KKR Real Estate Finance Trust Investor Presentation Deck

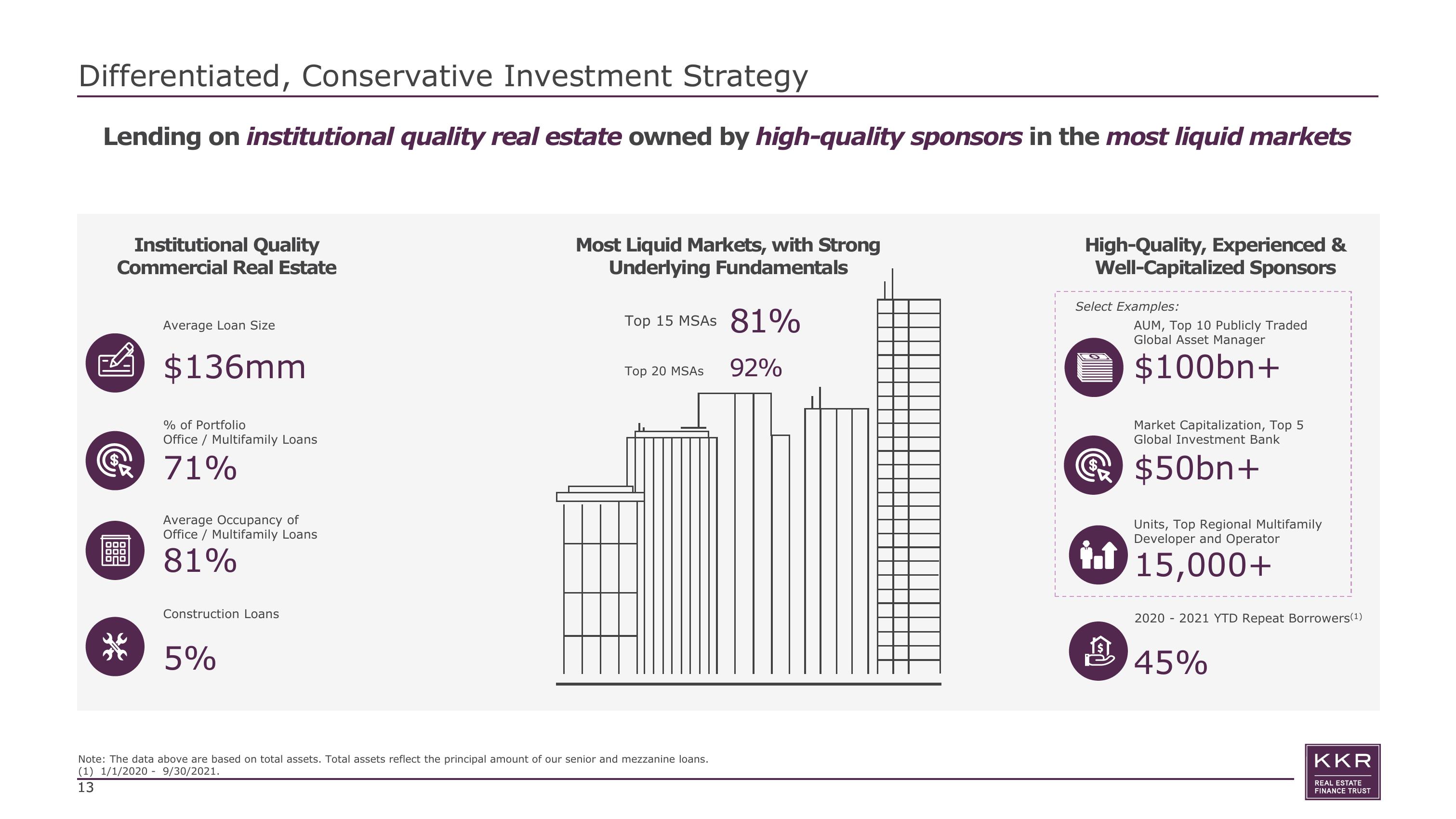

Differentiated, Conservative Investment Strategy

Lending on institutional quality real estate owned by high-quality sponsors in the most liquid markets

Institutional Quality

Commercial Real Estate

R

Average Loan Size

$136mm

% of Portfolio

Office / Multifamily Loans

71%

Average Occupancy of

Office / Multifamily Loans

81%

Construction Loans

* 5%

Most Liquid Markets, with Strong

Underlying Fundamentals

Top 15 MSAS 81%

Top 20 MSAS 92%

Note: The data above are based on total assets. Total assets reflect the principal amount of our senior and mezzanine loans.

(1) 1/1/2020 9/30/2021.

13

High-Quality, Experienced &

Well-Capitalized Sponsors

Select Examples:

AUM, Top 10 Publicly Traded

Global Asset Manager

$100bn+

Market Capitalization, Top 5

Global Investment Bank

$50bn+

Units, Top Regional Multifamily

Developer and Operator

15,000+

2020 2021 YTD Repeat Borrowers(¹)

45%

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation