Payoneer SPAC Presentation Deck

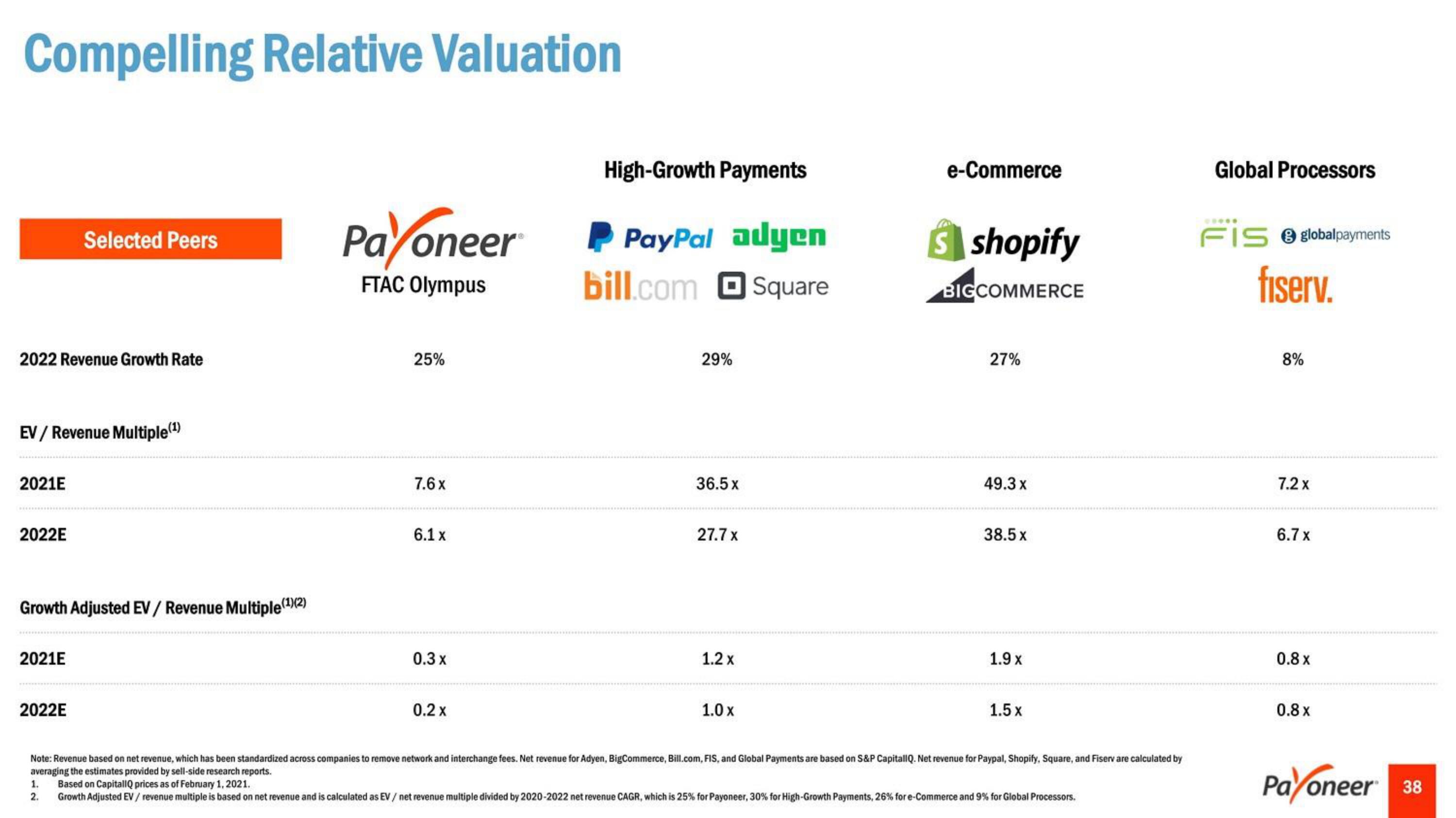

Compelling Relative Valuation

2022 Revenue Growth Rate

EV/ Revenue Multiple(¹)

2021E

2022E

Selected Peers

Growth Adjusted EV / Revenue Multiple(¹)(2)

2021E

2022E

Payoneer

FTAC Olympus

25%

7.6 x

6.1 x

0.3 x

0.2 x

High-Growth Payments

P PayPal adyen

bill.com

Square

29%

36.5 x

27.7 x

1.2 x

1.0 x

e-Commerce

S shopify

BIGCOMMERCE

27%

49.3 x

38.5 x

1.9 x

1.5 x

Note: Revenue based on net revenue, which has been standardized across companies to remove network and interchange fees. Net revenue for Adyen, BigCommerce, Bill.com, FIS, and Global Payments are based on S&P CapitallQ. Net revenue for Paypal, Shopify, Square, and Fiserv are calculated by

averaging the estimates provided by sell-side research reports.

1. Based on CapitallQ prices as of February 1, 2021.

2.

Growth Adjusted EV / revenue multiple is based on net revenue and is calculated as EV / net revenue multiple divided by 2020-2022 net revenue CAGR, which is 25% for Payoneer, 30% for High-Growth Payments, 26% for e-Commerce and 9% for Global Processors.

Global Processors

FIS & globalpayments

fiserv.

8%

7.2 x

6.7 x

0.8 x

0.8 x

oneer 38View entire presentation