Tudor, Pickering, Holt & Co Investment Banking

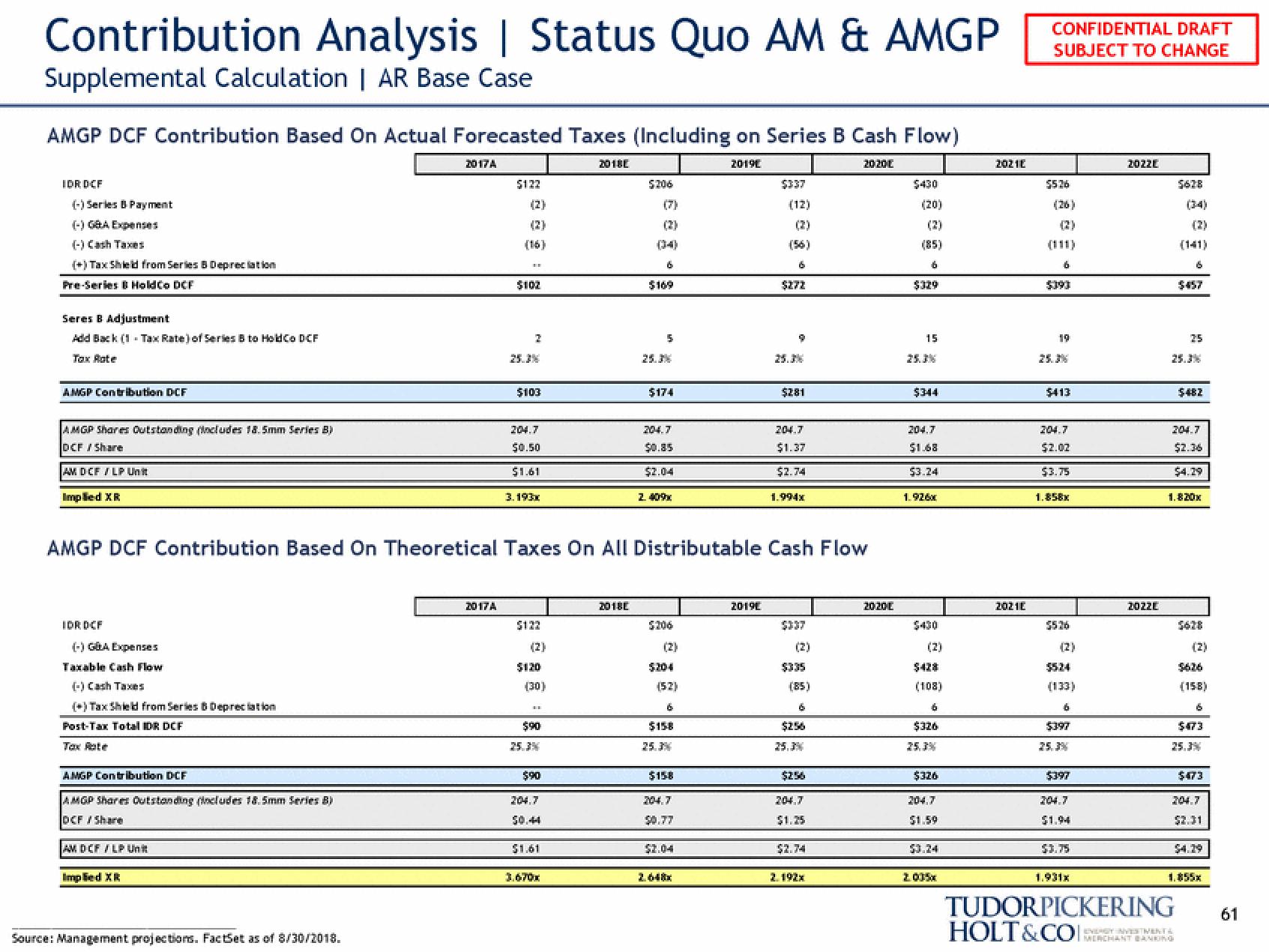

Contribution Analysis | Status Quo AM & AMGP

Supplemental Calculation | AR Base Case

AMGP DCF Contribution Based On Actual Forecasted Taxes (Including on Series B Cash Flow)

2019

2020E

IDR DCF

(-) Series B Payment

(-) G&A Expenses

(-) Cash Taxes

(+) Tax Shield from Series B Depreciation

Pre-Series B HoldCo DCF

Seres B Adjustment

Add Back (1 Tax Rate) of Series B to HoldCo DCF

Tax Rate

AMGP Contribution DCF

AMGP Shares Outstanding includes 18.5mm Series B)

DCF/Share

AM DCF / LP Unit

Implied XR

IDR DCF

(-) G&A Expenses

Taxable Cash Flow

(-) Cash Taxes

(+)Tax Shield from Series & Depreciation

Post-Tax Total IDR DCF

Tax Rate

AMGP Contribution DCF

AMGP Shares Outstanding includes 18.5mm Series Bl

DCF/Share

AM DCF / LP Unit

Implied XR

2017 A

Source: Management projections. FactSet as of 8/30/2018.

$122

2017A

(2)

(16)

$102

$103

204.7

$0.50

$1.61

3.193x

$132

(2)

$120

(30)

$90

AMGP DCF Contribution Based On Theoretical Taxes On All Distributable Cash Flow

$90

204,7

$1.61

2018E

3.670x

$206

2018E

(7)

(2)

6

5

25.3%

$174

204.7

$0.85

$2.04

2.409x

$306

(2)

(52)

6

$158

$158

204.7

$0.77

$2.04

2648x

$337

(12)

20190

6

$272

9

$281

204.7

$1.37

$2.74

1.994x

(2)

(85)

6

$256

$256

204,7

$2.74

2.192x

2020L

$430

(20)

(2)

6

$329

15

$344

204.7

$1.68

$3.24

1.926x

(2)

$428

(108)

6

$326

$326

204,7

$1.59

$0.24

2.005x

2021E

2021E

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

$526

6

5390

$413

204.7

$2.02

$3.75

1.858x

$524

(133)

6

$397

$397

204.7

$3.75

2022E

2022E

(2)

$457

25.3%

25

TUDORPICKERING

HOLT&CO

204.7

$2.36

$4.29

EVAGY NYESTMENTS

MERCHANT BANKING

$482

1.820x

(2)

(158)

6

$473

204.7

$2.31

$473

61View entire presentation