Orbia Investor Day Presentation Deck

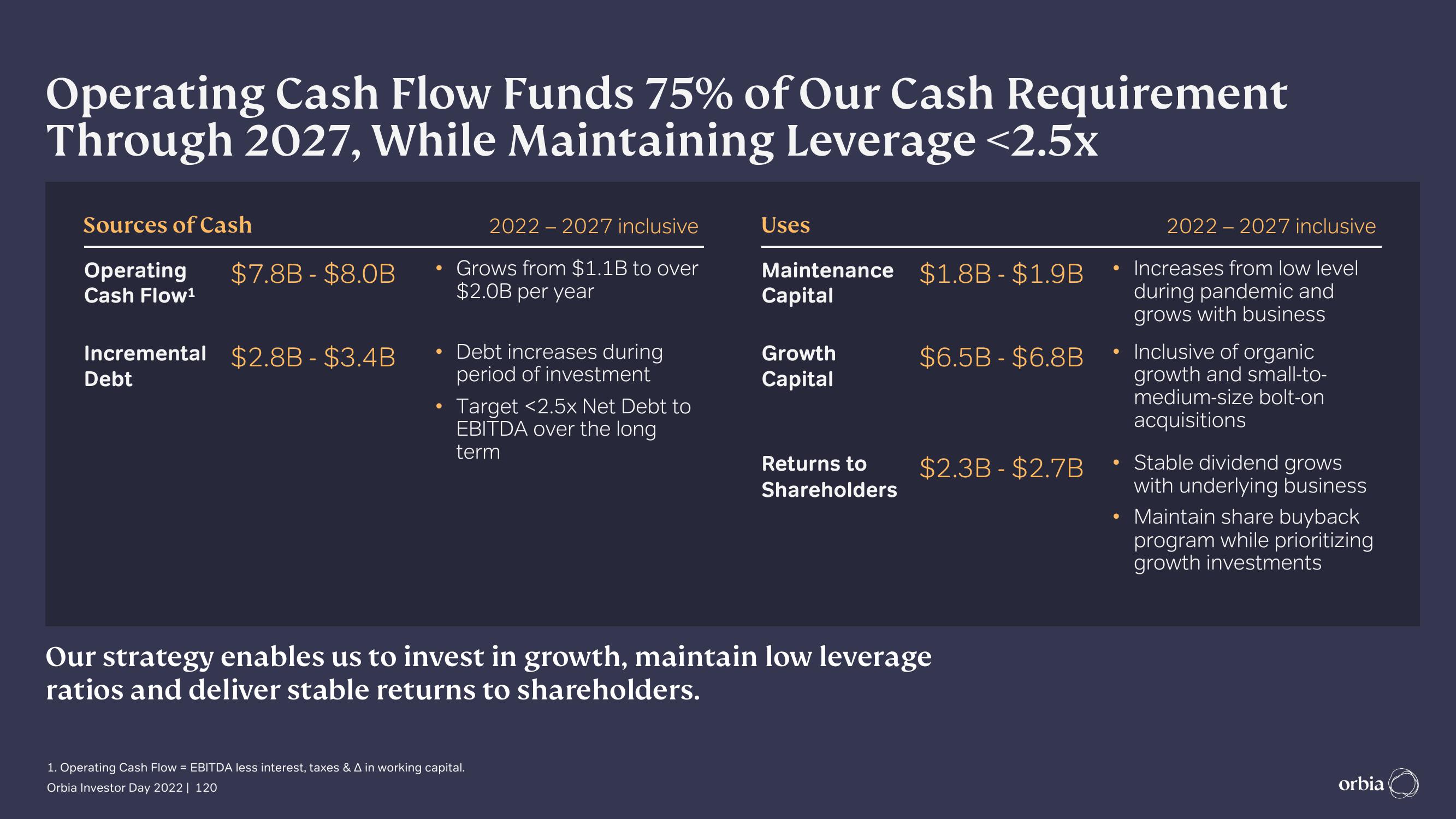

Operating Cash Flow Funds 75% of Our Cash Requirement

Through 2027, While Maintaining Leverage <2.5x

Sources of Cash

Operating

Cash Flow¹

$7.8B - $8.0B

Incremental $2.8B - $3.4B

Debt

2022 2027 inclusive

Grows from $1.1B to over

$2.0B per year

• Debt increases during

period of investment

●

Target <2.5x Net Debt to

EBITDA over the long

term

Uses

1. Operating Cash Flow = EBITDA less interest, taxes & A in working capital.

Orbia Investor Day 2022 | 120

2022 2027 inclusive

Maintenance $1.8B-$1.9B Increases from low level

Capital

during pandemic and

grows with business

Growth

Capital

Returns to

Shareholders

$6.5B - $6.8B

$2.3B-$2.7B

Our strategy enables us to invest in growth, maintain low leverage

ratios and deliver stable returns to shareholders.

●

●

●

Inclusive of organic

growth and small-to-

medium-size bolt-on

acquisitions

Stable dividend grows

with underlying business

Maintain share buyback

program while prioritizing

growth investments

orbiaView entire presentation