Baird Investment Banking Pitch Book

AR'S INCREASED TRANSPARENCY IN FINANCIAL REPORTING

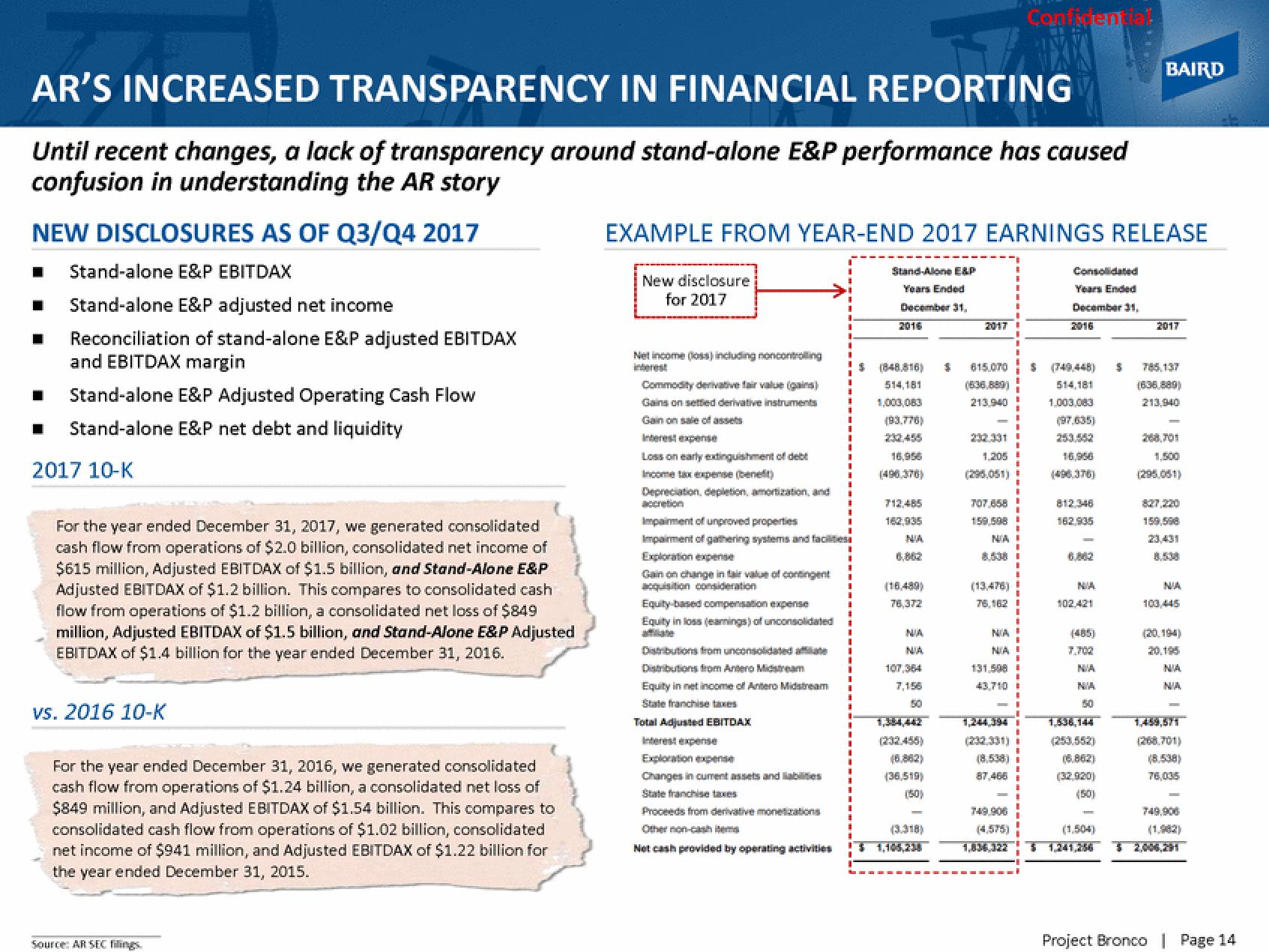

Until recent changes, a lack of transparency around stand-alone E&P performance has caused

confusion in understanding the AR story

NEW DISCLOSURES AS OF Q3/Q4 2017

Stand-alone E&P EBITDAX

Stand-alone E&P adjusted net income

Reconciliation of stand-alone E&P adjusted EBITDAX

and EBITDAX margin

Stand-alone E&P Adjusted Operating Cash Flow

Stand-alone E&P net debt and liquidity

2017 10-K

For the year ended December 31, 2017, we generated consolidated

cash flow from operations of $2.0 billion, consolidated net income of

$615 million, Adjusted EBITDAX of $1.5 billion, and Stand-Alone E&P

Adjusted EBITDAX of $1.2 billion. This compares to consolidated cash

flow from operations of $1.2 billion, a consolidated net loss of $849

million, Adjusted EBITDAX of $1.5 billion, and Stand-Alone E&P Adjusted

EBITDAX of $1.4 billion for the year ended December 31, 2016.

vs. 2016 10-K

For the year ended December 31, 2016, we generated consolidated

cash flow from operations of $1.24 billion, a consolidated net loss of

$849 million, and Adjusted EBITDAX of $1.54 billion. This compares to

consolidated cash flow from operations of $1.02 billion, consolidated

net income of $941 million, and Adjusted EBITDAX of $1.22 billion for

the year ended December 31, 2015.

Source: AR SEC filings

New disclosure

for 2017

EXAMPLE FROM YEAR-END 2017 EARNINGS RELEASE

Stand-Alone E&P

Years Ended

December 31.

Net income (los) including noncontrolling

Commodity derivative fair value (gains)

Gains on settled derivative instruments

Loss on early extinguishment of debt

Depreciation, depletion, amortization, and

Impairment of unproved properties

Impairment of gathering systems and facilities

Exploration expense

Gain on change in fair value of contingent

acquisition consideration

Equity-based compensation expense

Equity in loss (earnings) of unconsolidated

Distributions from unconsolidated afte

Distributions from Antero Midstream

Equity in net income of Antero Midstream

State franchise taxes

Total Adjusted EBITDAX

Interest expense

Exploration expense

Changes in current assets and liabilities

State franchise taxes

Proceeds from derivative monetizations

Net cash provided by operating activities

2016

$ (848,816)

514,181

1,003,083

(93.776)

16,956

712,485

162,935

76,372

107,364

7,156

(232.455)

(36,519)

(50)

(3.318)

2017

615.070 $

(636,889)

213.940

232.331

1.205

(295,051)

159.508

NIA

8,538

(13,476)

75,162

NIA

NIA

Confidential

131.508

43,710

(8.538)

87,466

749.906

(4.575)

Consolidated

Years Ended

December 31,

2016

514,181

1,003.083

(97.635)

253.552

16,956

(496,376)

162.935

102,421

(485)

7,702

NIA

NIA

(6.862)

(32.920)

(50)

(1.504)

BAIRD

$

2017

213,940

268,701

1,500

(295.051)

159,598

103,445

(20,194)

20,195

NIA

NA

(268.701)

(8.538)

76,035

749,900

Project Bronco | Page 14View entire presentation