Cerberus Global NPL Fund, L.P.

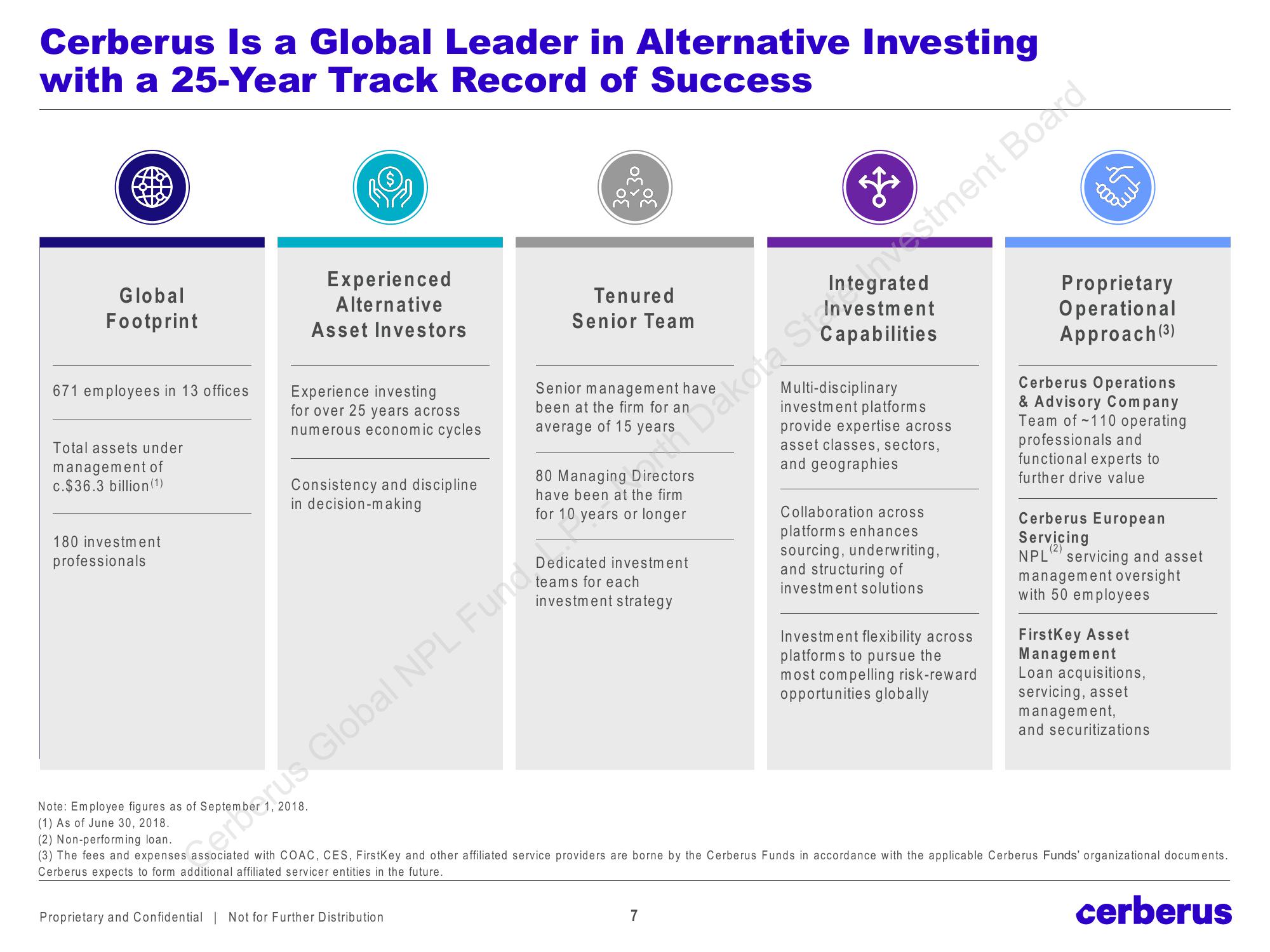

Cerberus Is a Global Leader in Alternative Investing

with a 25-Year Track Record of Success

Global

Footprint

671 employees in 13 offices

Total assets under

management of

c.$36.3 billion (1)

180 investment

professionals

Note: Employee figures as of September

Experienced

Alternative

Asset Investors

Experience investing

for over 25 years across

numerous economic cycles

Consistency and discipline

in decision-making

Tenured

Senior Team

Proprietary and Confidential | Not for Further Distribution

Senior management have

been at the firm for an

average of 15 years

80 Managing Directors

have been at the firm

for 10 years or longer

Dedicated investment

teams for each

investment strategy

serberus Global NPL Fund

Dakota Stanvestment

مج

7

Capabilities

Multi-disciplinary

investment platforms

provide expertise across

asset classes, sectors,

and geographies

Collaboration across

platforms enhances

sourcing, underwriting,

and structuring of

investment solutions

Investment flexibility across

platforms to pursue the

most compelling risk-reward

opportunities globally

Board

-ammo

Proprietary

Operational

Approach (3)

Cerberus Operations

& Advisory Company

Team of -110 operating

professionals and

functional experts to

further drive value

Cerberus European

Servicing

NPL servicing and asset

management oversight

with 50 employees

(1) As of June 30, 2018.

(2) Non-performing loan.

(3) The fees and expenses

associated with COAC, CES, FirstKey and other affiliated service providers are borne by the Cerberus Funds in accordance with the applicable Cerberus Funds' organizational documents.

Cerberus expects to form additional affiliated servicer entities in the future.

cerberus

FirstKey Asset

Management

Loan acquisitions,

servicing, asset

management,

and securitizationsView entire presentation