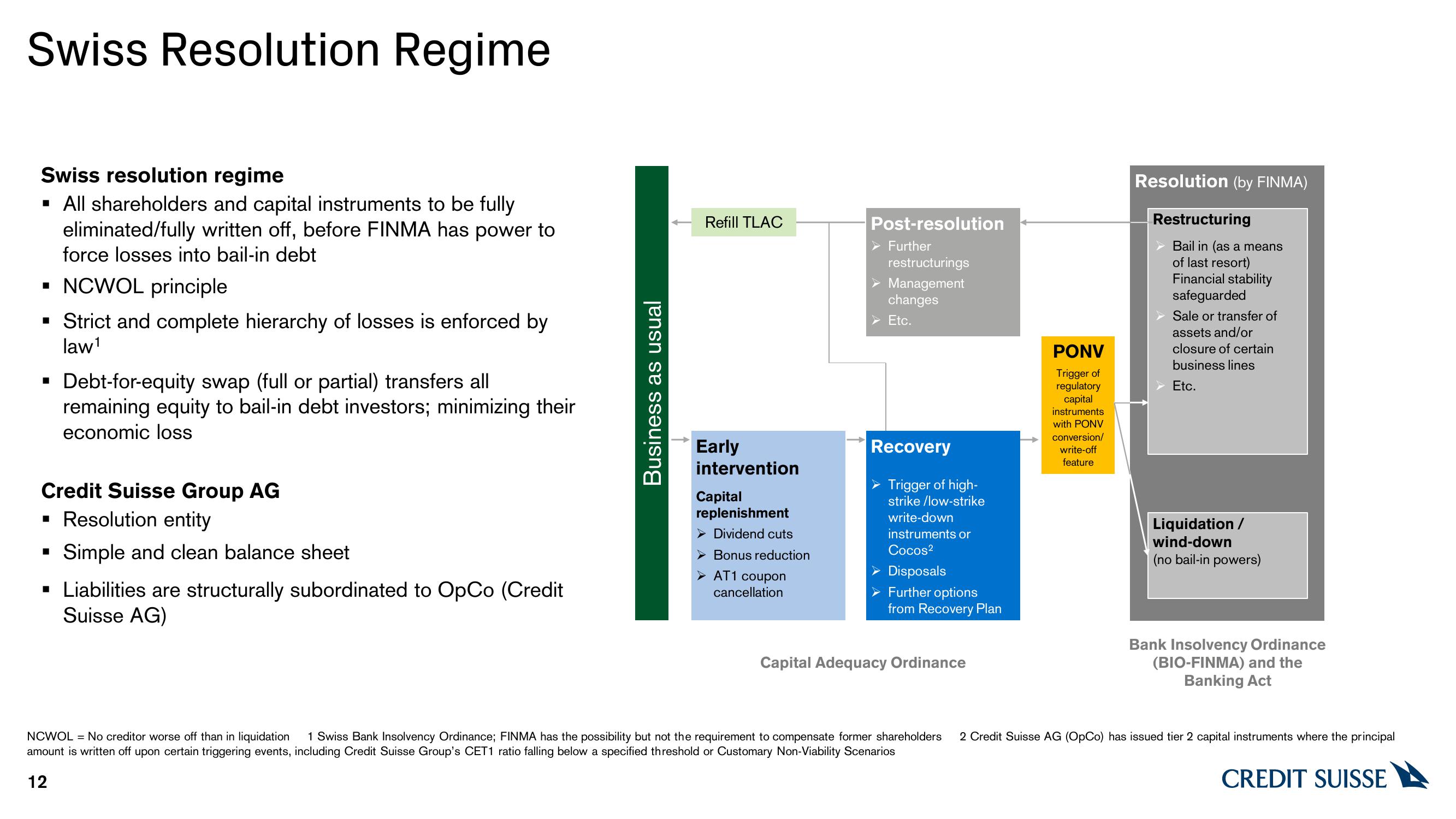

Swiss resolution regime

▪ All shareholders and capital instruments to be fully

eliminated/fully written off, before FINMA has power to

force losses into bail-in debt

▪ NCWOL principle

▪ Strict and complete hierarchy of losses is enforced by

law¹

▪ Debt-for-equity swap (full or partial) transfers all

remaining equity to bail-in debt investors; minimizing their

economic loss

Credit Suisse Group AG

▪ Resolution entity

Simple and clean balance sheet

■

▪ Liabilities are structurally subordinated to OpCo (Credit

Suisse AG)

Business as usual

Refill TLAC

Early

intervention

Capital

replenishment

▸ Dividend cuts

➤ Bonus reduction

➤ AT1 coupon

cancellation

Post-resolution

➤ Further

restructurings

➤ Management

changes

➤ Etc.

Recovery

Trigger of high-

strike /low-strike

write-down

instruments or

Cocos²

Disposals

Further options

from Recovery Plan

Capital Adequacy Ordinance

PONV

Trigger of

regulatory

capital

instruments

with PONV

conversion/

write-off

feature

Resolution (by FINMA)

Restructuring

Bail in (as a means

of last resort)

Financial stability

safeguarded

Sale or transfer of

assets and/or

closure of certain

business lines

Etc.

Liquidation /

wind-down

(no bail-in powers)

Bank Insolvency Ordinance

(BIO-FINMA) and the

Banking Act

NCWOL No creditor worse off than in liquidation 1 Swiss Bank Insolvency Ordinance; FINMA has the possibility but not the requirement to compensate former shareholders 2 Credit Suisse AG (OpCo) has issued tier 2 capital instruments where the principal

amount is written off upon certain triggering events, including Credit Suisse Group's CET1 ratio falling below a specified threshold or Customary Non-Viability Scenarios

12

CREDIT SUISSEView entire presentation