Melrose Mergers and Acquisitions Presentation Deck

Key point 5: Cash generation dynamics transformed

Melrose

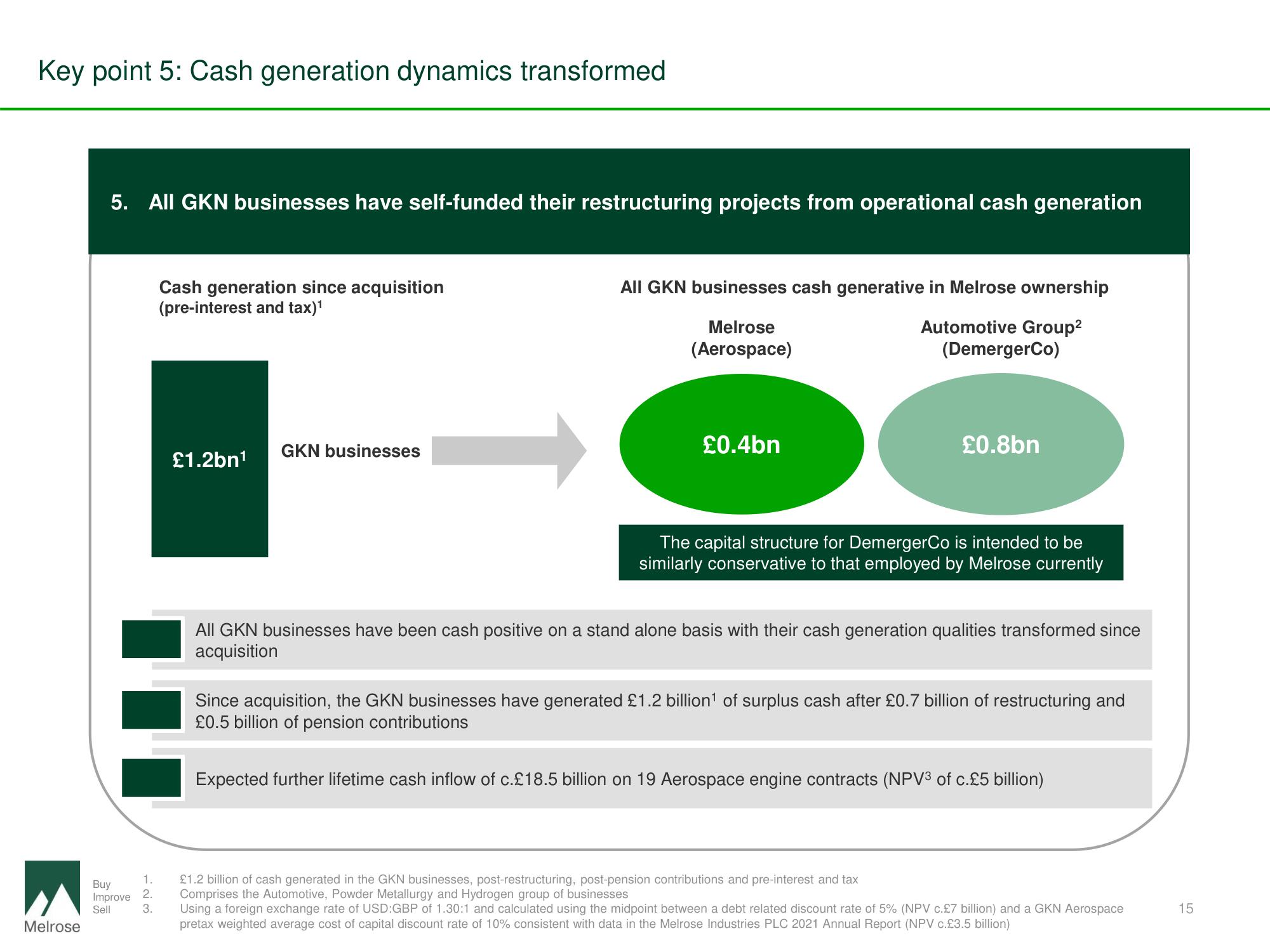

5. All GKN businesses have self-funded their restructuring projects from operational cash generation

Buy

Improve

Sell

123

Cash generation since acquisition

(pre-interest and tax)¹

2.

£1.2bn¹

GKN businesses

All GKN businesses cash generative in Melrose ownership

Melrose

(Aerospace)

Automotive Group²

(DemergerCo)

£0.4bn

£0.8bn

The capital structure for DemergerCo is intended to be

similarly conservative to that employed by Melrose currently

All GKN businesses have been cash positive on a stand alone basis with their cash generation qualities transformed since

acquisition

Since acquisition, the GKN businesses have generated £1.2 billion¹ of surplus cash after £0.7 billion of restructuring and

£0.5 billion of pension contributions

Expected further lifetime cash inflow of c.£18.5 billion on 19 Aerospace engine contracts (NPV3 of c.£5 billion)

1. £1.2 billion of cash generated in the GKN businesses, post-restructuring, post-pension contributions and pre-interest and tax

Comprises the Automotive, Powder Metallurgy and Hydrogen group of businesses

3. Using a foreign exchange rate of USD:GBP of 1.30:1 and calculated using the midpoint between a debt related discount rate of 5% (NPV c.£7 billion) and a GKN Aerospace

pretax weighted average cost of capital discount rate of 10% consistent with data in the Melrose Industries PLC 2021 Annual Report (NPV c.£3.5 billion)

15View entire presentation