HSBC Investor Day Presentation Deck

2021

1.6

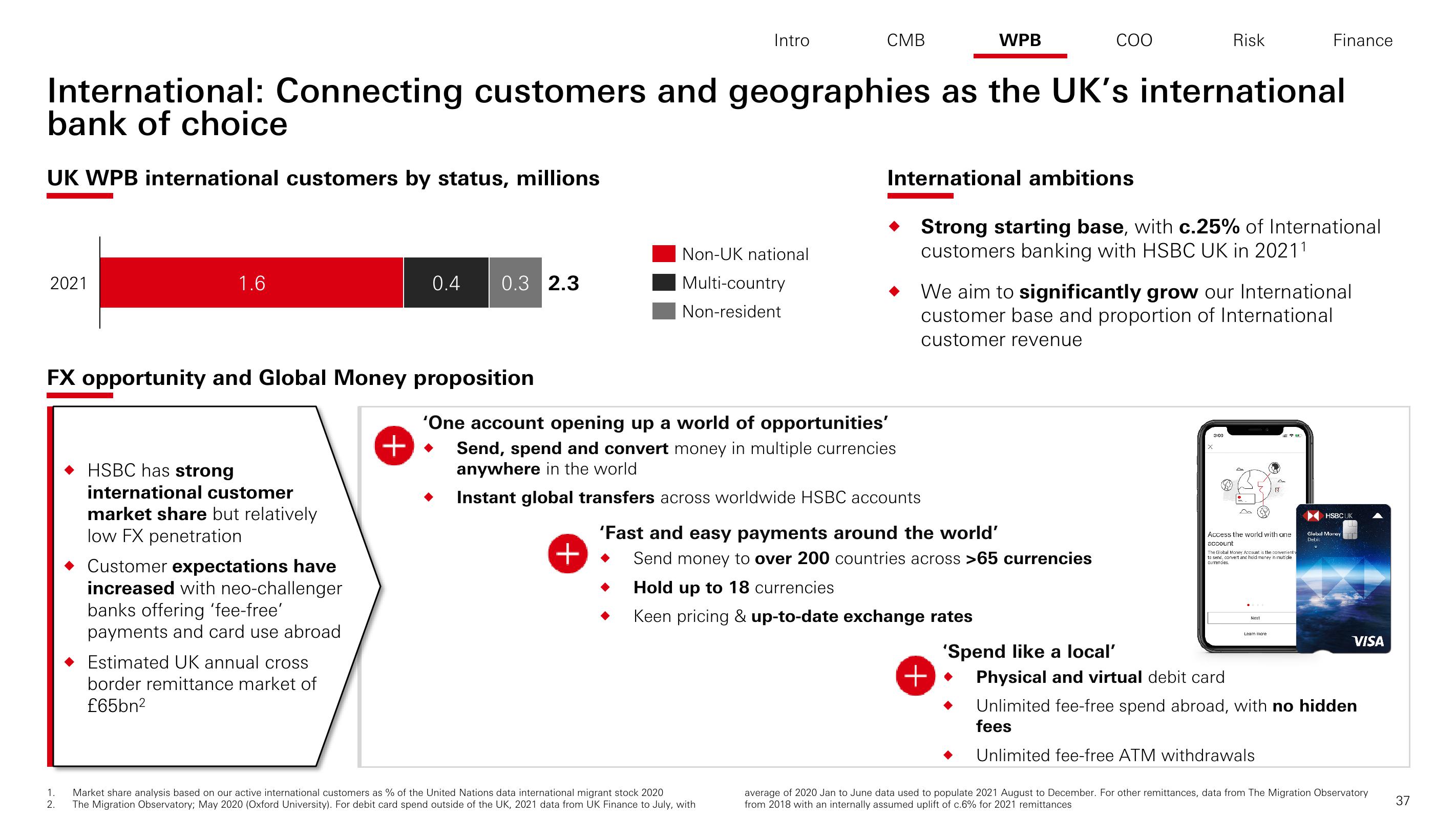

FX opportunity and Global Money proposition

HSBC has strong

international customer

market share but relatively

low FX penetration

Customer expectations have

increased with neo-challenger

banks offering 'fee-free'

payments and card use abroad

International: Connecting customers and geographies as the UK's international

bank of choice

UK WPB international customers by status, millions

0.4 0.3 2.3

Estimated UK annual cross

border remittance market of

£65bn²

+

Intro

Non-UK national

Multi-country

Non-resident

◆

CMB

1. Market share analysis based on our active international customers as % of the United Nations data international migrant stock 2020

2. The Migration Observatory; May 2020 (Oxford University). For debit card spend outside of the UK, 2021 data from UK Finance to July, with

+.

'One account opening up a world of opportunities'

Send, spend and convert money in multiple currencies

anywhere in the world

Instant global transfers across worldwide HSBC accounts

WPB

International ambitions

COO

'Fast and easy payments around the world'

Send money to over 200 countries across >65 currencies

Hold up to 18 currencies

Keen pricing & up-to-date exchange rates

Strong starting base, with c.25% of International

customers banking with HSBC UK in 20211

We aim to significantly grow our International

customer base and proportion of International

customer revenue

(+).

Risk

X

3:00

Finance

Access the world with one

account

The Global Money Account is the convenient w

to send, convert and hold money in multiple

currencies.

Next

Leam mare

HSBC UK

Global Money

Debil

11

VISA

'Spend like a local'

Physical and virtual debit card

Unlimited fee-free spend abroad, with no hidden

fees

Unlimited fee-free ATM withdrawals

average of 2020 Jan to June data used to populate 2021 August to December. For other remittances, data from The Migration Observatory

from 2018 with an internally assumed uplift of c.6% for 2021 remittances

37View entire presentation