FGI Industries Investor Presentation Deck

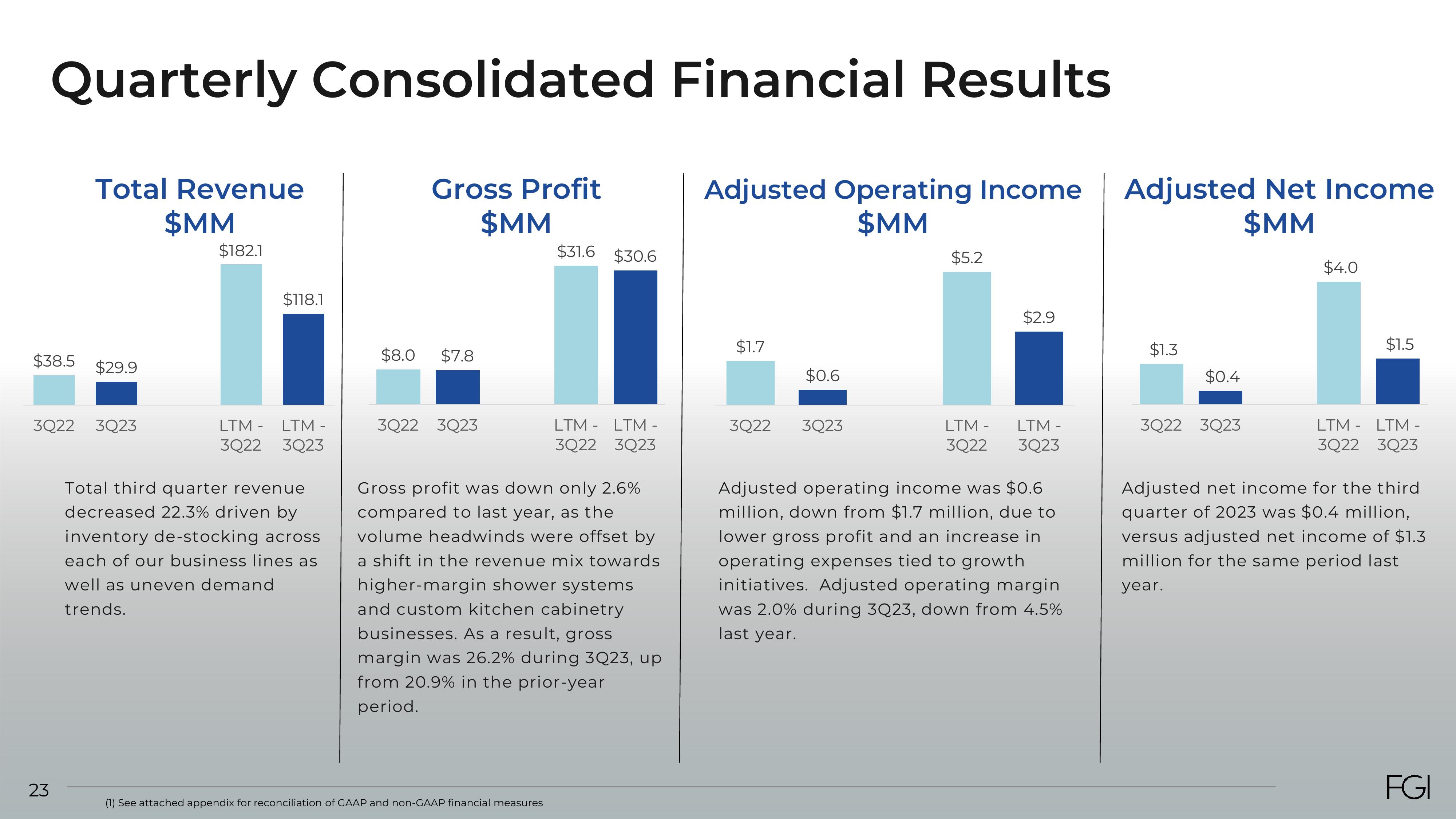

Quarterly Consolidated Financial Results

Total Revenue

$MM

Gross Profit

$MM

$38.5

23

$29.9

3Q22 3Q23

$182.1

$118.1

LTM - LTM -

3Q22 3Q23

Total third quarter revenue

decreased 22.3% driven by

inventory de-stocking across

each of our business lines as

well as uneven demand

trends.

$8.0

$7.8

3Q22 3Q23

$31.6 $30.6

(1) See attached appendix for reconciliation of GAAP and non-GAAP financial measures

LTM LTM -

3Q22 3Q23

Gross profit was down only 2.6%

compared to last year, as the

volume headwinds were offset by

a shift in the revenue mix towards

higher-margin shower systems

and custom kitchen cabinetry

businesses. As a result, gross

margin was 26.2% during 3Q23, up

from 20.9% in the prior-year

period.

Adjusted Operating Income Adjusted Net Income

$MM

$MM

$1.7

3Q22

$0.6

3Q23

$5.2

$2.9

LTM - LTM -

3Q22 3Q23

Adjusted operating income was $0.6

million, down from $1.7 million, due to

lower gross profit and an increase in

operating expenses tied to growth

initiatives. Adjusted operating margin

was 2.0% during 3Q23, down from 4.5%

last year.

$1.3

$0.4

3Q22 3Q23

$4.0

$1.5

LTM LTM -

3Q22 3Q23

Adjusted net income for the third

quarter of 2023 was $0.4 million,

versus adjusted net income of $1.3

million for the same period last

year.

FGIView entire presentation